54,8000 People to Receive Property Tax Payment Notices This Year

Property Tax Amount Nears 5 Trillion Won, Up 6.3%

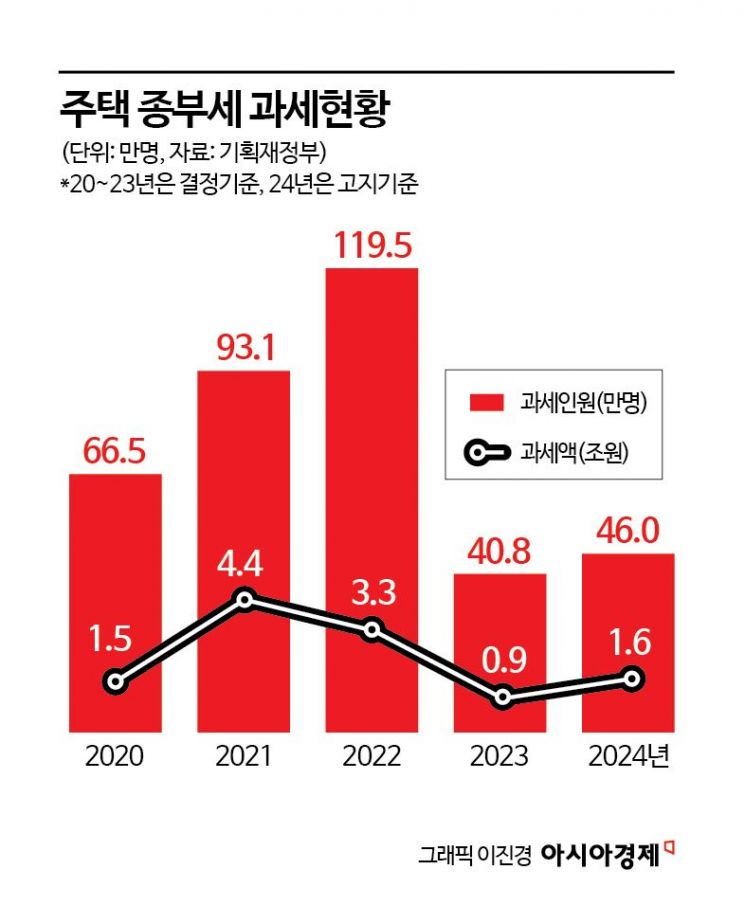

The number of citizens receiving comprehensive real estate tax (종합부동산세) payment notices increased by about 10% this year. The amount of the tax notices also saw a slight rise. Since the launch of the Yoon Seok-yeol administration, tax rate reductions and increases in deduction amounts have been implemented under the rationale of ‘normalizing real estate taxation,’ but rising housing prices, especially in the Seoul metropolitan area, have led to an increase in both the number of taxpayers and the tax amounts again.

According to the Ministry of Economy and Finance on the 26th, 548,000 people received comprehensive real estate tax payment notices this year. This is a 10.7% (53,000 people) increase from the 495,000 who paid the tax last year. Compared to the previous year’s notice recipients, it is a 9.7% (48,000 people) increase. The total tax amount notified is 5 trillion KRW, which is 800 billion KRW (19%) higher than the previous year’s assessed tax amount and 300 billion KRW (6.3%) higher than the previously notified tax amount.

The number of taxpayers subject to housing-related comprehensive real estate tax is 460,000, an increase of 48,000 people (11.6%) compared to the number of notices sent. The tax amount also rose by about 100 billion KRW (8.5%) to reach 1.6 trillion KRW.

Among the housing taxpayers, individuals account for 401,000 people, which is 48,000 (13.7%) more than last year. The tax amount for individuals reached 582.3 billion KRW, marking an increase of 112.7 billion KRW (24%). The average tax amount per individual was 1,453,000 KRW, up 121,000 KRW (9%) from last year.

The number of single-home owners (1 household 1 house) who received comprehensive real estate tax notices increased by 17,000 (15.5%) to 128,000, while multi-home owners increased by 31,000 (12.9%) to 273,000. The tax amounts for these groups rose by 26.3 billion KRW (29.1%) to 116.8 billion KRW and by 86.5 billion KRW (22.8%) to nearly 465.5 billion KRW, respectively.

The increase in the number of comprehensive real estate tax notice recipients is attributed to rising housing prices, mainly in the Seoul metropolitan area. The number of housing-related taxpayers increased in all regions, with particularly high changes in official property prices in the Seoul metropolitan area and Sejong. Nationwide official property prices rose by 1.52% this year, with Sejong increasing by 6.44% and Seoul by 3.25%. Gyeonggi (2.21%) and Incheon (1.93%) also showed relatively high growth rates.

The number of taxpayers in the Seoul metropolitan area also increased sharply compared to the previous year. Incheon saw the steepest increase among metropolitan local governments nationwide, with a 14.8% rise in taxpayers. Sejong followed with a 13.4% increase, then Seoul (13.2%) and Gyeonggi (13.0%).

The Ministry of Economy and Finance explained that although comprehensive real estate tax increased compared to the previous year, the ‘normalization effect continues’ when compared to 2022. Since the Yoon administration took office, the comprehensive real estate tax rate has been reduced from 0.6?6.0% to 0.5?5.0%. The basic deduction amount was raised from 600 million KRW to 900 million KRW, and for single-home owners from 1.1 billion KRW to 1.2 billion KRW. The fair market value ratio was also lowered from 100% to 60%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)