Accumulated Sales of Listed Travel Agencies This Year Surpass Last Year

Norang Poongseon Fails to Predict Airline Ticket Sales... 4.8 Billion KRW Loss

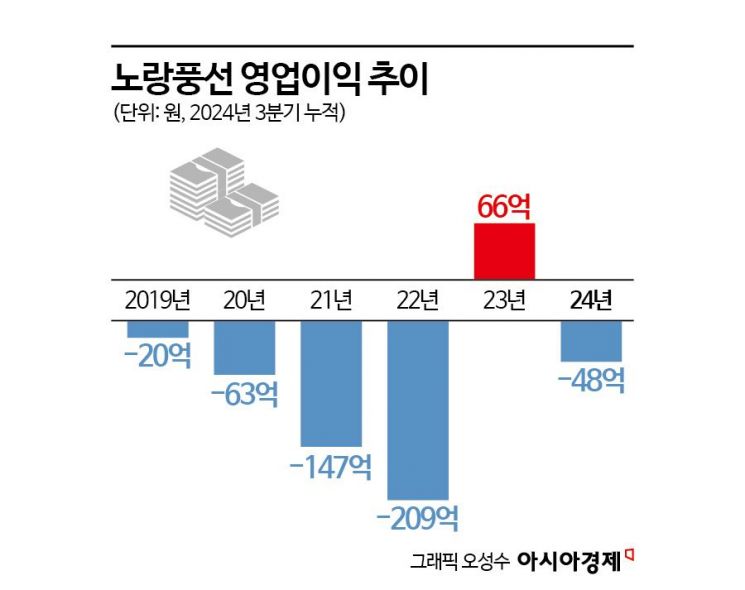

The travel industry has seen a simultaneous rebound in performance this year due to a surge in overseas travel demand, but among the domestic listed travel agencies, only Norangpungseon recorded an operating loss. The travel industry was hit by the delayed settlement incident involving Qoo10-affiliated e-commerce platforms TMON and WEMAKEPRICE in July, and profitability declined due to a failure to accurately forecast airline ticket demand.

The travel industry, which was directly impacted by the COVID-19 pandemic, has shown signs of recovery since last year. Sales through the third quarter of this year have already surpassed last year's figures, and if this trend continues, annual sales for this year are expected to recover to pre-COVID-19 levels. However, in the case of Norangpungseon, which has a high proportion of airline ticket sales, it is expected to be difficult to improve profitability in the near term.

Hana Tour Nearly 40 Billion KRW Profit... Only Norangpungseon in the Red

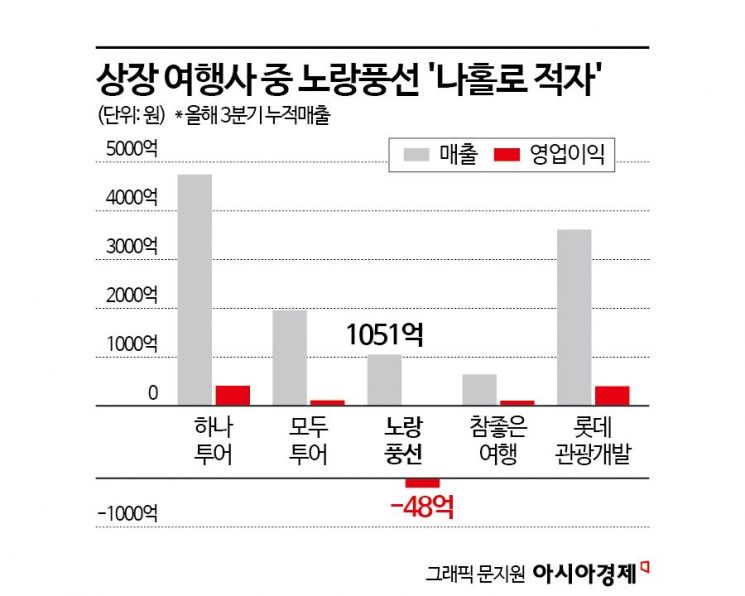

According to the Financial Supervisory Service's electronic disclosure system on the 2nd, Norangpungseon recorded a cumulative operating loss of 4.8 billion KRW through the third quarter of this year. While it achieved an operating profit of 6.3 billion KRW during the same period last year, it has turned to a loss this year. During this period, sales amounted to 105.1 billion KRW, already surpassing last year's annual sales of 98.6 billion KRW.

On the other hand, Hana Tour, the number one travel agency in the industry, posted sales exceeding 150 billion KRW in the third quarter alone, with cumulative sales this year reaching 474.3 billion KRW. Compared to the same period last year, sales jumped by 62%. The cumulative operating profit was 37.3 billion KRW, exceeding last year's annual profit of 34 billion KRW.

The same applies to other travel agencies. Lotte Tour Development (cumulative sales of 316.4 billion KRW this year) and Modetour (196.4 billion KRW) have already surpassed last year's annual sales, and Chamjoeun Travel (64.6 billion KRW) posted operating profits of 1.9 billion KRW, similar to last year's 68.6 billion KRW.

Norangpungseon's losses this year are attributed to management misjudgments. According to the company's quarterly report, penalty losses of 2 billion KRW occurred in the third quarter. The cumulative penalty losses this year reached 3.7 billion KRW, more than seven times the 470 million KRW recorded last year. The total cost of airline tickets also more than doubled from 17.3 billion KRW in the third quarter of last year to 39.5 billion KRW during the same period this year. Reflecting these costs, operating expenses surged 64% from 66.8 billion KRW last year to 109.9 billion KRW. Meanwhile, sales growth was limited to 43%.

This was due to the company anticipating a recovery in the travel market following the transition to the COVID-19 endemic phase, securing charter flights and hard-block seats (pre-purchased airline tickets) before the peak season, but sales underperformed expectations, leading to deteriorated profitability. A Norangpungseon representative said, "The market recovery rate was lower than expected, and unexpected poor sales led to penalty losses," adding, "With the Chinese government's visa-free policy implementation in the fourth quarter, demand in the Chinese market is expected to increase, and we plan to actively target this."

Airline Ticket Sales Account for 45%... Cost Burden Remains

In fact, after the Chinese government allowed visa-free entry for Koreans from the beginning of this month, reservations for travel to China have surged. However, since Norangpungseon has a high proportion of airline ticket sales, it is difficult to expect significant benefits.

Norangpungseon started as Departure Dream Tour on August 13, 2001, and is a travel agency that sells travel products directly to customers. As of the third quarter this year, 49% of the company's sales came from package tours and travel agency commissions, while sales from airline ticket sales accounted for 45.54%. In comparison, Hana Tour and Modetour's travel agency sales account for 93.30% and 96.48%, respectively.

In China, where English usage is low and communication difficulties exist, domestic travelers tend to prefer package tours over individual travel. According to Hana Tour, from October 1 to 21, when China allowed visa-free entry, reservations for China surged 75% compared to the previous three weeks, with package tours increasing by 110%.

Chae-rim Shin, a researcher at Korea Investment & Securities, forecasted, "Norangpungseon is expected to continue sales growth due to an increase in outbound travelers and higher reservation rates from the launch of various package products, leading to growth in travel agency commissions and airline ticket sales. However, due to the burden of airline ticket costs, profitability improvement is likely to be limited to a certain extent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.