Major Defense Stocks in Adjustment Phase

Investor Sentiment Drops Amid Geopolitical Risk Resolution Outlook

"Conflict Will Remain After War Ends, Defense Demand Remains Steady"

Defense stocks, which have risen relentlessly since the beginning of the year, are now showing signs of slowing down. Securities firms noted that while the ceasefire in the Middle East and the U.S. push for a Russia-Ukraine peace deal are negative factors for defense stocks in the short term, the seeds of conflict will remain regardless of the war’s end, and they expect the performance of domestic defense companies to continue growing steadily.

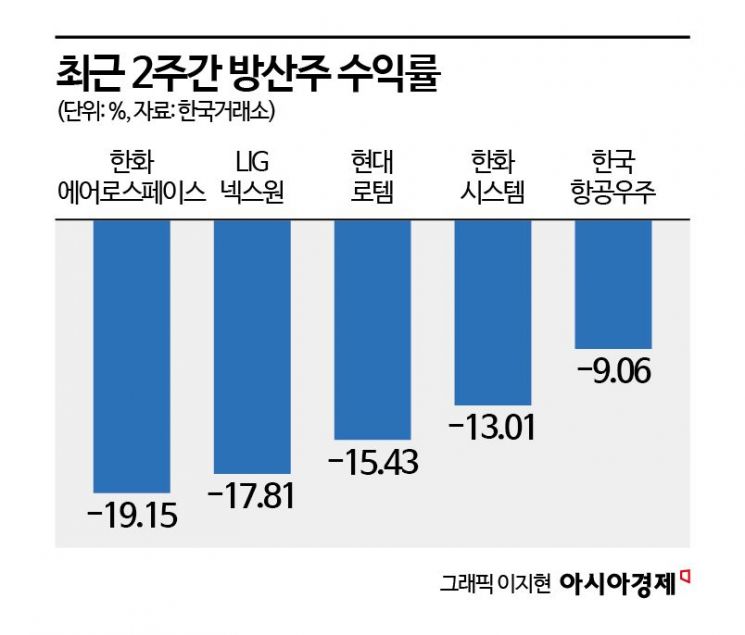

According to the Korea Exchange on the 29th, Hanwha Aerospace closed at 325,000 KRW, down 19.15% over the past two weeks. During the same period, major domestic defense companies also fell: LIG Nex1 (-17.81%), Hyundai Rotem (-15.43%), Hanwha Systems (-13.01%), and Korea Aerospace Industries (-9.06%). After a fierce rally earlier this year, stock prices are undergoing a rapid correction. This was triggered by the recent ceasefire agreement between Lebanon’s militant group Hezbollah and Israel, and the emphasis by Donald Trump, who will take office in January next year, on pushing for a Russia-Ukraine peace deal, raising concerns about a decline in global defense demand. Additionally, Elon Musk, nominated as co-head of the newly established Department of Government Efficiency (DOGE) in the next U.S. administration, stated that "there are still idiots making manned fighter jets like the F-35," highlighting defense budget cuts as a top priority, which also negatively affected investor sentiment.

Securities firms believe that although defense stocks have been shaken by concerns over the end of the war, global military build-up will continue. Lee Dong-heon, a researcher at Shinhan Investment Corp., said, "It is difficult for Ukraine to postpone or abandon its NATO membership or for Europe to accept Russia’s invasion war. While ceasefire negotiations will allow for a breather, it is far from ultimate peace." He added, "Israeli Prime Minister Netanyahu, who faced international criticism and needed to reduce the frontlines, is likely to continue the war from the perspective of strengthening security and extending his political life. Therefore, overseas orders for domestic defense companies are expected to continue next year."

There is also analysis emphasizing the unchanged fact that Trump has consistently pointed out the issue of allied countries’ defense cost-sharing. Lee Han-gyeol, a researcher at Kiwoom Securities, said, "Since early this year, Trump has demanded that NATO’s defense spending be raised to about 3% of GDP." He added, "As of this year, only 13% of countries, excluding the U.S., spend more than 3% of their GDP on defense." He further explained, "If defense budgets are set at over 3% of GDP, NATO’s defense budget would increase by 48.7%. If defense spending rises in line with Trump’s demands, the demand for weapon systems among NATO member countries will increase."

However, since stock prices have rallied for a long time, volatility may increase for the time being, and selective responses by stock depending on the ceasefire status in the Middle East and Europe will be necessary. Jung Dong-ho, a researcher at Mirae Asset Securities, said, "If the ceasefire continues, the trend in the defense industry will shift to technology transfer and local production, which could benefit Korea." He added, "In this case, LIG Nex1 and Korea Aerospace Industries, which are diversifying their export regions, would be advantageous." He continued, "Conversely, if the ceasefire fails and the war continues, attention should be paid to Hanwha Aerospace and Hyundai Rotem, which have strong export momentum and growth visibility mainly in the Middle East and European markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)