Vice Chairman Huh Yeon-su, who led the company for 9 years, steps down

GS Retail's overall profits decline, convenience stores reach 'saturation'

GS Group "Expecting business growth and creation of new growth engines"

A new leader in his 40s from the fourth generation of the owner family has emerged to lead GS Retail, which has total assets worth 10 trillion won. The distribution industry has been undergoing rapid generational change this year as consumer sentiment has frozen due to high inflation and economic downturn, and GS Retail is also expected to build a business portfolio that responds to rapidly changing consumer trends by appointing a CEO in his 40s.

On the morning of the 27th, GS Group held a board meeting and appointed Vice President Heo Seo-hong as the new CEO of GS Retail. Vice Chairman Heo Yeon-soo, who had been leading GS Retail, handed over his position to his nephew, the new CEO Heo, and retired. Vice Chairman Heo announced through the company bulletin board, "I intend to step down as CEO of GS Retail at the end of this year," and "Vice President Heo Seo-hong will take over as CEO."

GS Retail Injects 'Young Blood'... Accelerates New Business

The new CEO Heo Seo-hong, born in 1977, is the fourth generation of the owner family. He is the eldest son of Heo Kwang-soo, chairman of Samyang International, and the fifth cousin of Heo Tae-soo, chairman of GS Group. Vice Chairman Heo Yeon-soo is the cousin of Chairman Heo Kwang-soo. Additionally, CEO Heo is the nephew-in-law of Hong Seok-jo, chairman of BGF Retail, the operator of convenience store competitor CU. Hong Jung-guk, vice president and CEO of BGF Retail, is the cousin of Hong Jeong-hyun, the wife of Heo Seo-hong. GS Retail and BGF Retail, the two major players in the convenience store industry, are related by marriage, making competition inevitable in the increasingly fierce convenience store market.

CEO Heo graduated from Seoul National University with a degree in Western History and from Stanford University Graduate School of Business in the United States. He joined GS Home Shopping in 2006 as an assistant manager in the new business team. In 2012, he moved to GS Energy as head of the LNG business team, then served as executive director of GS Energy’s management support headquarters and vice president of GS Future Business Team. In the regular executive personnel reshuffle last November, he was appointed vice president and head of the GS Retail management strategy service unit, joining GS Retail.

Over the past year, CEO Heo has overseen strategy, finance, and new business at GS Retail, increasing his understanding of the retail business. In particular, during his tenure at GS Group, he was praised for his excellent insight in diversifying business, leading the acquisition of the aesthetic company Hugel. GS Group plans to initiate new changes and growth at GS Retail through the 40-something CEO Heo. GS Group is known for faster generational changes compared to other groups. CEOs in their 40s and 50s, such as Heo Se-hong of GS Caltex and Heo Yoon-hong of GS Construction, are leading their companies.

Growth Stagnation at GS Retail, CEO Heo’s Heavy Burden

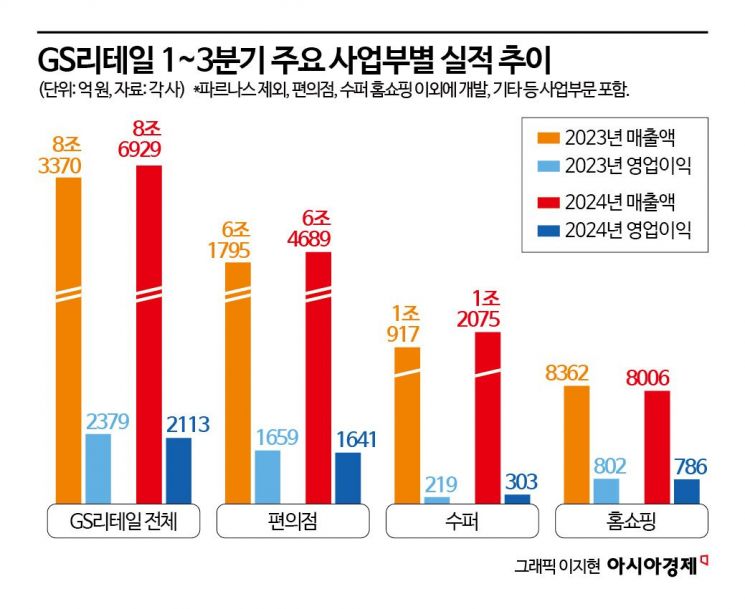

However, looking solely at the distribution industry, the new CEO Heo faces a heavy burden. Although GS Retail has maintained sales growth recently, profitability has been declining. As of the third quarter this year, cumulative sales reached 8.6929 trillion won, a growth of about 4.3% compared to the same period last year. However, operating profit sharply dropped by 11% to 211.4 billion won compared to the same period last year. This was due to bad debt write-offs related to convenience stores, home shopping divisions, and new projects starting from the second quarter.

