Record High Forecast for Japanese Beer Imports This Year

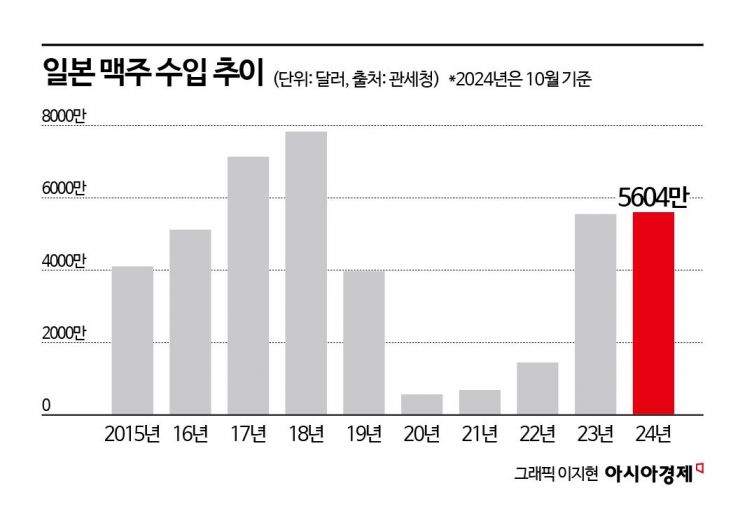

Up 33.1% Year-on-Year... Top Spot for 2 Consecutive Years

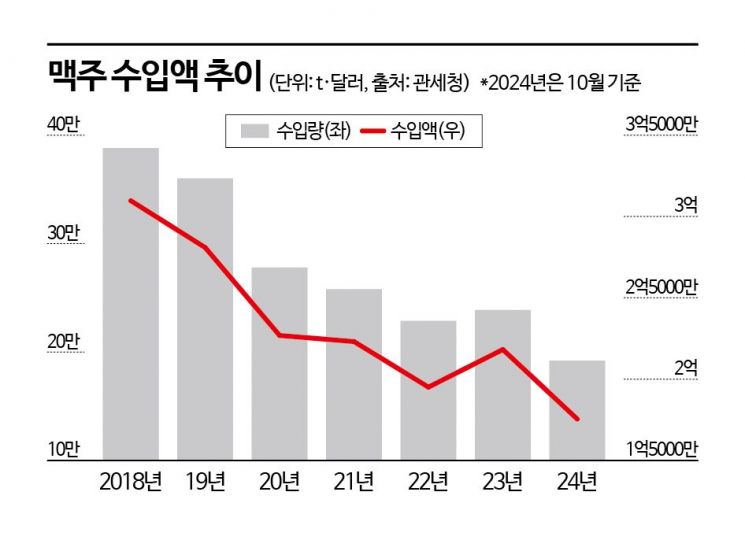

Total Imported Beer Import Value Remains Flat

While the sluggishness in the imported beer market that has persisted over recent years continues this year, only Japanese beer is showing strong growth. Although Japanese beer faced difficulties in the past due to boycott movements, it has solidified its regained top position from last year by leveraging quality and marketing as its weapons.

According to export-import trade statistics from the Korea Customs Service on the 10th, the import value of Japanese beer this year reached $56.044 million (approximately 79.5 billion KRW) as of October, marking a 33.1% increase compared to the same period last year ($42.105 million). During the same period, the import volume also rose by 38.2% to 69,784 tons from 50,498 tons the previous year.

Beer, which was the absolute leader in the existing imported alcoholic beverage market, has been facing difficulties as its influence has gradually diminished over several years amid a wave of diversification in alcoholic beverage types. Imported beer did not see a significant rebound even during the COVID-19 pandemic, when home drinking and solo drinking trends peaked, and this year’s import value only reached $175.49 million (approximately 249 billion KRW) by October, a 6.2% decrease compared to the same period last year ($187.16 million).

However, Japanese beer stands out by showing a 'solo growth trend.' The import value of Japanese beer peaked at $78.3 million (approximately 111 billion KRW) in 2018 but plummeted to $5.67 million (approximately 800 million KRW) in 2020 due to boycott movements triggered by Japan’s export restrictions on Korea in 2019. Since then, as the boycott movement waned, it began to recover gradually, reaching $55.52 million (approximately 79 billion KRW) last year. This year, it has already surpassed last year’s import volume within eight months, moving one step closer to its past glory. If this trend continues, it is expected to record the highest import value since 2018.

