KOSDAQ Falls Over 8% Last Month

KOSDAQ Leveraged Bear ETNs Soar

KOSDAQ Inverse ETFs Also Post Double-Digit Returns

Buying Interest in Leveraged ETFs Rises Amid Expectations of Rebound Following Continued Decline

Last month, as the KOSDAQ fell more than 8% in a month due to sluggish stock market performance, KOSDAQ 'Gopbus (Multiply + Inverse)' Exchange Traded Notes (ETNs) recorded high returns.

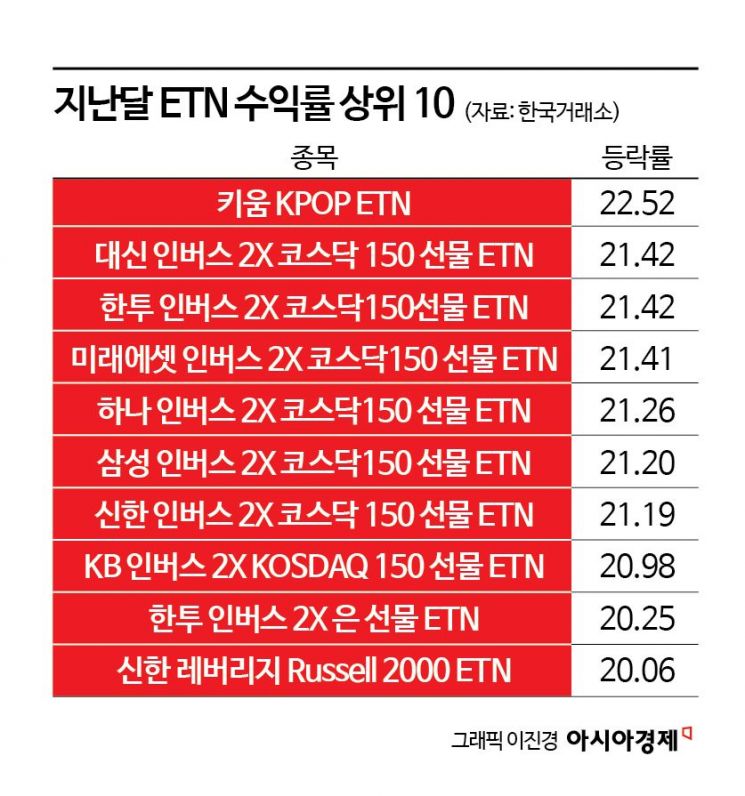

According to the Korea Exchange on the 3rd, KOSDAQ Gopbus items dominated the top ETN returns last month. Daishin Inverse 2X KOSDAQ 150 Futures ETN and Hantoo Inverse 2X KOSDAQ 150 Futures ETN rose 21.42% each, Mirae Asset Inverse 2X KOSDAQ 150 Futures ETN 21.41%, Hana Inverse 2X KOSDAQ 150 Futures ETN 21.26%, Samsung Inverse 2X KOSDAQ 150 Futures ETN 21.20%, Shinhan Inverse 2X KOSDAQ 150 Futures ETN 21.19%, and KB Inverse 2X KOSDAQ 150 Futures ETN increased by 20.98%. Among the top 10 highest-yielding items, 8 were KOSDAQ Gopbus products.

These products are designed to track twice the inverse of the KOSDAQ150 futures index, allowing investors to earn double profits when the KOSDAQ150 index declines.

KOSDAQ inverse ETFs, which also generate profits when the KOSDAQ falls, showed favorable returns. KODEX KOSDAQ150 Futures Inverse rose 11.39%, PLUS KOSDAQ150 Futures Inverse increased 11.29%. KOSEF KOSDAQ150 Futures Inverse gained 10.98%, RISE KOSDAQ150 Futures Inverse 10.92%, and TIGER KOSDAQ150 Futures Inverse 10.83%, all recording double-digit returns.

Last month, the sharp decline in the KOSDAQ led to increased returns for Gopbus ETNs. The KOSDAQ fell 8.73%, and the KOSDAQ150 index dropped 10.95%. During the same period, the KOSPI declined 3.92%, showing that the KOSDAQ underperformed significantly. The KOSDAQ, which was around the 750 level at the beginning of last month, continued its downward trend, falling below the 700 level and remaining around the 670 level. Compared to the beginning of the year, it has dropped more than 20%. Delayed interest rate cuts and other factors are cited as reasons for the deeper slump in the KOSDAQ. KB Securities researcher Ha In-hwan analyzed, "The high market interest rates caused by delayed interest rate cuts are still holding back the market, and issues such as the slowdown in the secondary battery industry, semiconductor weakness, and recent instability in the bio sector are ongoing."

iM Securities researcher Lee Woong-han said, "The weakness in secondary batteries and adjustments in the bio sector caused the KOSDAQ to suffer a sharp decline."

With the stock market outlook remaining bleak this month as well, the market slump is expected to continue, and the returns of Gopbus products are likely to maintain an upward trend.

Researcher Lee analyzed, "Difficult external conditions will persist. The tariff imposition risk from the Trump administration is unlikely to be resolved soon, and the November export indicators show that the peak-out is not far off. Despite occasional stimulus measures, China's economic downturn continues, and foreign investors have been selling domestic stocks throughout the second half of the year. Additionally, outflows to overseas stocks and cryptocurrencies have weakened domestic stock buying momentum."

However, there also appears to be some expectation of a rebound after the prolonged decline. Individual investors net purchased 455.8 billion KRW of KODEX KOSDAQ150 Leverage ETF last month, making it the most net-purchased ETF overall. Leverage ETFs can earn double profits when the underlying index rises.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)