SEMI Announces Global Semiconductor Equipment Billings for Q3 This Year

With the surge in artificial intelligence (AI), the demand for semiconductors is increasing, and the market for equipment essential to semiconductor manufacturing is also rapidly growing. There are forecasts that the annual global semiconductor equipment billings will reach an all-time high this year.

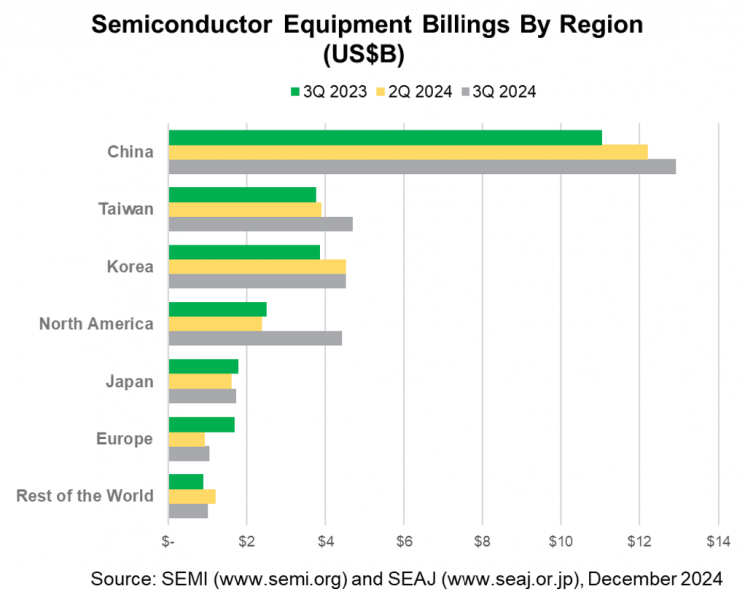

SEMI (formerly the Semiconductor Equipment and Materials International) announced on the 6th that the global semiconductor equipment billings for the third quarter of this year amounted to $30.38 billion (approximately 43 trillion KRW). This represents a 19% increase compared to the same period last year and a 13% increase compared to the previous quarter.

Ajit Manocha, CEO of SEMI, said, "The global semiconductor equipment market recorded solid growth in the third quarter of this year, driven by the spread of AI," adding, "Investment in semiconductor equipment is increasing in various regions to strengthen the semiconductor manufacturing ecosystem." He continued, "The North American region is growing rapidly," and "In terms of investment scale, China is leading the market."

The global semiconductor equipment billings refer to the amount semiconductor companies in each country must pay to equipment manufacturers to purchase semiconductor equipment. A SEMI official stated, "The annual global semiconductor equipment billings are expected to record the highest ever this year."

North America's semiconductor equipment billings reached $4.43 billion (approximately 6 trillion KRW), marking a 77% increase compared to the same period last year and an 85% increase compared to the previous quarter. Taiwan also recorded $4.69 billion (approximately 6.6 trillion KRW), a 20% increase from the previous quarter and a 25% growth compared to the same period last year.

China's semiconductor equipment billings amounted to $12.93 billion (approximately 18 trillion KRW), still accounting for the largest share of the global semiconductor equipment market. This represents a 17% increase compared to the same period last year and a 6% increase compared to the previous quarter.

Korea recorded $4.52 billion (approximately 6.4 trillion KRW), the same as the previous quarter. Compared to the same period last year, it grew by 17%, maintaining a steady investment flow.

On the other hand, Europe and Japan showed sluggish performance. Europe recorded $1.05 billion (approximately 1.5 trillion KRW), down 38% compared to the same period last year, and Japan recorded $1.74 billion (approximately 2.4 trillion KRW), down 3%, showing a slowdown in growth.

This announcement was prepared based on data collected by SEMI and the Semiconductor Equipment Association of Japan (SEAJ).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)