The increase in preference for Japanese beer is considered a natural phenomenon when taking into account the characteristics of beer as an alcoholic beverage. Unlike high-proof distilled spirits such as whiskey, which essentially have no expiration or consumption limits, beer with an alcohol content around 5% requires management of the distribution process based on its quality retention period due to the risk of spoilage depending on storage methods.

The quality retention period is usually set within one year, and the industry consensus is that the sooner it is consumed, the better the taste. For this reason, Japanese beer, which has a relatively short process from production locally to distribution domestically, can secure competitiveness compared to European beers that are imported after long journeys through equatorial regions and others.

Additionally, the quality of Japanese beer and aggressive marketing efforts have been factors supporting the recent rise of Japanese beer. As demand for Japanese beer increases, Japanese beer companies are actively targeting the domestic market. Sapporo Beer launched 'Sapporo Draft Beer 70' this year, which simultaneously reduces sugar and purine content by 70%, and even aired TV commercials.

This month, they have also increased their offensive by introducing the winter limited edition beer 'Sapporo Winter Story.' Lotte Asahi Liquor, which led the return of Japanese beer last year with 'Asahi Super Dry Draft Beer Can,' officially launched the second series of draft beer cans, 'Asahi Shokusai,' and operated pop-up stores for 'Asahi Super Dry' and 'Orion The Draft,' showing active moves.

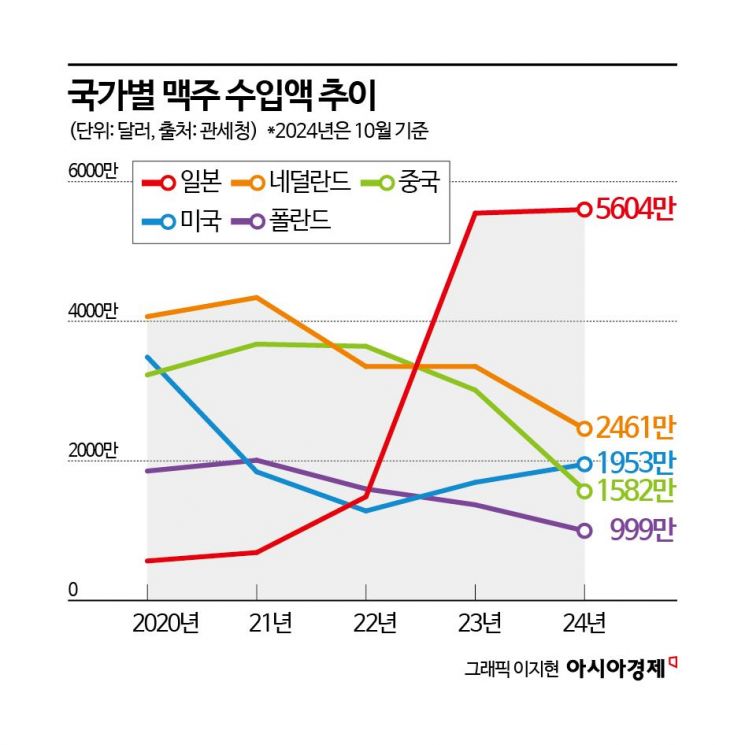

On the other hand, Chinese beer, which enjoyed a windfall and rose to the top when Japanese beer was shunned due to boycott movements, continued to struggle this year as well. The import value of Chinese beer this year was $15.82 million (approximately 2.2 billion KRW), a 45.8% decrease compared to the same period last year ($29.21 million), effectively halving. Last year, Chinese beer was hit hard by a so-called urine attack incident at the Qingdao brewery in Shandong Province, one of its representative beers, and has yet to regain its previous momentum this year.

Meanwhile, looking at the origins of imported beer this year, the Netherlands, the origin of 'Heineken,' followed Japan with an import value of $24.61 million, and the United States ranked third with $19.53 million. While import values from most countries shrank, the U.S. increased its import value by 42.8% compared to last year ($13.67 million), filling the gap left by Chinese beer. Other countries in the top 10 included Poland ($9.99 million), the Czech Republic ($9.83 million), Ireland ($9.81 million), Germany ($8.8 million), Vietnam ($5.53 million), and Belgium ($2.47 million).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)