Amendment to Commercial Act Expands 'Fiduciary Duty of Directors'

"Legal Responsibility for Resolutions Increases" Business Community Opposes

Amid strong opposition from the business community over the partial amendment to the Commercial Act currently under discussion in the National Assembly, citing concerns about the contraction of corporate management, legal circles are divided between worries that lawsuits accusing directors of breach of fiduciary duty will be abused and cause significant damage to companies, and opinions that legal amendments are necessary to protect minority shareholders. On the 26th, the Legislation and Judiciary Committee of the National Assembly held the 1st Subcommittee on Bill Review and officially began discussions on the amendment to the Commercial Act.

Concerns Over Increase in Breach of Fiduciary Duty Lawsuits Against Directors

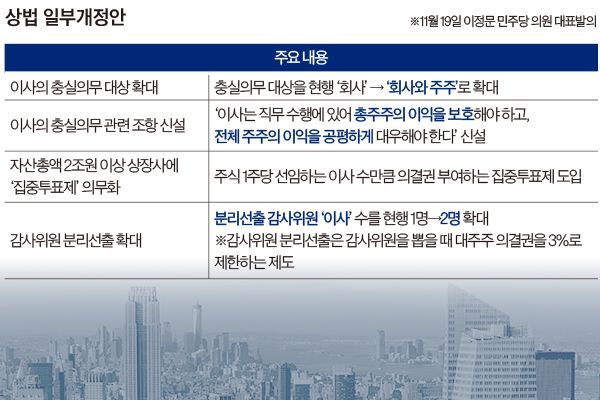

The amendment to the Commercial Act, spearheaded by Lee Jung-moon, senior deputy chairman of the Democratic Party’s Policy Committee, centers on expanding the ‘duty of loyalty of directors’ from the current ‘company’ to ‘company and shareholders.’ In the bill’s proposal, Lee stated, “Korean companies are often criticized for prioritizing the interests of major shareholders during various governance restructurings such as mergers and splits, while neglecting the interests of numerous minority shareholders,” emphasizing the need to legislate directors’ duty of loyalty toward shareholders.

In line with this, the amendment introduces a clause stating that “directors must protect the interests of the majority shareholders and treat the interests of all shareholders fairly” when performing their duties. This aims to establish a legal basis under the Commercial Act for damages liability or criminal liability for breach of trust under the Criminal Act if corporate directors make decisions unfavorable to general shareholders for the benefit of controlling shareholders.

Additionally, the amendment includes provisions to change the term ‘outside director’ to ‘independent director’ and require that one-third of all directors be independent directors; to mandate cumulative voting in the appointment process of directors for listed companies with total assets exceeding 2 trillion won; and to increase the number of separately elected audit committee ‘directors’ from one to two. Regarding the cumulative voting and separately elected audit committee provisions, opinions suggest these will enhance the influence of minority shareholders and activist funds.

On the 26th, the bill subcommittee reviewed reports on eight contentious issues of the amendment. However, as members of the People Power Party’s judiciary committee expressed opposition to the amendment, there was strong confrontation between the ruling and opposition parties during the meeting. Kim Seung-won, the Democratic Party’s judiciary committee whip, said, “It seems difficult for all eight contentious issues to pass,” adding, “We should at least discuss the most important matters, such as the scope of directors’ duty of loyalty.”

Concerns Over Litigation Abuse and Potential Attacks by Foreign Speculative Capital

The business community has strongly opposed the amendment. On the 21st, the Korea Economic Association and presidents of 16 major companies including Samsung, SK, Hyundai Motor, and LG issued a statement saying, “If the amendment passes, corporate competitiveness will be severely damaged, leading to a value downgrade of our stock market,” and warned, “Many companies will suffer from excessive litigation and attacks by foreign speculative capital, making it difficult to operate boards of directors normally.”

The government also expressed opposition. On the 24th, Kim Byung-wan, chairman of the Financial Services Commission, appeared on a broadcast and said, “While I agree that corporate governance should become more transparent, we also need to consider the negative impacts of the amendment to the Commercial Act on corporate management and capital markets.” He added, “Including shareholders in the duty of loyalty could significantly delay decision-making,” and “There are concerns about an increase in lawsuits, and if foreign speculative capital uses this as a pretext to make excessive demands or threaten management rights, it could negatively affect corporate value.”

A legal professional working in a major corporation’s legal team lamented, “According to the amendment, if an outside director is judged to have failed to protect the interests of the majority shareholders in their voting actions, they will bear legal responsibility. Who would want to become a director under such conditions?” and predicted, “The shortage of capable outside directors will worsen.”

Kim Young-jong (58, 23rd Judicial Research and Training Institute class), advisor at POSCO Holdings, pointed out, “Strengthening directors’ duty of loyalty to shareholders through legal amendments will not eliminate the ‘Korea discount.’” He warned, “The amendment to the Commercial Act essentially opens the door for foreign speculative capital to attack domestic companies, which could cause significant side effects.” He added, “To find alternatives that can achieve both ‘transparent management and enhancement of shareholder value,’ it is necessary to open the appointment rights of outside directors to external parties so that outside directors can perform proper monitoring roles,” and emphasized, “Shareholders should be able to recommend outside directors, and institutional investors should be allowed to be elected as outside directors.”

Hong Yoon-ji, Reporter for Legal Times

※This article is based on content supplied by Law Times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.