IMF Annual Consultation Results Released This Year

Growth Rate Adjusted Reflecting Q3 Performance

Inflation Expected to Approach 2% Next Year

Gradual Monetary Policy Normalization Needed

Response Requested for Rapid Aging

External Conditions Rated as "Very Favorable"

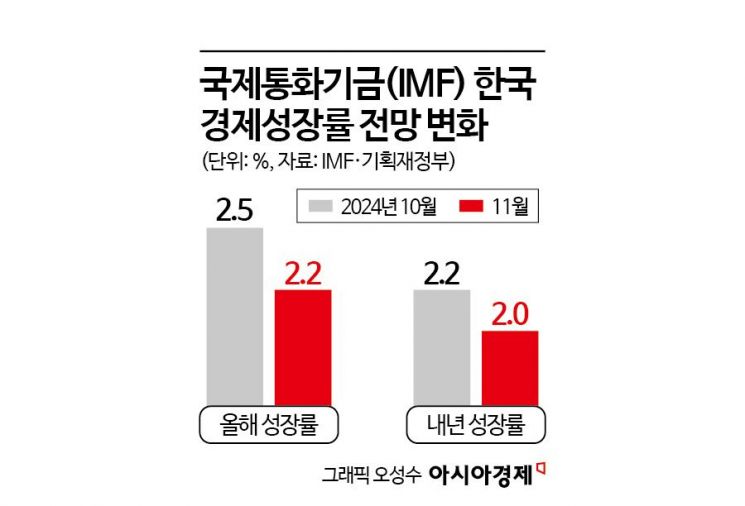

The International Monetary Fund (IMF) has downgraded its economic growth forecasts for South Korea for this year and next year. The projection for this year was lowered from 2.5% to 2.2%, and for next year from 2.2% to 2.0%. This adjustment reflects the weaker-than-expected third-quarter gross domestic product (GDP) figures. The IMF assessed that uncertainty surrounding South Korea's economic outlook remains high, with significant downside risks. Regarding concerns over exchange rate volatility, the IMF evaluated that South Korea is capable of responding effectively.

Rahul Anand, Head of the International Monetary Fund (IMF) Korea Mission (third from the left), is announcing the results of the IMF annual consultation on the 20th at the Government Seoul Office in Jongno-gu, Seoul. Rahul Anand and the IMF consultation team visited Korea from the 7th to the 20th to conduct the annual consultation.

Rahul Anand, Head of the International Monetary Fund (IMF) Korea Mission (third from the left), is announcing the results of the IMF annual consultation on the 20th at the Government Seoul Office in Jongno-gu, Seoul. Rahul Anand and the IMF consultation team visited Korea from the 7th to the 20th to conduct the annual consultation.

IMF Calls for Gradual Monetary Policy and Strong Economic Measures

The IMF Korea Mission announced the results of this year's IMF annual consultation on the 20th at the Government Seoul Office. The annual consultation is a meeting held every year under the IMF agreement to review the overall economic situation of member countries, including macroeconomics, fiscal, and financial conditions. The mission visited South Korea on the 7th for the consultation and met with key ministries such as the Ministry of Economy and Finance, Ministry of Trade, Industry and Energy, Ministry of Land, Infrastructure and Transport, as well as the Bank of Korea, Financial Services Commission, Financial Supervisory Service, and private companies.

Rahul Anand, head of the IMF Korea Mission, stated, "South Korea's economic growth this year is expected to reach 2.2%, partly offset by weak domestic demand recovery but supported by strong semiconductor exports." He further explained, "As the economic growth rate converges to the potential growth rate and the output gap narrows, real GDP is projected to increase by 2.0% next year."

The IMF had forecast South Korea's economic growth at 2.5% for this year and 2.2% for next year last month, but lowered these projections by 0.3 and 0.2 percentage points respectively within about a month. A Ministry of Economy and Finance official explained, "The third-quarter GDP results were not reflected at that time, and the figures were lowered after incorporating them this time." The third-quarter real GDP growth rate released last month was 0.1%, significantly below the Bank of Korea's August forecast of 0.5%.

Anand noted, "Inflation fell by 1.3% year-on-year in October and is expected to approach the target level of 2.0% next year." He analyzed, "The economic outlook remains highly uncertain, with downside risks being more prominent." He also assessed, "Although inflation is nearing the Bank of Korea's 2% target, given the high uncertainty, a gradual normalization of monetary policy appears appropriate."

