European Unified Patent Court Dismisses Insulet Sales Injunction Application

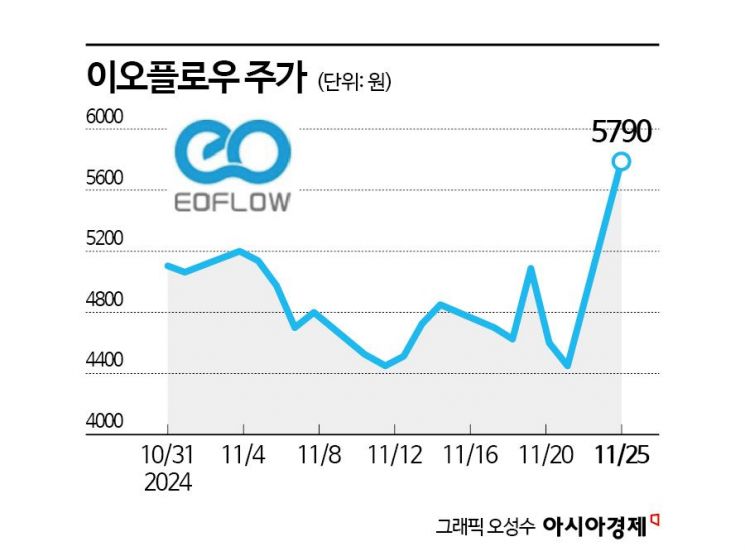

Reflected Positive Sentiment as Stock Hits Upper Limit on 25th

The stock price of Eoflow, which is raising funds through a rights offering, surged to the upper price limit. Investors interpreted the European Unified Patent Court (UPC)'s dismissal of the injunction request related to a patent lawsuit filed by competitor Insulet as a positive signal, leading to a flood of buy orders. This is also expected to affect the subscription of existing shareholders in the rights offering.

According to the financial investment industry on the 26th, Eoflow closed at 5,790 KRW the previous day, up 29.82% from the previous trading day.

The day before, Eoflow announced that the injunction request filed by Insulet to the UPC to ban the sale of Eopatch had been dismissed. Insulet is a Nasdaq-listed company in the U.S. and a global leader with a worldwide sales network in the wearable insulin pump sector.

Earlier, on July 3rd, Insulet filed an injunction request with the UPC claiming patent infringement, seeking to ban the sale of Eopatch products. The UPC Milan Central Court dismissed Insulet's injunction request, stating that the validity of Insulet's patent was in doubt due to prior patents presented by Eoflow. The court also ordered Insulet, which lost the case, to bear the litigation costs related to Eoflow's lawsuit.

An Eoflow official explained, "We prepared prior patents that could invalidate Insulet's clutch structure patent," adding, "By appropriately presenting the prior patents, we were able to obtain the dismissal decision."

On August 21st, Eoflow held a board meeting and resolved to proceed with a rights offering. As uncertainties related to the patent lawsuit increased, amendments to the securities registration statement continued, and the subscription schedule was postponed. Eoflow has been incurring massive costs due to Insulet's patent lawsuit. Legal expenses amounted to 5.6 billion KRW last year and 19.8 billion KRW through the third quarter of this year. It is expected that legal expenses will decrease once the first trial jury verdict in the U.S. is announced.

With unexpected expenditures added, the stock price has continued to show a sluggish trend. The planned issue price for the new shares was lowered from 9,040 KRW at the initial board resolution to 4,235 KRW. The scale of fund-raising shrank from 82.3 billion KRW to 38.5 billion KRW. For the shortfall compared to the planned use of funds, the company has set a plan to raise additional capital. They plan to recruit strategic investors including pharmaceutical companies or attract investments linked to business partnerships.

The UPC Milan Central Court's dismissal of the injunction request is welcome news that can partially resolve uncertainties. The company explained that the ongoing jury trial in the U.S. is also proceeding smoothly as planned. Once the jury verdict is announced, they plan to conduct investor relations (IR) activities targeting shareholders and investors. Eoflow stated that, leveraging the dismissal decision, they plan to closely cooperate with the European distributor Menarini to increase sales in the European region.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.