Stock Prices Rise Despite KOSPI Decline

Cost Structure Improvement Expected from US LNG Export Expansion

Significant Earnings Growth Anticipated Next Year "Full Effect of Electricity Rate Hike"

Korea Electric Power Corporation (KEPCO) is maintaining a steady trend despite the recent market downturn. Analysts suggest that with the electricity rate hike last month leading to increased earnings next year and the anticipation of energy market reforms under U.S. President-elect Donald Trump, KEPCO could move beyond its defensive stock role and escape undervaluation.

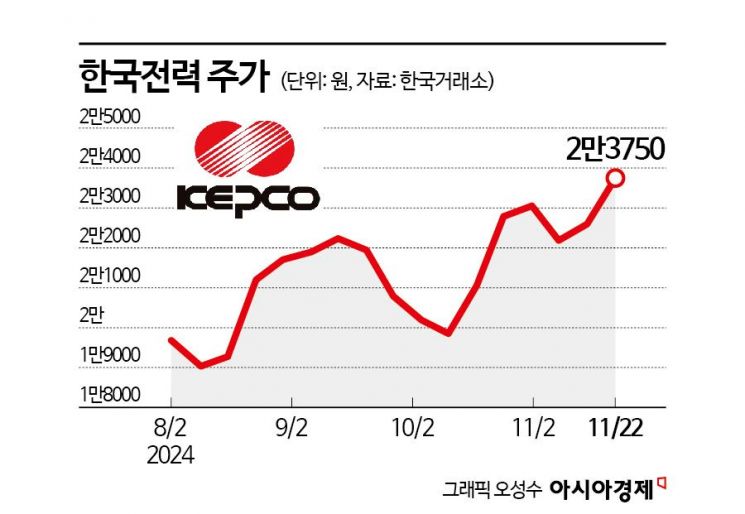

According to the Korea Exchange on the 25th, KEPCO closed at 23,750 won on the 22nd, up 100 won (0.42%) from the previous trading day. While the KOSPI has fallen 7.40% over the past three months, KEPCO has risen 13.10%, showing resilience against the market decline. Attention is focused on whether the stock price can gain momentum and surpass the intraday high of 25,450 won recorded in March to set a new 52-week high.

The recent favorable stock performance of KEPCO appears to be influenced by expectations that the global energy market will change under Trump's leadership. Trump, who pledged to increase oil and natural gas extraction and remove related regulations, announced on the 15th the establishment of a National Energy Council to oversee the administration's energy policy. He emphasized the importance of energy dominance by stating, "Energy superiority will enable us to sell energy to all our allies, making the world a safer place," highlighting his commitment to resuming liquefied natural gas (LNG) exports, which had been halted under the Biden administration.

In the securities industry, there is speculation that if Trump expands crude oil and gas production and exports, the global LNG supply growth cycle will accelerate. Kyungwon Moon, a researcher at Meritz Securities, said, "The expansion of the U.S. LNG export production capacity (CAPA), which had been delayed, will gain momentum," adding, "If the terminals currently under construction successfully enter commercial operation, U.S. LNG export CAPA will increase by about 85% by 2029." He further noted, "Projects that have already completed permits and are awaiting construction account for about 66% of the current CAPA, and under the Trump administration, the number of newly permitted projects is expected to increase."

Moon explained that increased U.S. LNG supply could lead to price declines, improving spreads. He said, "Spot prices, which account for about 20-30% of Korea's gas imports, will be affected, leading to a decrease in the system marginal price (SMP) and KEPCO's power purchase cost." For example, if the Japan-Korea Marker (JKM) natural gas price falls from the current $13.4 per 1 MMBtu (million British thermal units) to $8.4, the SMP could decrease by about 8 won per kilowatt-hour (kWh), potentially improving KEPCO's operating profit by approximately 2.3 trillion won next year."

The record-scale electricity rate hike last month is also expected to positively impact KEPCO's earnings. Minho Heo, a researcher at Daishin Securities, observed, "The average electricity rate increase effect is 5%, based on a 9.7% hike in industrial electricity rates effective from the 24th of last month. With industrial sales accounting for 52%, the annual operating profit improvement from electricity sales could reach 4.7 trillion won."

Jaeseon Yoo, a researcher at Hana Securities, added, "Although further short-term increases in electricity rates may be difficult after rates have been raised close to normalization levels, considering the increase effect, annual operating profits could reach around 13 trillion won. Next year, with decreases in both fuel and power purchase costs and the full effect of the electricity rate hike, significant growth compared to the previous year is expected."

With macroeconomic benefits and improved earnings combined, there is analysis that KEPCO could break free from its perennial undervaluation. Yurim Song, a researcher at Hanwha Investment & Securities, said, "With clear earnings improvement expected next year, the path to 'normalization' has opened. The stock price needs to escape the extreme undervaluation zone," adding, "There is potential for further earnings upgrades depending on energy price declines, interest rate and exchange rate drops." She also noted, "The company is moving closer to scenarios such as debt repayment and dividend resumption. The bond issuance limit is continuously decreasing, so the possibility of additional electricity rate hikes next year cannot be ruled out."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)