In the convenience store business, which accounts for more than 70% of sales, profitability continues to shrink due to fierce competition for first place. As of the cumulative basis this year, GS25’s sales amounted to 6.4689 trillion won, with operating profit of 164.1 billion won. While sales slightly increased, operating profit slightly decreased. Operating profit for the third quarter alone (72.9 billion won) fell by 5% compared to last year.

Costs increased due to the rise in the number of stores from competition with BGF Retail, which operates convenience store CU, and advertising and promotional expenses also grew, reducing profitability. The close pursuit by BGF Retail is also a burden. In the third quarter, BGF Retail recorded sales and operating profit of 2.2356 trillion won and 91.2 billion won, respectively, growing 5.4% and 5% compared to the same period last year.

Home shopping is also sluggish. GS Home Shopping, once the industry leader, saw profitability severely deteriorate due to increased transmission fees, and failed to find a rebound opportunity this year as the transition to mobile was delayed amid a declining TV viewership trend.

Another burden is the poor performance of companies invested in to strengthen new businesses. As of the cumulative basis this year, GS Retail’s equity-method evaluation loss amounts to 89.5 billion won. Equity-method evaluation loss refers to the loss reflected in the company’s accounts proportional to its shareholding in the invested company’s losses. Because of this, CEO Heo was appointed as a non-executive director of Great Imagination, the operating corporation of Yogiyo, and also became a non-executive director of Cookat, reviewing the business portfolio.

Therefore, CEO Heo is expected to focus on capturing two rabbits: strengthening competitiveness in core businesses such as convenience stores and home shopping, and discovering new businesses. Earlier, GS Retail diversified its business by spinning off its hotel division, Parnas Hotel, on December 1. A GS Group official explained, "He demonstrated excellent insight by drawing the blueprint for new businesses across the group during his tenure at GS Group," and added, "Based on his broad business experience, he is expected to create sustainable growth in retail business and new growth engines."

Vice Chairman Heo Yeon-soo 'Retires'... Presents New Business Blueprint

Vice Chairman Heo Yeon-soo, who had led GS Retail, attracted attention by unusually presenting management directions while announcing his retirement. According to a post he made on the company bulletin board, there are plans to promote the Quick Commerce Office under the O4O division of the Platform BU to a dedicated organization. Also, in the home shopping division, the home shopping business unit and mobile business unit will be integrated into a 'Unified Channel Business Unit' to strengthen mobile-centered marketing. This move supports CEO Heo, his 40s nephew, by empowering him to organize the company.

Vice Chairman Heo devoted himself to the company’s growth during his 20 years at GS Retail. He first entered the distribution industry in 2003 as a new store planning manager at LG Distribution (now GS Retail). He then served as executive director of the convenience store business MD division in 2007 and vice president of sales and MD headquarters in 2010. He was appointed president and CEO of GS Retail in 2015 and promoted to vice chairman in 2019.

During his tenure as head of GS Retail, Vice Chairman Heo was recognized for his management skills by leading convenience store GS25 to become the industry’s top sales performer. He also elevated GS Supermarket, a corporate supermarket, to first place in the industry, turning it into a profitable business. In 2021, he led the merger of GS Retail and GS Home Shopping, strengthening competitiveness in the online sector. Vice Chairman Heo was also active in seeking new growth engines. Since 2021, he emphasized the need for new businesses and invested in major companies such as Yogiyo (307.7 billion won), food commerce company Cookat (55 billion won), Danggeun Market (20 billion won), and Pet Friends (32.5 billion won). Although not all investments were successful, Vice Chairman Heo is credited with breaking the mold of a 'conservative investor' company and driving change and innovation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.