Exploring Investments of Korea's Top 3 Value Investment Firms

K-Defense Exits, K-Food, Travel, and Beauty Continue Investment

Undervalued Materials, Components, and Equipment Stocks Also Chosen as Value Investments

'Defense Industry Investment Exit, Continued K-Wave (Hallyu), Discovery of Undervalued Stocks'

In the midst of the domestic stock market slump, the investment directions of leading domestic value investment management firms can be summarized into these three points.

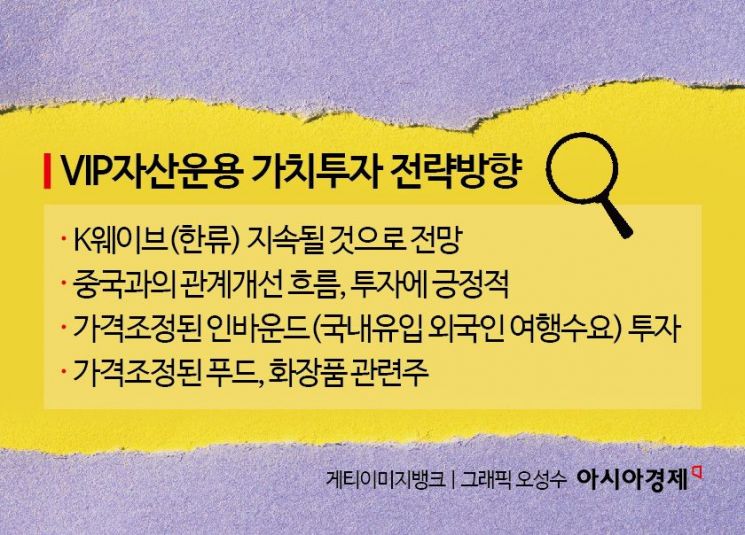

Choi Joon-chul, CEO of VIP Asset Management, recently told Asia Economy, "K-defense industry investment has come to a conclusion." The temporary ceasefire agreement between Israel and the Iran-aligned militant group Hezbollah in Lebanon, along with rising expectations for the end of the Russia-Ukraine war following Trump's election, have reduced the attractiveness of defense industry-related stocks.

CEO Choi mentioned, "We still believe the K-Wave will continue, so we are investing in inbound (foreign travel demand to Korea), food, cosmetics, etc., where prices have adjusted." In particular, CEO Choi highly values the competitiveness of K-food stocks such as Paris Baguette and Orion.

The J Asset Management and Must Asset Management Actively Discover Undervalued Companies in Materials, Parts, and Equipment

Alongside VIP Asset Management, The J Asset Management and Must Asset Management, recognized as Korean-style value investment firms, have identified undervalued stocks in the materials, parts, and equipment (SoBuJang) sector as their investment targets.

Since the 14th of this month, VIP Asset Management has increased its stake in PHA, an automobile parts manufacturer, through on-market purchases, securing more than a 5% stake. PHA, established in 1985, produces products such as vehicle door modules and hinges. It supplies products to domestic automakers including Hyundai Motor, Kia, KGM, and Renault Korea.

The J Asset Management recently secured more than a 5% stake in AP System, a developer of semiconductor and display laser application equipment. AP System's stock price surged sharply in May this year due to growing expectations for new semiconductor equipment supply and an increased proportion of semiconductor equipment sales ahead of the first-quarter earnings announcement. However, the stock price declined afterward. As the stock price plummeted, The J Asset Management accumulated shares, securing a 5.22% stake, betting on AP System's growth potential.

Another value investment firm, Must Asset Management, has recently attracted attention by making shareholder proposals targeting Young Poong, which is engaged in a management rights dispute with Korea Zinc. Must Asset Management, holding 2% of Young Poong's shares, demanded through shareholder proposals the complete cancellation of treasury shares and disclosure of information regarding the put option (the right to sell) on Korea Zinc shares made with MBK Partners. They also pointed out that Young Poong's market capitalization is about 711 billion KRW, only 0.14 times its actual net asset value (5 trillion KRW), marking it as one of the lowest levels in the Korean stock market. Ninety percent of Young Poong's net assets consist of Korea Zinc shares and buildings in central Seoul, and despite the high quality of these assets, it is effectively traded at the cheapest price in the Korean stock market. Following Must Asset Management's shareholder proposals, Young Poong's stock price rose about 12% to 432,500 KRW (as of the close on the 22nd and 27th, respectively).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.