Real Estate and REITs ETFs Limited to 13

Under 1 Trillion Won Despite 100 Trillion Won ETF Era

Expectations for Expansion of Real Estate and REITs ETF Lineup

Prohibition of Duplicate Fees if Managed by Same Entity

Prepared Sub-Indirect REITs Products Expected to Benefit

Financial authorities are welcoming the asset management and REITs industries as they have decided to allow listed exchange-traded funds (ETFs) to invest in fund-of-fund REITs (Real Estate Investment Trusts) to revitalize public funds. The relaxation of regulations on fund-of-fund REIT investments comes after more than five years since the REITs industry began voicing concerns in 2019.

On the 21st, the financial investment industry expected that the amendment to the Enforcement Decree of the Capital Markets Act, which the Financial Services Commission announced for legislative notice on the 19th, would expand the lineup of public real estate and REIT ETFs upon its implementation.

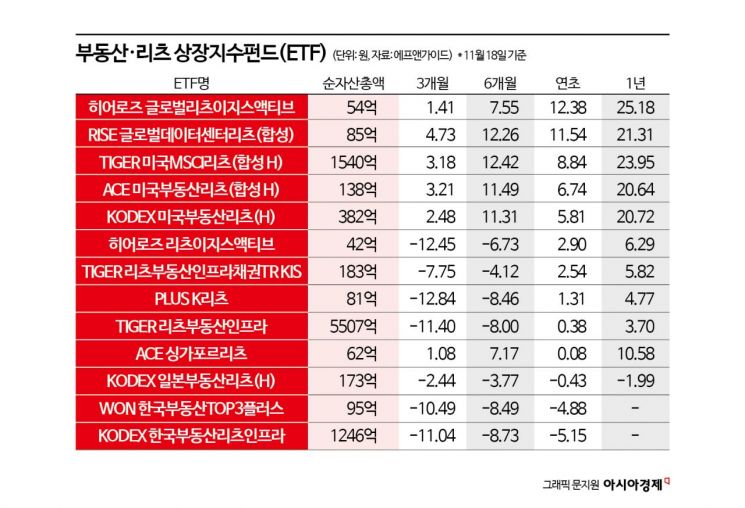

As of the end of August, there are 13 domestic real estate and REIT ETFs, accounting for only 1.5% of the total 879 listed ETFs. According to financial information provider FnGuide, the combined net asset value of these 13 ETFs was approximately 958.7 billion KRW as of the 18th. This amount falls short of 1 trillion KRW. The recent sluggishness in the real estate market globally, including South Korea, has also affected asset value declines.

Under the current Capital Markets Act, ETFs cannot invest more than 40% of their total assets in fund-of-fund REITs that invest in beneficiary certificates. There were concerns that if a fund holds a fund-of-fund REIT that invests in REITs, management fees could be charged redundantly, increasing the cost burden on final investors. For example, Mirae Asset Global Investments, which manages the 'TIGER US MSCI REIT ETF,' also operates as an asset management company (AMC). The 'Mirae Asset MAPS No.1 REIT' is Mirae Asset Global Investments' first publicly listed REIT.

A representative from the Korea Financial Investment Association explained, "There were concerns that public funds investing in fund-of-fund REITs would result in triple-layered investments, leading to excessive management fees. To resolve this, the recent amendment to the Enforcement Decree prevents duplicate fee collection when the ETF and the asset management entity of the investment target are the same."

Although the government introduced this policy to revitalize public funds, the REITs industry is optimistic about the measure. In particular, listed fund-of-fund REITs have been requesting the authorities to ease investment restrictions since 2019. If listed fund-of-fund REITs are included as part of ETF assets, significant stock liquidity can be expected. The domestic ETF market continues its rapid growth, having surpassed 100 trillion KRW in net asset value for the first time on June 29.

There is also anticipation that the overall REITs industry will gain momentum. According to the Korea REITs Association, there are 24 listed REITs domestically. This number is significantly lower compared to 204 in the United States, 60 in Japan, 47 in Australia, and 39 in Singapore.

Expectations for institutional improvements were also expressed in the securities industry. Samsung Securities identified Aegis Value REIT and Aegis Residence REIT as expected beneficiaries in a report released that day. Currently recognized as fund-of-fund REITs, Aegis Value REIT and Aegis Residence REIT do not have a dual fee structure and essentially have the same structure as general parent-child REITs, but due to formal reasons, they have been classified as fund-of-fund REITs and faced investment restrictions. Researcher Lee Kyung-ja of Samsung Securities noted, "Given the significant influence of ETFs in the domestic listed REITs market, this will be an important event."

A representative from Asset Management Company A said, "There has been strong demand in the industry for reconsidering the regulation that classifies REITs as indirect investment products, to allow ETFs to invest in fund-of-fund REITs. We expect this measure to diversify ETF product lineups and increase trading volumes of fund-of-fund REITs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)