Overseas Expansion with Samsung SDS... Performance Expected from Next Year

High Profitability Proven Through Q3 Results This Year

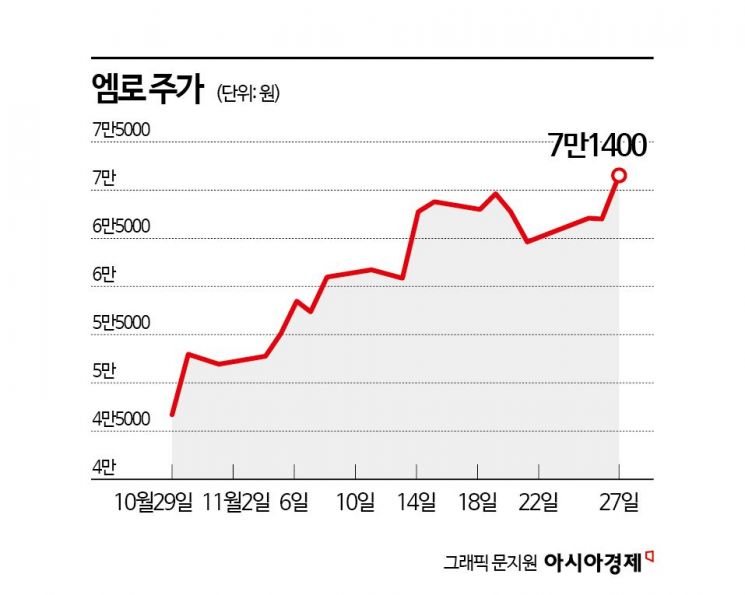

Recently, AI software companies are being re-evaluated in the domestic stock market. As the stock prices of AI-related semiconductor and electrical equipment companies have stalled, attention has shifted to software. The stock price of Emro, the nation's top supply chain management (SCM) software developer, has also been on an upward trend over the past month, increasing its corporate value.

According to the financial investment industry on the 28th, Emro's stock price rose 53% over the past month. During the same period, the KOSDAQ index fell by 7%. The return compared to the market reached 60 percentage points (P). Emro's market capitalization grew to 868 billion KRW. Institutional investors led the stock price increase with a cumulative net purchase of 26 billion KRW from the 30th of last month to the day before. Foreign investors also net purchased 11.3 billion KRW worth of shares, raising their ownership stake from 3.67% to 5.05%.

Emro specializes in SRM, one of the three areas of supply chain management: planning (SCP), execution and logistics (SCE), and procurement and supply chain management (SRM). By utilizing supply chain management software, companies can enhance purchasing transparency and induce cost-saving effects to efficiently manage their supply chains.

Emro's SCM software (SMARTsuite) covers all purchasing-related areas including cost management, procurement, electronic contracts, and partner management. Together with its largest shareholder Samsung SDS, it developed the SRM software-as-a-service (SaaS) solution called 'Kadenxia.'

In the third quarter, Emro recorded consolidated sales of 23.2 billion KRW, operating profit of 4.4 billion KRW, and net profit of 6.2 billion KRW. Sales and operating profit increased by 41% and 238.4%, respectively, compared to the same period last year, achieving the highest quarterly performance in its history. The operating profit margin rose by 11 percentage points to 18.9% from 7.9% in the previous year’s quarter.

On a cumulative basis for the first three quarters, sales and operating profit increased by 24.6% and 73.2%, respectively, compared to the same period last year. Sales growth was driven by the expanded supply of the supply chain management software SMARTsuite v10.0 and the cloud-based supply chain management service EmroCloud. The company is growing steadily by securing additional projects from large clients acquired in the first half of this year.

Yoon Cheol-hwan, a researcher at Korea Investment & Securities, explained, "Despite continuous increases in personnel recruitment for overseas market expansion and investments in developing an integrated SCM SaaS platform, the operating profit margin has improved," adding, "This is thanks to a significant rise in the proportion of high-margin technology-based sales." He continued, "Since sales began to increase from the second quarter after bottoming out in the first quarter, the leverage effect is now fully in play," and concluded, "We believe the rapid growth of a profitable AI software company has begun."

Overseas expansion through Kadenxia is also progressing smoothly, suggesting a strong likelihood of continued performance improvement. Earlier, Samsung SDS signed a Kadenxia contract with a U.S. electronics manufacturer last month, proving its software competitiveness by securing contracts with global companies.

Kim Su-jin, a researcher at Mirae Asset Securities, said, "We expect tangible results from overseas markets starting next year," and analyzed, "The policy direction of U.S. President-elect Donald Trump will create a positive environment for increased demand for SCM solutions."

Mirae Asset Securities estimates that Emro will achieve sales of 86.7 billion KRW and operating profit of 10.7 billion KRW this year. Next year, sales and operating profit are expected to increase by 26.4% and 61.5%, respectively, compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)