Luxury lifestyle including Rolls-Royce leasing and expensive wine purchases

National Tax Service collects 2.5 trillion KRW through asset tracking investigations until October this year

Reward offered for reporting hidden assets of high-value tax delinquents

A 92-year-old tax delinquent was caught by the National Tax Service (NTS) after transferring land to their children and hiding 200 million KRW worth of cash and gold bars in kimchi containers without paying tens of billions of won in taxes. The NTS forcibly collected a total of 1.1 billion KRW in cash and real estate and filed charges against seven family members, including the delinquent’s children and daughter-in-law. There was also a real estate sales company CEO who hid slot machine winnings from Kangwon Land. The CEO is suspected of receiving several hundred million won in winnings by check without paying 500 million KRW in value-added tax arrears and hiding the money.

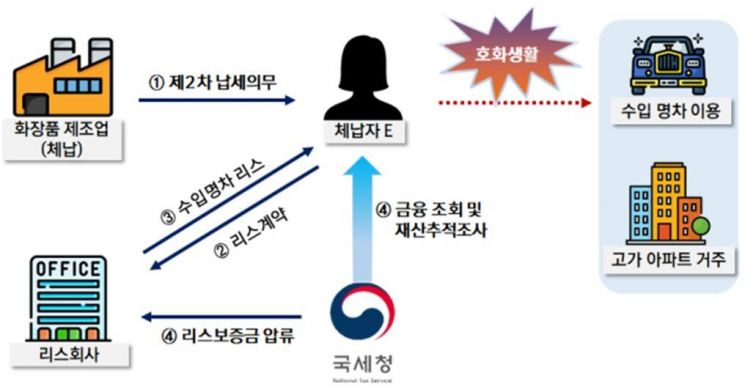

On the 21st, the NTS announced that it is conducting asset tracking investigations on 696 high-value tax delinquents who hide assets through sophisticated methods or live lavishly without paying taxes despite having the ability to pay.

The main targets of this asset tracking investigation are ▲216 delinquents who hid gambling winnings despite having the ability to pay ▲81 delinquents who illegally transferred assets to related parties through false provisional registrations ▲399 delinquents living lavish lifestyles by leasing imported luxury cars, purchasing high-end luxury goods, etc.

The first group includes 216 delinquents who did not pay taxes but participated in gambling games (horse racing, cycle racing, slot machines, etc.), received large winnings by check, and hid assets, as well as those who diverted business income to enroll in overseas insurance under related parties’ names, remitted insurance premiums in foreign currency, and concealed assets through insurance payouts.

The NTS is strictly conducting asset tracking investigations by tracing the use of winnings through financial inquiries, verifying the source of funds for overseas insurance premium remittances, suspending payment of issued checks, and seizing payment claims.

There were also delinquents who, before tax delinquency occurred, conspired with related parties to set up false provisional registrations, and when real estate was seized due to delinquency, converted the provisional registration to a full registration to transfer ownership to related parties. Some delinquents set up false mortgages so that related parties would receive priority distributions over national taxes during auctions or public sales, deliberately transferring assets to related parties to evade forced collection. The NTS is filing lawsuits to cancel fraudulent acts to restore original ownership and is taking measures such as filing charges against delinquents and related parties when tax delinquency evasion is confirmed.

The NTS is also conducting focused searches on 399 delinquents living lavish lifestyles by leasing imported luxury cars or purchasing wine. These include delinquents who directly lease imported cars such as Rolls-Royce, use leased vehicles under company names, remit large amounts of foreign currency overseas for children’s study abroad funds despite having the ability to pay, or purchase high-end luxury goods to live extravagantly.

Additionally, the NTS is actively responding to delinquents who hide assets in virtual assets such as Bitcoin, whose prices have recently surged, by seizing 28.7 billion KRW in the second half of this year. The NTS is promptly seizing and collecting continuous income such as YouTubers’ Super Chats (viewer donations) from platform operators, and is using virtual asset tracking programs to thoroughly trace delinquents suspected of transferring or hiding virtual assets under relatives’ or acquaintances’ names.

In the first half of this year, the NTS conducted planned analyses of high-value delinquents who hid art pieces, precious metals, and inherited property, as well as delinquents living lavish lifestyles, and strengthened on-site collection activities such as inquiries and searches at actual residences. Through this, by October this year, the NTS has collected or secured bonds totaling 2.5 trillion KRW through asset tracking investigations of high-value and habitual delinquents.

An Deok-su, Director of the Tax Collection and Legal Affairs Bureau at the NTS, said, "The NTS will continue to respond swiftly to increasingly sophisticated asset concealment acts and will relentlessly track and collect hidden assets from high-value and habitual delinquents. We ask for active reporting by referring to the lists of high-value and habitual delinquents published on the NTS website and elsewhere."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.