Investment Based on Growth Factors Such as Transaction Volume and User Numbers

Global Market Cooperation Expected Amid K-Fashion Popularity

Alibaba Group, China's largest e-commerce company, has made an equity investment in the domestic fashion platform Able Corporation. This marks Alibaba Group's first investment in a Korean e-commerce company, and it appears that Able has been chosen as a rival to China's online fashion platform SHEIN, which has recently dominated the global fashion market. The two companies are expected to strengthen their cooperation in the global fashion market through this investment.

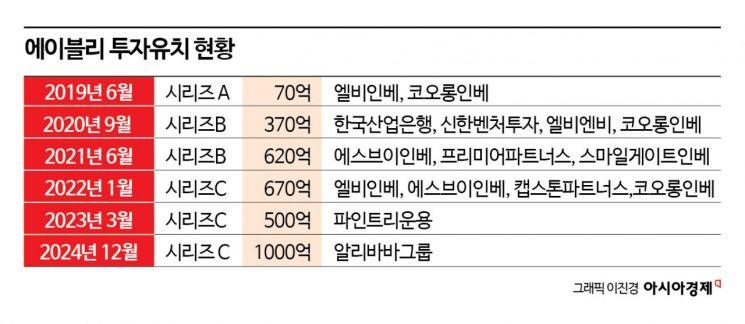

According to the distribution industry on the 3rd, Alibaba Group invested about 100 billion KRW in Able Corporation, which operates the fashion specialty mall Able. Through this investment, Alibaba is reported to have acquired around a 5% stake in Able Corporation. Able joined the ranks of unicorn companies by being valued at over 3 trillion KRW during this fundraising round. A unicorn company refers to a startup with a valuation exceeding 1 trillion KRW.

Able Corporation operates the style commerce platform Able, the men's fashion specialty mall 4910 (Saguilgong), and the Japanese fashion mall Amood. The company entered the women's fashion platform market in 2018 by changing its name from the women's clothing shopping mall 'Banhalla.' Although its market entry was later than competing women's fashion platforms such as W Concept (2008), 29CM (2011), and Zigzag (2015), Able quickly expanded its customer base through personalized recommendation services utilizing artificial intelligence (AI).

Alibaba's decision to invest in Able Corporation is analyzed to be due to Able's high growth potential. At the time of Able's first fundraising in 2021, its annual transaction volume was around 700 billion KRW, but this year, it surpassed 1 trillion KRW in transaction volume in just the first half. If this trend continues, Able is expected to become the first women's fashion platform to achieve an annual transaction volume of 2 trillion KRW.

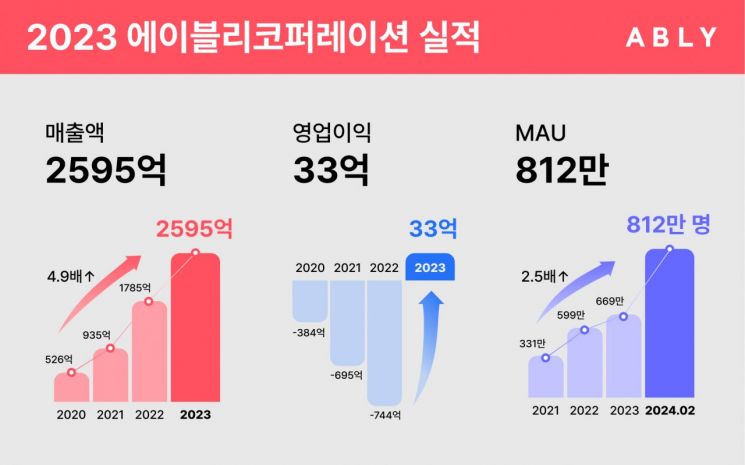

Indicators such as profitability and user numbers are also showing improvement, which is positive. Able was the only women's fashion platform to turn a profit last year. Able's revenue and operating profit last year were 259.5 billion KRW and 3.3 billion KRW respectively, marking its first-ever profitability since its founding. The number of users is also steadily increasing. According to IGAWorks Mobile Index, Able's monthly active users (MAU) in October reached approximately 5.05 million, ranking second among all fashion platforms after Musinsa (about 5.73 million).

This investment by Alibaba in Able is the first case of investment in a domestic e-commerce platform. Previously, there were speculations in the distribution industry that Alibaba would acquire the e-commerce platform Wemakeprice and the corporate supermarket (SSM) Homeplus Express, but Alibaba promptly denied these rumors. Wemakeprice entered rehabilitation proceedings due to unsettled payments in the Tmon-Wemakeprice (Timempe) incident, and Homeplus Express is currently being put up for sale by its parent company MBK Partners.

Until now, Alibaba has expanded its investments in the domestic market mainly through its own platforms. Alibaba currently operates the B2B platform Alibaba.com and the overseas direct purchase platform AliExpress in Korea. Earlier this year, Alibaba submitted an investment plan to the Korean government that included building logistics centers and executing investments totaling about 1.5 trillion KRW.

With this investment, collaboration possibilities between Alibaba and Able are also anticipated. Since Alibaba Group is actively sourcing Korean products globally, cooperation in overseas markets is the most expected area. In October, AliExpress launched the 'Global Selling Program,' which helps Korean sellers on AliExpress simultaneously sell their products on Alibaba Group's global platforms. The program's fees will be waived for the next five years.

As K-fashion and K-beauty enjoy high popularity in the global market, it is expected that Alibaba and Able will collaborate to help domestic fashion brands expand overseas. Just as the Chinese fashion specialty mall SHEIN, established in 2008, grew into a global fashion company by leveraging price competitiveness, it is anticipated that domestic fashion brands equipped with both price and quality will target the global fashion market. SHEIN delivers over 600,000 items to 150 countries worldwide through its online platform, with last year's revenue surpassing 45 billion USD (about 59 trillion KRW) and operating profit exceeding 2 billion USD (about 2.6 trillion KRW).

More than 70,000 sellers are registered on Able. Upon announcing the fundraising, Able also set a goal to strengthen its global network to help sellers expand their sales channels to various countries.

An Able representative stated, "Through this fundraising, we plan to strengthen support for K-sellers' overseas expansion," adding, "Able will provide opportunities for continuously growing domestic fashion brands to leap into global brands through Alibaba's global platforms." However, a representative from Alibaba Korea, the Korean branch of Alibaba Group, explained, "This investment was executed at the level of the Chinese headquarters," and added, "There is currently no position to disclose from the Korean branch."

Meanwhile, Able plans to raise a total of 200 billion KRW in global alliance investments starting with this investment. It is reported that discussions are underway with Silicon Valley in the United States and overseas sovereign wealth funds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)