Restrictions on Actions Must Be Lifted Within 2 Years of Converting to Holding Company

Jungheung Togeon to Absorb Intermediate Holding Company Jungbong Holdings

Naju Tourism Development Increases Stake in Seonwol High Park Valley

Borrowed 940.5 Billion Won from Affiliates This Year Alone

Jung Won-ju, chairman of Daewoo Engineering & Construction, who holds 100% of the shares in Jungheung Togeon, is leading Jungheung Group's restructuring into a holding company and has entered the final stage of resolving cross-shareholdings. By raising nearly 1 trillion KRW in borrowings from affiliates, the group has been organizing its grandchild companies and securing a large number of shares in subsidiaries, beginning to establish itself as a holding company. While this fund will also be used to repay the acquisition financing for Daewoo Engineering & Construction, concerns have been raised about the increased reliance on borrowings.

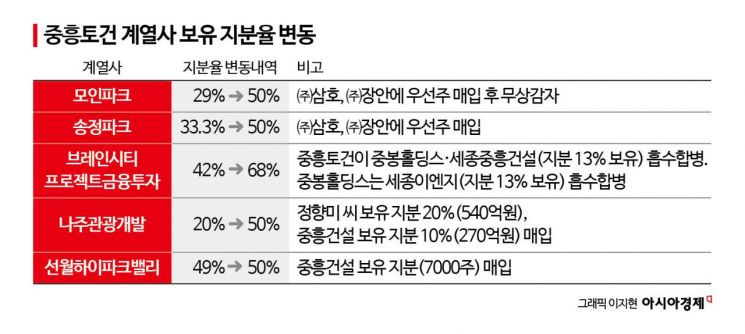

According to the Financial Supervisory Service on the 10th, Jungheung Togeon recently merged with Jungbong Holdings and raised its stake in affiliates such as Naju Tourism Development, Seonwol High Park Valley, Brain City Project Finance Investment, Moin Park, and Songjeong Park to 50%. Designated as a large business group, Jungheung Group completed its holding company system registration in May last year and must resolve cross-shareholdings by the end of the year. Jungheung Togeon is a subsidiary wholly owned by Vice Chairman Jung and serves as the holding company of Jungheung Group. Upon conversion to a holding company, it must resolve restrictions within a two-year grace period, requiring subsidiaries of the holding company to hold at least 50% of the shares in their grandchild companies, and at least 30% if the company is publicly listed.

Final Stage of Resolving Holding Company Activity Restrictions

As of the 1st of this month, Jungheung Togeon merged with Jungbong Holdings and Sejong Jungheung Construction. Jungbong Holdings had served as an intermediate holding company, and Sejong Jungheung Construction was an affiliate engaged in real estate development and supply. Before merging into Jungheung Togeon, Jungbong Holdings had merged with Sejong ENG. During this process, the 43.75% stake in Saebit Development held by the grandchild company Sejong ENG was also resolved. Saebit Development is a special purpose company (SPC) established for the Gwangju Songam Park development project. In October, when Jungbong Holdings merged with Sejong ENG, the 43.75% stake (598,500 shares) in Saebit Development changed ownership to Jungbong Holdings.

Jungbong Holdings was utilized in the process of restructuring the ownership structure to organize affiliate shareholdings. Jungbong Holdings was established through a spin-off of the investment business division from Jungbong Construction, a 100% subsidiary of Jungheung Togeon. Jungbong Construction is a subsidiary responsible for the Naepo RH3 and Gimhae Naedeok District projects, and Jungbong Holdings was established on July 1 through this spin-off.

Last month, Jungheung Togeon also acquired preferred shares of Moin Park and Songjeong Park, subsidiaries established for private park special projects. It acquired 410,000 preferred shares from Samho Co., Ltd. and Jangan Co., Ltd., shareholders of Moin Park, for 2.583 billion KRW. Subsequently, a free reduction of 400,000 preferred shares was executed, increasing the stake from 29% at the end of last year to 50%. Jungheung Togeon also increased its stake in Songjeong Park from 33.3% to 50%. At the end of October, it purchased 80,000 common shares (worth 576 million KRW) from Samho Co., Ltd. and 130,000 preferred shares (worth 819 million KRW) from Jangan Co., Ltd., fulfilling the 50% stake requirement.

