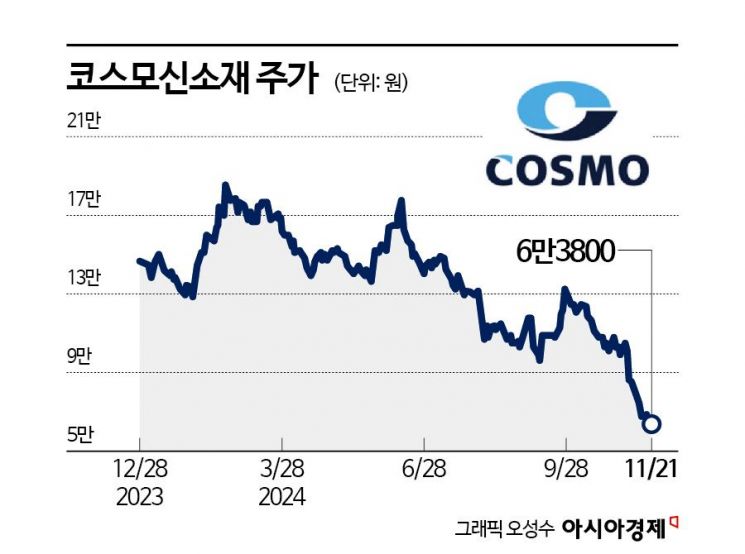

Recorded the highest price of 194,300 KRW on February 21 this year

Current stock price down 67% to 63,800 KRW

Q3 sales decreased 35% compared to previous quarter

Until February this year, Cosmo Advanced Materials' market capitalization exceeded 6 trillion won, but it has shrunk to 2 trillion won in just nine months. The shipment volume of cathode active materials, a key component in secondary batteries, has decreased, leading to continued poor performance. However, stock market experts expect profits to increase rapidly starting next year.

According to the financial investment industry on the 22nd, Cosmo Advanced Materials has fallen 56% this year. Compared to the year's highest price of 194,300 won recorded on February 21, it has dropped 67%. During the previous day's trading session, it fell to 61,900 won at one point, marking the year's lowest price.

Cosmo Advanced Materials recorded sales of 119.3 billion won and an operating profit of 6.5 billion won in the third quarter of this year. Compared to the same period last year, sales decreased by 23% and operating profit by 19%. Compared to the previous quarter, they fell by 35% and 6%, respectively.

Hyunwook Lee, a researcher at IBK Investment & Securities, explained, "The results fell short of market expectations of 125.4 billion won in sales and 7.3 billion won in operating profit. The cathode active material segment maintained steady shipments of single-crystal cathode materials to LG Chem, but was affected by delayed specification changes in Samsung SDI's ESS model." He added, "Due to the lowered operating rate, the profitability of the cathode active material segment is estimated to be around 2%."

The sluggish performance in the third quarter is expected to continue through the fourth quarter of this year. IBK Investment & Securities estimates that Cosmo Advanced Materials will achieve sales of 121 billion won and an operating profit of 5 billion won in the fourth quarter. Sales are expected to increase by about 1% compared to the previous quarter, while operating profit is projected to decrease by 30%.

Cosmo Advanced Materials is rapidly expanding its cathode material production capacity. Annual production capacity is expected to increase from 20,000 tons last year to 100,000 tons next year. The company aims to produce 300,000 tons by 2030. The third plant's facilities were expanded in the third quarter and are currently undergoing mass production testing. Contrary to expansion plans, the operating rate has declined due to the "electric vehicle chasm (temporary demand stagnation)." Profitability deterioration due to increased fixed costs is inevitable. Considering the policies of U.S. President-elect Donald Trump, volatility in the electric vehicle industry outlook is also a negative factor.

Cheoljung Kim, a researcher at Mirae Asset Securities, said, "Stock prices in the secondary battery value chain are inevitably volatile around the U.S. presidential election," adding, "The survival of the Inflation Reduction Act (IRA) legislation could change the mid- to long-term U.S. investment direction of front-end customers."

However, optimistic forecasts suggest that the situation will improve next year compared to this year. Due to new product supply and profitability improvements from vertical integration from raw materials to precursors and cathode materials, sales and profits are expected to increase next year. Mirae Asset Securities estimates that Cosmo Advanced Materials will achieve sales of 1.153 trillion won and an operating profit of 58 billion won next year. If uncertainties regarding the IRA legislation are resolved, there is potential for stock prices to rebound along with improved investor sentiment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)