It has been revealed that only one business operator participated in the floating offshore wind power bid, which was implemented for the first time this year. While the wind power industry points to a lack of business feasibility as the cause, it is also known that supply negotiation issues for the key component, wind turbines, played a major role.

According to the wind power industry on the 27th, only the Firefly project led by Norway's Equinor participated in the floating offshore wind power bid, which closed on the 22nd this year.

The Ministry of Trade, Industry and Energy conducted bids for a total of 1,800 MW (1.8 GW) this year, including 1,500 megawatts (MW) of offshore wind power and 300 MW of onshore wind power. Among them, six fixed offshore wind power operators?Anma Offshore Wind Power, Taean Offshore Wind Power, Hanbit Offshore Wind Power, Handong Offshore Wind Power, Yawol Offshore Wind Power, and Aphae Offshore Wind Power?applied for a total of 1,668 MW. In contrast, only Firefly (Equinor) participated in the floating offshore wind power bid with a scale of 750 MW.

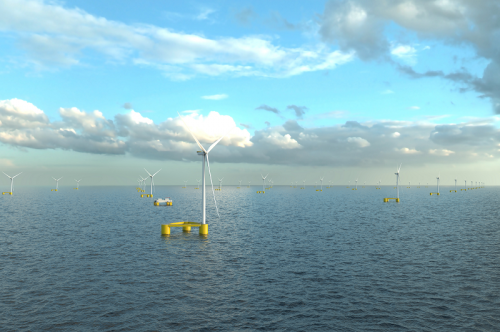

This bid attracted attention as it marked the starting point for floating offshore wind farms, which are being conducted for the first time domestically. However, with only Firefly participating, it failed to generate excitement.

For the floating offshore wind power project being established in the offshore waters of Ulsan, five projects have been prepared: Firefly, Haewool (CIP/COP), Ghost Whale (Korea-O, TotalEnergies, SK Ecoplant), Munmu Wind (Shell, Hexicon), and Korea Floating Offshore Wind Power (Ocean Winds, Mainstream, Geumyang Green Power). These five projects had completed government environmental impact assessment consultations and were preparing for the bid.

The wind power industry cites high development costs and fees for occupying and using public waters as major factors causing business uncertainty. The government conducted the bid separately for floating offshore wind power, considering its higher initial investment costs compared to fixed offshore wind power. The ceiling price for floating offshore wind power was set the same as for fixed offshore wind power at 176.565 KRW/MWh. To participate in the bid, a price lower than the ceiling must be submitted. The higher the ceiling price, the less burden on the business operator.

Floating offshore wind power, installed in offshore areas with good wind quality, has high electricity production efficiency, but since the floating body must be floated on the sea and the wind turbine installed on top, the initial installation investment burden is large. Operators preparing for floating offshore wind power had requested bid conditions that could reduce investment burdens, but this was not sufficiently reflected this time. Regarding this, a Ministry of Trade, Industry and Energy official explained, "Since floating offshore wind power contracts were made with a higher weighting than fixed offshore wind power, the conditions were by no means unfavorable."

The floating offshore wind power industry also requested improvements to the fees for occupying and using public waters, but these were not accepted. Fees for occupying and using public waters are costs paid to the government or local governments when occupying or using water surfaces such as seas and rivers. In the case of Ulsan floating offshore wind power, fees are charged based on the publicly announced land price of the adjacent Ulsan area, resulting in higher fees compared to other offshore wind power projects in regions like Jeolla Province. Operators requested reductions in these fees, but the government reportedly did not accept them for reasons of fairness.

On the other hand, there is also a view that the failure to conclude contracts with wind turbine companies was a major reason for withdrawing from the bid. For the Firefly project, which applied for the bid this time, Siemens Gamesa and Doosan Enerbility plan to cooperate to supply 15MW-class turbines.

In contrast, the other four projects were reportedly planning to receive 15MW-class turbines from Vestas, the world's largest wind turbine company based in Denmark. A wind power industry official said, "I understand that negotiations broke down at the last minute because Vestas decided to supply turbines with lower generation capacity than originally planned." If the generation capacity is lower, more wind turbines must be installed to produce the same amount of electricity, which inevitably increases investment costs.

Meanwhile, if Firefly, the sole participant, is finally selected, the country's first floating offshore wind power project is expected to be launched in earnest. The domestic wind power industry expects that through this project, domestic companies will be able to accumulate experience and technology in floating offshore wind power.

For the Firefly project, Doosan Enerbility will assemble and supply Siemens Gamesa's nacelles at its factory in Changwon, Korea. Doosan Enerbility expects to independently develop 15MW-class turbines by acquiring Siemens Gamesa's technology. Currently, Doosan Enerbility has commercialized turbines up to 8MW.

The substructure of the Firefly project will be handled by Samsung Heavy Industries. To this end, Equinor signed an exclusive supply contract with Samsung Heavy Industries in August. LS Cable will be responsible for the subsea cables. Subsea cables for floating offshore wind power must withstand high waves and strong currents.

Posco E&C also signed an exclusive supply contract with Equinor on the 24th. Posco E&C will perform the basic design of the Firefly offshore wind power project and will be responsible for the cable landing points, underground lines, and onshore substations that transmit power generated offshore to the land.

Meanwhile, Equinor is promoting a project to build a floating offshore wind power plant with a generation capacity of 750 MW about 70 km offshore from Ulsan Port by 2030. Once completed, the power plant will be able to supply electricity to approximately 440,000 households annually.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)