Citron, MicroStrategy 'Short Selling'

"A Strategy Divergent from Cryptocurrency Fundamental Principles"

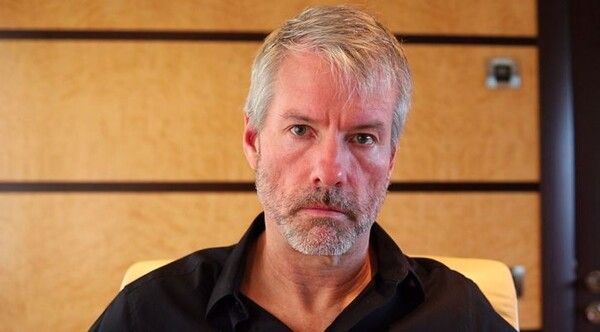

As Bitcoin repeatedly hit new all-time highs, once approaching the $100,000 mark (about 140 million KRW) for the first time ever, the stock price of MicroStrategy, which has gone 'all-in' on Bitcoin investment, plummeted instead. MicroStrategy is a company led by Chairman Michael Saylor and currently holds the largest amount of Bitcoin in the world.

On the 21st (local time), MicroStrategy's stock price on the New York Stock Exchange fell sharply by 16.16% compared to the previous trading day, closing at $397.28 (about 550,000 KRW). The plunge was triggered by the announcement that Citron Research had shorted MicroStrategy.

Citron Research stated on its official X account, "Four years ago, we first said that MicroStrategy investing in Bitcoin was the best way. We set a target price of $700 (about 980,000 KRW)." They added, "Now, this company's stock is overvalued."

Citron Research changed its outlook on MicroStrategy due to an investment strategy completely detached from the fundamental principles of cryptocurrency. With the approval of Bitcoin exchange-traded funds (ETFs) in the U.S. stock market, it has become easier than ever to invest in Bitcoin. Citron Research believes this has diminished the investment appeal of MicroStrategy.

In other words, MicroStrategy was once a stock that allowed investors to benefit from Bitcoin price increases without directly investing in Bitcoin, but now it is seen as less representative of Bitcoin. However, Citron Research clarified that while it is selling MicroStrategy shares, its view on Bitcoin remains positive.

Meanwhile, MicroStrategy is the world's largest Bitcoin-holding company led by Chairman Saylor. Originally started as a Silicon Valley IT company, it transformed into a Bitcoin investment company from 2020 due to Saylor's strong insistence. Initially, the company purchased Bitcoin using its cash reserves, but now it buys Bitcoin using proceeds from stock issuance and sales, and sometimes even by issuing convertible bonds.

Chairman Saylor argues that this strategy can increase investment returns. The more Bitcoin MicroStrategy holds, the higher its stock price rises, allowing the company to sell shares and buy more Bitcoin. Saylor has dubbed this strategy the 'BTC (Bitcoin) yield.'

However, many remain skeptical of this strategy. The U.S. financial media outlet The Wall Street Journal (WSJ) also pointed out on the same day, "This yield calculation method does not reflect cases where the company maintains the number of shares and Bitcoin holdings but Bitcoin prices plummet."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.