Automotive Research Institute 'Huawei's Rise and Prospects' Report

Local Market Ranked 7th Due to Advanced Driving Assistance Technology

An analysis has emerged that software (SW) technology capabilities, such as advanced driver assistance, are becoming a key measure of competitiveness among companies in the Chinese automobile market. With electrification already progressing rapidly, China is likely to take the lead in the next phase, which is considered to be the widespread adoption of smart cars.

The Korea Automotive Technology Institute pointed out in its report titled ‘The Rise and Prospects of Huawei in the Chinese Automobile Market,’ released on the 26th, that "the Chinese automobile industry, which has low operating profit margins, is focusing on developing smart driving technologies such as urban NOA (navigation-based autonomous driving) to achieve high value-added differentiation."

Aito M9 (left) and Lucid R7 developed through collaboration between Chinese company Huawei and automobile company Seres. It is a Huawei software technology HIMA series brand. Photo by Yonhap News Agency

Aito M9 (left) and Lucid R7 developed through collaboration between Chinese company Huawei and automobile company Seres. It is a Huawei software technology HIMA series brand. Photo by Yonhap News Agency

Smart driving basically refers to driving systems, including software, that operate at Level 3 or below, where driver intervention is still required. Although the vehicle can drive itself using road conditions and navigation information, the driver must always be prepared to intervene due to the significant influence of surrounding conditions. Autonomous driving is generally considered to start from Level 4. Up to Level 3, it is closer to advanced driver assistance.

Huawei is recognized as a leader in smart driving in China. Known as a technology company that manufactures communication equipment and smartphones, Huawei has refined advanced driver assistance technologies and quickly established itself in the finished vehicle market. Existing automakers such as BYD, which has become the world’s number one electric vehicle manufacturer, and Changan actively use Huawei’s technology. In China, Huawei is often regarded as a personal tutor for traditional automakers, as it supplies software technology, considered the brain of the car, evenly to various companies.

Senior researcher Seo Hyun Lee, who authored the report, explained, "(Existing automakers) find it difficult to respond promptly to demand with their own software technology, so they are pursuing collaboration with Huawei," adding, "Around 2023, smart driving technology emerged as a key factor in Chinese consumers’ purchasing decisions."

Huawei collaborates with automakers in various scopes and methods. These include the cockpit, which encompasses control functions around the driver’s seat; Tier 1 suppliers who provide general parts such as displays and motors; and the HI (Huawei Inside) approach, which covers autonomous driving and smart car system software and hardware. Going a step further, HIMA (Harmony Intelligent Mobility Alliance) represents a Tier 0.5 level collaboration, involving vehicle design, quality control, design, brand management, and sales.

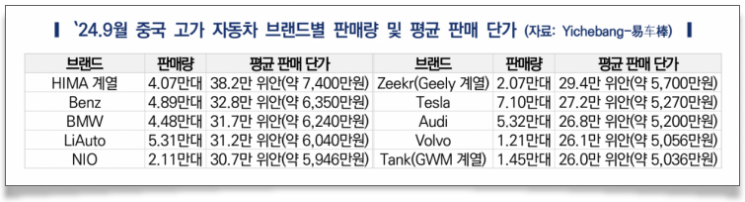

HIMA brand electric vehicles are expensive. According to the report, the average selling price is about 74 million KRW per vehicle. This is more than 15% higher than Mercedes-Benz (average 63.5 million KRW) and BMW (average 62.4 million KRW), which are considered premium brands locally. Tesla’s average selling price is around 52.7 million KRW.

Despite the high price, sales are strong. HIMA-affiliated vehicles sold about 40,000 units in September alone, totaling approximately 310,000 units from January to September this year. This ranks seventh in domestic new energy vehicle (battery electric vehicles, plug-in hybrids, hydrogen fuel cell vehicles) sales. The local top manufacturer BYD sold about 2.47 million units from January to September, followed by the largest private automaker Geely with 530,000 units, and Tesla with about 460,000 units.

Senior researcher Lee said, "Huawei uniquely offers a Level 2 autonomous driving technology package with basic smart driving functions plus additional features like urban NOA only as a paid service," adding, "Despite the high package price, the purchase rate is high."

However, while Huawei is currently regarded as having a higher technological level than other automakers, this could change depending on future collaboration relationships and whether it maintains its relative advantage. Some companies, like BYD, are developing their own technologies, and collaborations to refine software or autonomous driving technologies, such as Xiaopeng-NVIDIA and Tesla-Baidu, have increased.

Senior researcher Lee analyzed, "Huawei aims to be a platformer in the automobile industry, but its influence will be concentrated in the Chinese domestic market," adding, "U.S. semiconductor sanctions against China are expected to largely determine Huawei’s relative advantage." This means that due to U.S. sanctions on Huawei and the high prices in emerging markets, there will inevitably be limitations to its expansion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)