Vescent, Rutnik, Musk, and Others with Billion-Dollar Assets

Must Disclose and Plan Asset Disposal After Inauguration

Trump Reluctant to Dispose of Assets Like During First Term

As the appointment process for the Donald Trump administration in the United States enters its final stages, concerns over 'conflicts of interest' have arisen due to the appointment of numerous billionaire entrepreneurs and Wall Street executives.

Bloomberg News reported on the 25th (local time) that billionaire CEOs and Wall Street figures, including Elon Musk, CEO of Tesla, have taken key positions in the next Trump cabinet, highlighting the potential reemergence of the cronyism issues that surfaced during Trump's first term.

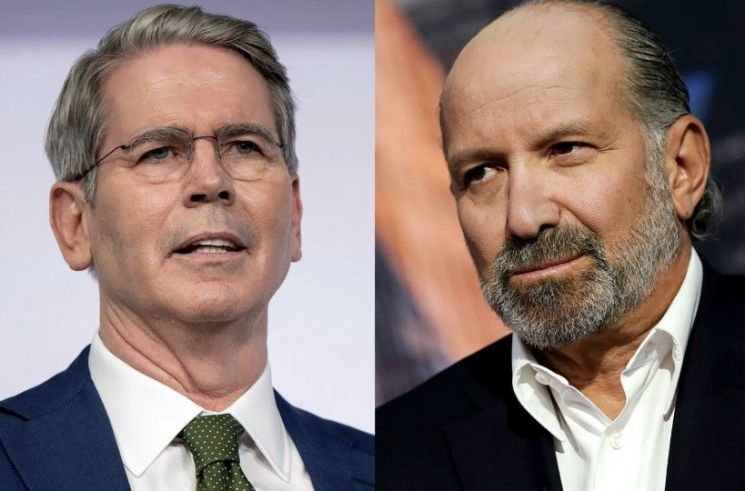

Nominee for Secretary of the Treasury Scott Bessent (left) and nominee for Secretary of Commerce Howard Lutnick (right).

Nominee for Secretary of the Treasury Scott Bessent (left) and nominee for Secretary of Commerce Howard Lutnick (right).

The second Trump cabinet includes many individuals expected to hold substantial financial assets. Scott Bessent, nominated for Secretary of the Treasury, previously led the macro hedge fund Key Square Group, which profited from market volatility caused by political and economic events. Howard Lutnick, selected as Secretary of Commerce, is a former CEO of investment bank Cantor Fitzgerald and is known to hold significant stakes in real estate and financial services brokerage firms.

Additionally, Linda McMahon, nominee for Secretary of Education and former operator of World Wrestling Entertainment (WWE), disclosed ownership stakes in over 300 companies during her tenure as head of the Small Business Administration. Chris Wright, appointed Secretary of Energy, owns $40 million worth of shares in Liberty Energy, an oil drilling services company.

Bloomberg stated, "The newly appointed individuals must establish plans to eliminate potential conflicts of interest and implement them within 90 days," adding, "Officials requiring Senate approval must sign ethics pledges specifying the list of assets to be sold and the timing of such sales." However, CEO Musk is expected to be exempt from asset disclosure and divestiture obligations since the newly established Department of Government Efficiency (DOGE) is likely to be formed as an external advisory committee rather than a federal agency.

Concerns over conflicts of interest in the billionaire- and Wall Street-filled second Trump cabinet arose as the transition team reportedly missed the deadline for submitting the 'ethics pledge' to prevent conflicts of interest. The Presidential Transition Act (PTA) stipulates that if an ethics plan is not submitted, the transition team cannot sign a memorandum of understanding (MOU) with the General Services Administration (GSA) and the White House. Without this MOU, the second Trump transition team would be restricted from accessing government classified information, entering 438 federal agencies, reviewing materials, and attending briefings.

Sources explained that the delay in submitting the ethics pledge stems from Trump’s reluctance to relinquish his business interests. During his first term, Trump was estimated to own about 400 properties nationwide, including luxury condos and mansions worth approximately $250 million, but the status of ownership and sales was not properly tracked, raising concerns about conflicts of interest.

Recently, after winning the presidential election, Trump stated he has no plans to sell his stake in the social networking service (SNS) Truth Social, which he founded, drawing a line on asset disposal after inauguration. Trump Media and Technology (DJT), the operator of Truth Social and a major beneficiary of the 'Trump trade,' reportedly holds shares worth $3.76 billion owned by Trump himself. Bloomberg estimates Trump’s assets at $6.1 billion.

The Washington Post (WP) explained, "Because the president and vice president oversee too many areas, applying conflict of interest laws is practically difficult, and they are not obligated to sell their assets." It added, "Since Jimmy Carter in the 1970s, U.S. presidents have avoided the appearance of conflicts of interest by placing assets in blind trusts or investing in Treasury bonds, but this is not legally mandated." Critics point out that Trump may break White House traditions and move domestic and foreign companies and stakeholders in ways that benefit the expansion of his own business interests.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.