KOSPI Drops Below 2500 in One Day

Foreigners Also Switch to Net Selling in One Day

Short-Term Volatility Expansion Inevitable Due to Political Uncertainty

Authorities Expected to Play Buffer Role with Financial Market Stability Measures

Due to the emergency martial law situation overnight, the KOSPI gave up the 2500 level in just one day and retreated to the 2470 level. Experts foresee that while the expansion of uncertainty due to the emergency martial law situation is inevitable, the shock intensity will be limited thanks to government liquidity supply and other measures.

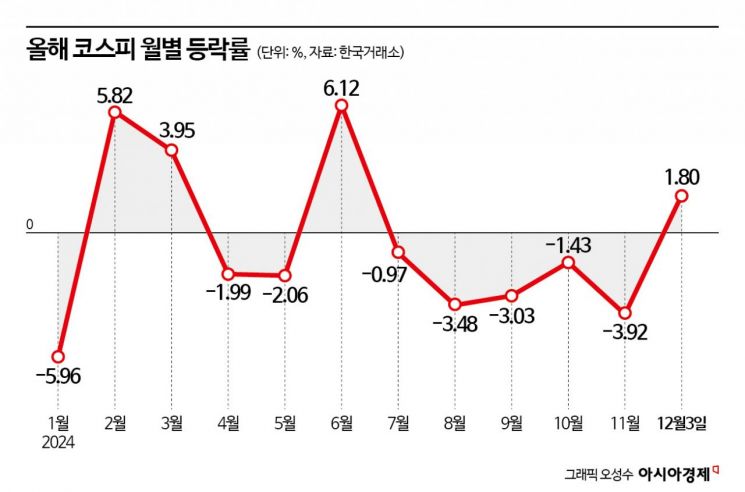

As of 9:20 a.m. on the 4th, the KOSPI was trading at 2470.37, down 29.73 points (1.19%) from the previous day. The KOSDAQ recorded 681.57, down 9.23 points (1.34%). The won-dollar exchange rate opened at 1418.1 won, up 15.2 won from the previous day's closing price at 3:30 p.m.

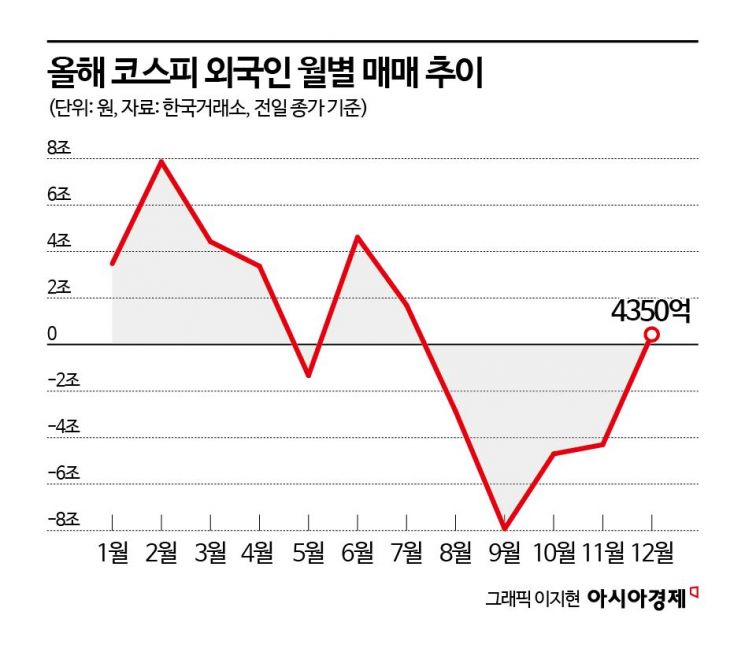

Foreign investors, who had taken a buying stance the previous day, switched to selling in just one day, net selling 220 billion won in the stock market.

Due to the declaration and lifting of emergency martial law overnight, volatility in the domestic stock market is expected to expand for the time being. Immediately after the declaration of martial law, the won-dollar exchange rate surged to the 1444 won level in an instant, and the MSCI Korea Index Exchange-Traded Fund (ETF) traded in the U.S. also fell more than 6% at one point.

Lee Kyung-min, a researcher at Daishin Securities, said, "Following this incident, the expansion of domestic political uncertainty is inevitable, so short-term volatility expansion should be guarded against."

Although the martial law situation ended after six hours and Korean-related assets somewhat calmed down, the situation remains uneasy. Han Ji-young, a researcher at Kiwoom Securities, said, "After the lifting of martial law, the won-dollar exchange rate fell to the high 1410 won range, and the MSCI Korea Index ETF closed down only 1.6%, showing signs that the instability of Korean-related asset prices is calming down." However, she pointed out, "The fact that the price levels of financial markets such as the MSCI Korea Index ETF and the won-dollar exchange rate have risen to higher levels than at the previous day's market close itself is a concerning factor. Since Korea's unique political uncertainty has intensified, there is a possibility that short-term volatility expansion in the domestic stock market is inevitable in the future."

In particular, foreign investor outflows are expected to continue. Foreign investors, who showed a selling trend on all but three days in November, bought more than 500 billion won in the stock market the previous day, leading the KOSPI to recover the 2500 level and raising expectations for the end of the foreign selling streak. Foreign investors have continued their selling streak from August through last month. During this period, they net sold 19.7935 trillion won in the stock market. One researcher said, "The previous day, foreign investors recorded the largest net buying scale in the KOSPI since August 16 (1.2 trillion won), raising expectations that the aggressive net selling would end, but these expectations may retreat due to the intensification of Korea's unique political uncertainty." Na Jung-hwan, a researcher at NH Investment & Securities, also predicted, "In the short term, foreign investors may exit the domestic stock market, causing a sharp drop in stock prices."

However, since the emergency martial law situation was quickly resolved, the market shock intensity is expected to be limited. The researcher said, "Considering that martial law was lifted immediately after being declared and that the declines in the exchange rate and overnight futures were reduced during this process, the shock intensity in the financial market will be limited." He added, "Especially since the domestic stock market and exchange rate market are located in extremely undervalued areas, there is a high possibility that they will gradually stabilize."

Financial authorities are also actively working to stabilize the financial market, so they are expected to play a buffering role. Kim Byung-hwan, chairman of the Financial Services Commission, held a financial situation review meeting that day and said, "The stock market is prepared to immediately activate market stabilization measures such as the 10 trillion won scale stock stabilization fund at any time, and the bond and money markets will maintain stability by fully operating the 40 trillion won scale bond market stabilization fund and corporate bond and commercial paper (CP) purchase programs." One researcher said, "Short-term price volatility may be inevitable, but since the authorities' financial market stabilization measures can be actively implemented, the persistence of volatility amplification will be limited."

However, political uncertainty triggered by this emergency martial law is unlikely to subside easily, making a quick recovery of the stock market difficult. Park Seok-jung, a researcher at Shinhan Investment Corp., said, "Although financial market volatility is expected to be controlled by government liquidity support, there remain factors of national instability such as the increasing possibility of entering an impeachment political situation by the end of the year, raising concerns about a triple weakness in foreign exchange, bonds, and stocks." He added, "It is necessary to prepare for repeated uncertainties in the financial market toward the end of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)