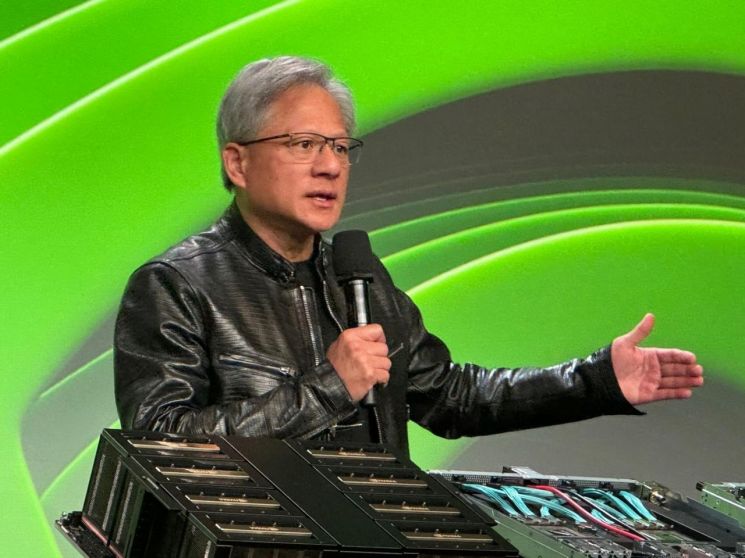

NVIDIA Doubles Q3 Revenue and Profit Growth

Fails to Meet Excessively High Market Expectations

Alphabet Plummets on Potential Forced Sale of Google Chrome

Last Week's New Unemployment Claims Hit 7-Month Low

The three major indices of the U.S. New York Stock Exchange showed mixed trends in early trading on the 21st (local time). Although Nvidia announced earnings that exceeded Wall Street expectations the previous day, the stock price fell more than 2% due to the market's overly high expectations, failing to create momentum for the stock market's rise. Alphabet, Google's parent company, plunged more than 6% amid the possibility of a forced sale of Chrome.

As of 10:39 a.m. in the New York stock market that day, the Dow Jones Industrial Average, centered on blue-chip stocks, was trading at 43,507.43, up 0.23% from the previous trading day. The S&P 500 index, focused on large-cap stocks, was down 0.38% at 5,894.55, and the tech-heavy Nasdaq index was down 1.2% at 18,739.43.

By stock, Nvidia was down 2.5%. While Nvidia, expected to be a catalyst determining the year-end market direction, showed weakness, other tech stocks also fell in unison. Alphabet, Google's parent company, was down 6.11%. This followed the U.S. Department of Justice's request to the Washington D.C. federal court for a forced sale order of Chrome as a remedy to break Google's monopoly in the search market. Apple and Microsoft (MS) were down 1.05% and 0.91%, respectively.

The previous day, Nvidia announced its fiscal year 2025 third-quarter (August to October) earnings after the market closed. Revenue was $35.08 billion, and adjusted earnings per share (EPS) were $0.81, surpassing estimates ($33.16 billion and $0.75, respectively). Compared to a year ago, revenue surged 94%, and net income rose 109%. The data center segment, which generates revenue from AI chip-related sales, recorded $30.8 billion in revenue, significantly exceeding the expected $28.82 billion. The company stated that the next-generation AI chip, Blackwell, which has attracted market attention, is scheduled for production and shipment this quarter, and supply is expected to remain tight next year. It was also confirmed that the current latest chip, Hopper, is not meeting demand.

Nvidia's fourth-quarter revenue forecast is $37.5 billion, expecting a fluctuation of around 2%, which also exceeds market expectations (LSEG forecast of $37.08 billion). However, the expected revenue growth rate for the fourth quarter is 70% year-over-year, a significant drop from 265% a year ago, and with market expectations for Nvidia being too high, the stock price is declining.

Eric Clark, portfolio manager at Rational Dynamic Brands Fund, analyzed, "Investors may buy during a bear market, but traders may reduce stock exposure if there are no earnings and guidance upgrades exceeding expectations for several quarters." He added, "When growth and momentum investors leave the market, there is generally a trace of decline."

The labor market remains robust. According to the U.S. Department of Labor on that day, new unemployment claims for the week of November 10-16 decreased by 6,000 from the revised previous week to 213,000. This is the lowest level in seven months since April. The expert forecast (220,000) was also 7,000 below expectations. Continued unemployment claims, which are claims for unemployment benefits for at least two weeks, were 1,900,800 for the week of November 3-9, the highest in three years. This is analyzed to be due to the lingering effects of the Boeing strike. Economists expect unemployment claims to stabilize at the current level in the short term. Although some companies recently announced layoffs, there are hardly any signs of a general increase in dismissals.

Tensions between Russia and Ukraine are escalating further. After Ukraine launched missiles supported by the U.S. and the U.K. at Russian military targets on the 19th and 20th, Russia responded on the same day by launching an intercontinental ballistic missile (ICBM) toward Ukraine, raising the level of attacks between the two countries.

Government bond yields are steady. The U.S. 10-year Treasury yield, a global bond yield benchmark, fell 1 basis point (1 bp = 0.01 percentage point) from the previous day to 4.39%, and the U.S. 2-year Treasury yield, sensitive to monetary policy, was trading at 4.3%, unchanged from the previous day.

International oil prices are rising amid heightened geopolitical tensions. West Texas Intermediate (WTI) crude oil rose $1 (1.45%) from the previous trading day to $69.75 per barrel, and Brent crude, the global oil price benchmark, increased $1.08 (1.48%) to $73.89 per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)