'Startup Trend Report 2024'

"Startup Ecosystem Worse Than Last Year"

Both startup investors and founders evaluated the investment market as contracted this year. Additionally, more than half predicted that the startup investment market next year will either remain the same or contract further compared to this year.

Startup Alliance and Open Survey announced the ‘Startup Trend Report 2024’ containing these findings on the 21st. The Startup Trend Report is an annual survey jointly conducted by Startup Alliance and Open Survey since 2014.

This survey was conducted from September 13 to 27 over 15 days through Open Survey and Remember (founders, investors) to understand the perceptions and realities of participants in the domestic startup ecosystem. A total of 250 founders, 200 investors, 200 employees of large corporations, 200 startup employees, and 200 job seekers participated in the survey. This year, ‘investors’ were newly added to the survey targets, and ‘Artificial Intelligence (AI) related perceptions’ were investigated as a special topic.

Both Founders and Investors Feel the Investment Market Has Contracted

According to the survey results, 6 out of 10 founders and investors (63.2% and 64.0%, respectively) assessed that the startup investment market contracted compared to last year. The proportion of respondents who reported difficulties in raising and executing investments also reached about half, with 48.4% of founders and 53.5% of investors indicating such challenges.

As countermeasures startups should take during this investment market winter, founders cited ‘establishing diversified sales strategies (53.2%)’ and ‘pursuing government support projects (49.6%)’. On the other hand, investors pointed to ‘focusing on profitable businesses to improve profitability (60.0%)’ and ‘reducing corporate costs (55.5%)’. Compared to founders, investors seem to perceive that startups should prepare more conservatively for the risks of the investment winter.

Regarding the overall atmosphere of the startup ecosystem this year, founders gave a score of 50.5, and investors gave 52.6. Although founders’ score rose about 4 points from 46.5 last year, it remains relatively low.

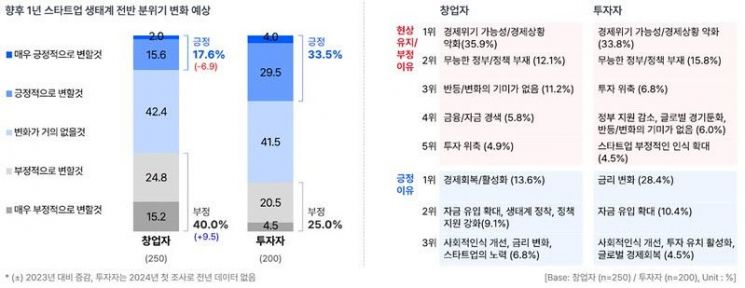

Many founders and investors felt that the startup ecosystem atmosphere had ‘negatively changed’ compared to last year. 64.8% of founders and 58.9% of investors responded that the startup ecosystem atmosphere had ‘negatively changed’ compared to last year. Most founders and investors showed a pessimistic outlook on the future startup ecosystem. 82.4% of founders and 66.5% of investors expected that the startup ecosystem atmosphere would not improve or would worsen within the next year.

They cited ‘possibility of economic crisis/economic deterioration (35.9% of founders, 33.8% of investors)’ as reasons for expecting the startup ecosystem atmosphere not to improve or to worsen. Founders and investors who evaluated the outlook positively cited ‘economic recovery/activation (13.6% of founders)’ and ‘interest rate changes (28.4% of investors)’ as their top reasons.

Companies Actively Supporting Startups Are ‘Naver’; Preferred Investors Are ‘Bluepoint, Altos Ventures, Kakao Ventures’

When asked which companies are most actively supporting startups, founders most frequently chose Naver at 16.6%. Kakao and Samsung tied for second place with 14.4% each, followed by SK at 11.6% in fourth place.

The startup support center most desired for residency and use was Seoul Startup Hub, with 11.6% of first-choice responses. Next were Pangyo Startup Campus (10.4%) and Google Startup Campus (9.2%), ranking within the top three.

The most preferred accelerator was Bluepoint (8.0%). Newly added to the survey this year, Creative Economy Innovation Center (7.2%) and KAIST Youth Startup Holding Company (6.4%) ranked second and third, respectively. They were followed by SparkLabs (5.2%), Sopung Ventures (5.2%), and Primer (4.4%).

When asked about the most preferred venture capital (VC), Altos Ventures ranked first with 9.6%. Korea Investment Partners (8.4%) and KB Investment (8.0%) followed in second and third places, while Mirae Asset Venture Investment (6.4%) and SBVA (SoftBank Ventures Asia) (3.6%) also ranked within the top five.

The most preferred corporate venture capital (CVC) among founders was Kakao Ventures (10.4%), followed by Samsung Venture Investment (8.0%), POSCO Technology Investment (6.8%), Naver D2SF (6.0%), and Hyundai Motor Zero One (5.2%).

Urgent Government Improvement Tasks Are ‘Investment Activation and Regulatory Relaxation’

Founders gave the government’s role an evaluation score of 54.6, slightly up from 52.5 last year. The urgent improvement tasks that the government should address, as in last year, were ‘securing ecosystem-based funds and activating investment (29.2%)’ and ‘relaxing various regulations (19.2%)’. Responses related to investment activation remained similar to last year, while demands for regulatory relaxation decreased by 6 percentage points compared to last year.

Investors gave the government’s role an evaluation score of 55.8, slightly higher than founders. Investors also cited ‘relaxing various regulations (26.5%)’ and ‘securing ecosystem-based funds and activating investment (25.0%)’ as urgent improvement tasks, indicating that both founders and investors see investment activation and regulatory relaxation as critical.

Lee Gi-dae, Center Director of Startup Alliance, stated, “Polarization is progressing where capable companies go global to find customers, while those who cannot rely on subsidies to survive,” adding, “The startup ecosystem now has only those who are serious about founding companies remaining, as the bubble caused by global low interest rates has completely burst.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)