Regarding foreign exchange market intervention, he stated, "It should be conducted restrictively only to prevent disorderly market conditions." He added, "The authorities' budget plan for next year, which maintains a sound fiscal stance and adjusts spending priorities, is appropriate," but pointed out, "However, a more proactive sound fiscal stance will be necessary to prepare for long-term spending pressures."

Anand welcomed selective policy efforts to address real estate-related financial risks, saying, "The authorities should continue monitoring vulnerabilities and be prepared to take preemptive measures." He added, "As monetary policy gradually normalizes, additional prudential measures may be considered if necessary."

The IMF diagnosed that enhancing resilience in the changing global environment is a critical task for South Korea's economy. Anand said, "Addressing labor force decline due to rapid aging, improving capital allocation efficiency, and boosting productivity remain important challenges to expand growth potential." He added, "Strengthening reforms in response to changing environments such as geopolitical fragmentation, technological changes, and climate change will also help enhance resilience."

In particular, Anand emphasized that "comprehensive reforms are needed" to address labor force decline. He explained, "Efforts are required to alleviate economic constraints that hinder South Korea's fertility rate, increase women's economic participation, and attract foreign talent."

He also stressed, "Strong economic policies are necessary to strengthen resilience amid domestic and international environmental changes," and emphasized, "Maintaining South Korea's competitiveness is key to responding to changes in the global trade environment." Furthermore, he pointed out, "Policy priorities include strengthening innovation, diversifying supply chains, and promoting service exports." He explained that "continuous efforts are also required to achieve South Korea's climate goals."

Next Year’s Export Expansion Expected to Boost Tax Revenues... “Good Timing to Pursue Fiscal Soundness”

During a Q&A session with reporters, Anand provided additional explanations regarding the annual consultation results. He said, "Regarding South Korea's fiscal stance, debt is at a sustainable level and the national debt level is lower compared to advanced countries," but added, "From a long-term perspective, issues such as aging and climate change may increase fiscal needs." He also anticipated increases in various social expenditures.

Anand stated, "South Korea needs to secure fiscal capacity to prepare for the future," and assessed, "Various reform packages will be necessary for this." He elaborated that to increase revenue in this process, "It may be possible to review various exemptions related to value-added tax or examine aspects related to personal income."

Regarding the ongoing shortfall in tax revenues through this year following last year, he expressed optimism, saying, "Since exports are favorable, if corporate earnings rebound next year, the overall situation will improve through strengthened tax revenues," and added, "It could be a good time to pursue fiscal soundness."

On downside risks, he said, "Economic slowdowns in South Korea's major trading partners, heightened geopolitical tensions, and Middle East conflicts could affect commodity prices, causing price fluctuations." He also stated, "If downside risks materialize, monetary and fiscal policies can respond," and explained, "Especially regarding fiscal policy, there is capacity to implement countercyclical measures."

Regarding concerns about exchange rate volatility, Anand assessed, "It is not a macro-financial challenge for South Korea," and said, "I do not see risks to financial stability or inflation due to volatility." He explained, "The flexible exchange rate system provides absorption capacity against shocks," and emphasized, "Flexibility should be maintained." He also added that South Korea's external stance is "very sound."

On domestic demand weakness, he evaluated, "Household purchasing power had declined, and public sector debt was a burden." He also noted, "As monetary policy adjustments are reflected in the market and inflation gradually decreases, real income will increase, leading to a rebound in domestic demand." He viewed household debt management, expanded housing supply, and corporate capital reallocation as factors that will also help domestic demand recovery.

Regarding capital market reforms, he mentioned, "Efforts to eliminate the Korea discount are underway through value-up programs," and said, "This will improve corporate access to capital markets and reduce the actual valuation gap." He further added, "The South Korean government needs to consider various incentives," and explained, "These should be directed toward encouraging price discovery."

On the need for gradual monetary policy normalization, he explained, "Although inflation is above the target level, long-term expectations are stable," and said, "Despite several prudential measures related to household debt, gradual policy is likely needed until their effects are confirmed."

Ultimately, he argued that "strengthening potential growth is the solution." Anand emphasized the need for various structural reforms, saying, "There are ways to narrow productivity gaps between manufacturing and services, and between large and small-medium enterprises, as well as reforms in product markets and proactive adoption of artificial intelligence (AI)."

He particularly stressed the need for reforms to increase fertility and expand the labor force, stating, "Costs related to starting a family and raising children, such as education expenses, housing costs, and opportunity costs due to women giving birth, should be well addressed." He added, "Providing quality jobs for youth to expand income bases, thereby enabling them to start families and raise children, is also worth considering."

The IMF plans to prepare a report based on this annual consultation and submit it to the IMF Executive Board after management approval.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)