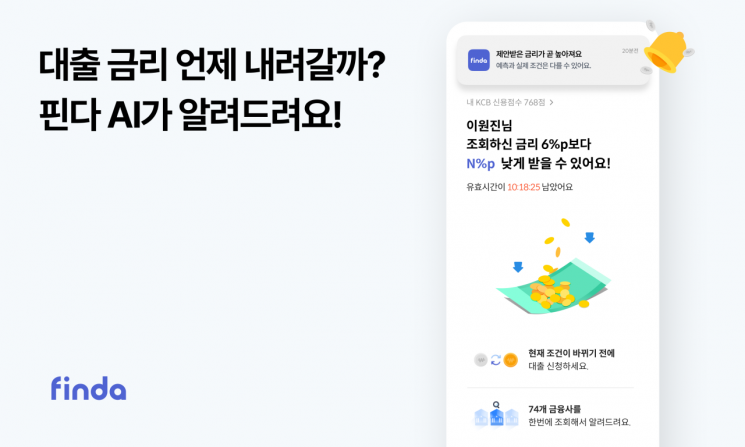

Fintech (finance + technology) company Finda announced on the 20th that it has launched an 'Interest Rate Change Prediction Notification Service' powered by artificial intelligence (AI) that detects and notifies users of changes in loan interest rates.

This service notifies users via app push notifications when there is a possibility of an interest rate change on loan products they have checked for credit limits. To assist financial consumers who find it difficult to pinpoint the exact timing of loan interest rate changes, the service provides alerts based on AI analysis results when there is a high likelihood that loan conditions will improve.

According to Finda, more than 100,000 applicants have used the service within two months of its launch. Users who completed loan agreements under better conditions received loans at an average interest rate 1.4 percentage points lower than their previous rates. The average loan limit was 12.41 million KRW. Some users received loans with interest rates 4.56 percentage points lower than their previous credit limit inquiry results. Previously, users could only check high-interest products with minimum rates of 17.43%, but through Finda's interest rate change prediction notification service, they were guided to mid-interest products at 12.87%, significantly reducing their interest payments, according to Finda.

Park Hong-min, co-CEO of Finda, said, "This service was introduced after careful consideration of ways Finda could proactively assist users struggling to cope with fluctuating loan interest rates. We expect that users will be able to obtain loans more easily at optimal interest rates without having to check their credit limits every time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)