Through successive subsidiary incorporations, Jungheung Togeon was able to resolve the stake issue in Brain City Project Finance Investment, which is implementing the Pyeongtaek Brain City project, all at once. The shares of Brain City Project Finance Investment were held by Jungheung Togeon (42%), Sejong ENG (13%), Sejong Jungheung Construction (13%), and Pyeongtaek Urban Corporation (32%). Sejong ENG merged into Jungbong Holdings in August, and with Jungbong Holdings and Sejong Jungheung Construction merging into Jungheung Togeon, the stake held by Jungheung Togeon in Brain City Project Finance Investment increased to 68%.

Additionally, Jungheung Togeon completed the shareholding reorganization of Naju Tourism Development. In August, it purchased 20% (120,000 shares) of Naju Tourism Development held by Jung Chang-sun’s daughter, Jung Hyang-mi, for 54 billion KRW, and 10% (60,000 shares) held by Jungheung Construction for 27 billion KRW. This acquisition raised Jungheung Togeon’s stake in Naju Tourism Development from 20% at the end of last year to 50%. Naju Tourism Development operates the Gold Lake Country Club golf course, condos, and a theme park, with Vice Chairman Jung Won-ju holding 20%, Chairman Jung Chang-sun 14.2%, An Yang-im (Chairman Jung’s spouse) 8%, and Jungheung Construction 7.8%.

Furthermore, at the end of July, Jungheung Togeon acquired 7,000 shares (worth 1.0787 billion KRW) of Seonwol High Park Valley from Jungheung Construction. With this acquisition, its stake increased from 49% to 50%. Seonwol High Park Valley is the developer of the Sunwol District housing development project in Suncheon and is preparing for land sales next year.

Raised 940.5 Billion KRW in Borrowings from Affiliates This Year

Jungheung Togeon significantly increased long-term borrowings from affiliates to expand its shareholdings. The total amount borrowed from affiliates this year reached 940.5 billion KRW. As of November, the amounts borrowed this year were 91 billion KRW from Jungheung Housing, 119 billion KRW from Saesol Construction, 149 billion KRW from Jungbong Industrial Development, 71 billion KRW from Jungbong Construction, 35 billion KRW from Sejong Jungheung Construction, 257 billion KRW from Jungheung Industrial Development, 88.5 billion KRW from Jungheung S-Class, and 130 billion KRW from Suncheon Eco Valley. Additionally, Jungheung Togeon has long-term borrowings of 1.4127 trillion KRW scheduled for repayment next year.

This fund is also used to maintain control over Daewoo Engineering & Construction. The maturity for repayment of Daewoo Engineering & Construction acquisition financing is February next year. As of the end of last year, the amounts to be repaid were 714.7 billion KRW by Jungheung Togeon and 178.5 billion KRW by Jungheung Construction. At the time of Daewoo Engineering & Construction’s acquisition in February 2021, Jungheung Group raised 1.02 trillion KRW and 180 billion KRW from Jungheung Togeon and Jungheung Construction respectively, with a four-year maturity.

Industry insiders expected that the restructuring of the ownership structure would proceed smoothly until the repayment of the acquisition financing for Daewoo Engineering & Construction. However, concerns remain about the increasing reliance on borrowings. Jungheung Togeon’s borrowing dependency already exceeds the normal range. As of the end of last year, the borrowings accounted for 2.4869 trillion KRW of Jungheung Togeon’s liabilities, with a debt ratio of 120.9% and borrowing dependency of 47.4%. Generally, borrowing dependency below 30% is considered stable. Jungheung Togeon’s operating profit at the end of last year was 47.7 billion KRW, while interest expenses were 118.9 billion KRW, resulting in an interest coverage ratio of only 0.4 times. The increase in borrowings was influenced by the acquisition financing for Daewoo Engineering & Construction, as well as land development funds and affiliate loan burdens, leading to an increase in net borrowings compared to the previous year.

A Jungheung Group official explained, "Acquiring Daewoo Engineering & Construction made it inevitable to transition to a holding company system. The shareholding reorganization among affiliates is almost complete, and the borrowings were raised as necessary for securing affiliate shares and for projects undertaken by Jungheung Togeon. We are also operating a tight financial plan to repay acquisition financing for Daewoo Engineering & Construction by February next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)