Major Telecom Stocks Hit '52-Week High' Side by Side

Amid AI Hardware to AI Software Expansion

High Growth Kickoff Leveraging AI Data Centers

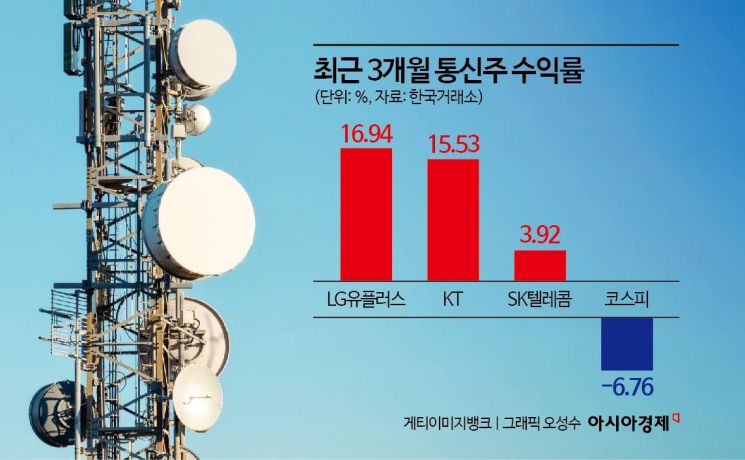

While the market is declining, telecommunications stocks are continuing their strong performance by hitting new highs. The securities industry has noted the AI infrastructure of telecommunications stocks, which had previously only played a defensive role in the stock market, and analyzed that they could emerge as growth stocks in the future.

According to the Korea Exchange on the 27th, LG Uplus closed at 11,570 won, up 330 won (2.94%) from the previous session. Along with LG Uplus, SK Telecom (2.64%) and KT (1.56%), known as the 'Big 3' telecommunications companies in Korea, also showed strong performance. In particular, KT and LG Uplus hit 52-week highs on the day. This contrasts with the KOSPI, which fell 0.55%. Recently, whenever the overall market fluctuates, telecommunications stocks have effectively played a defensive role by maintaining their returns.

The securities industry analyzes that as AI software spreads across industries in the future, telecommunications stocks could transform from defensive stocks into growth stocks. This is because it is no longer easy to achieve sales growth focused on B2C (business-to-consumer) transactions, and telecommunications companies are concentrating their capabilities on AI infrastructure businesses. Junseop Kim, a researcher at KB Securities, said, "The AI infrastructure business of telecommunications companies will act as a momentum for stock price increases in the future," adding, "The AI infrastructure business operated by telecommunications companies is divided into data center business and cloud management service (MSP) business. The revenue generated from these businesses is expected to grow 25% year-on-year to 1.69 trillion won this year and continue to grow by about 18% next year."

Telecommunications companies themselves are also highlighting AI infrastructure-related businesses as next-generation growth engines. SK Telecom plans to open an AI data center based on Nvidia's graphics processing units (GPUs) next month and launch a subscription-based AI cloud service within the year. KT has set a specific goal to expand its data center capacity to 215 megawatts (MW) by 2028, emphasizing its commitment to developing high-density, high-efficiency infrastructure technologies and expanding hyperscale data centers. LG Uplus also plans to establish an AI data center in Paju by 2027 and enhance related services by integrating AI into infrastructure, platforms, and data fields.

Researcher Kim explained that a particular strength of telecommunications companies is their ability to efficiently develop AI data center businesses by utilizing their existing network assets. He said, "Telecommunications companies have built stable network infrastructure based on nationwide backbone networks and submarine cable connectivity. They also have competitiveness in terms of economies of scale, with a market share exceeding 60%." He added, "Furthermore, accessibility and experience in providing customized services secured through strategic partnerships with global cloud providers will positively influence tenant acquisition in the future."

The B2B (business-to-business) business using AI data centers is expected to be a factor that differentiates stock prices among telecommunications companies in the future. Wonseok Jung, a researcher at Shin Young Securities, said, "Among the business areas of the Big 3 telecommunications companies, the most emphasized area is the B2B sector, especially AI data centers," explaining, "With continuous demand growth expected due to cloud and AI growth, the AI data center business is characterized by clear growth visibility according to production capacity (CAPA) expansion plans."

Researcher Jung predicted that the profitability of the AI data center business will increase as competition in AI model training intensifies. He said, "Compared to conventional data centers, AI data centers have higher rental fees and utilization rates," noting, "In fact, in North America, data center rental fees, which had been declining by an average of 3% annually since 2014, began to surge from 2022, and vacancy rates are also decreasing." He added, "AI-specialized data centers provide high-speed and high-bandwidth networks and high-spec cooling equipment compared to general data centers, which also results in higher floor rental fees."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.