Newly Disclosed Individuals 1,599, 88.8 Billion KRW in Arrears

Top Individual Arrears Debtor Om Moon-chul

15.1 Billion KRW in Arrears... Corporation is JU Development

The Seoul Metropolitan Government has publicly disclosed the names of over 12,000 high-amount and habitual tax delinquents on its official website. Detailed information including names and corporate names is fully disclosed.

On the 20th, the city announced that it has published on its website the information of 12,686 taxpayers who have overdue local taxes exceeding 10 million KRW for more than one year, including their names, business names (corporate names), ages, addresses, and outstanding amounts. The total amount owed by these individuals and entities is 1.4118 trillion KRW.

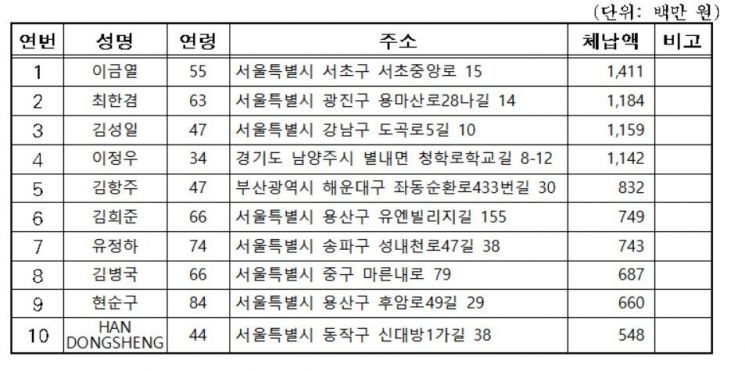

Among those newly disclosed on the list, there are 1,599 individuals, with a total outstanding amount of 88.8 billion KRW. Of these, 1,183 are individuals and 416 are corporations, with an average delinquency amount of 56 million KRW. Those who owe more than 100 million KRW account for 11.2% (180 people).

The highest individual delinquent among the newly disclosed is Mr. Lee Geum-yeol (55), who owes 1.411 billion KRW. The top corporate delinquent is Agricultural Corporation Balhyo Maeul, owing 1.329 billion KRW. Combining both existing and new disclosures, the highest individual delinquent is Mr. Oh Moon-chul (65), who owes 15.174 billion KRW. Mr. Oh, former CEO of Bohae Savings Bank, has been ranked as the top individual high-amount delinquent for several years. The top corporate delinquent is JY Development, owing 11.322 billion KRW. The second place, JY Network (10.947 billion KRW), shares the same CEO.

Earlier in March, Seoul sent advance notification letters to 1,790 newly selected individuals for disclosure. Through this, 389 people paid 4.3 billion KRW in overdue taxes. The city plans to strengthen enforcement beyond disclosure by imposing sanctions on high-amount delinquents who deliberately evade taxes, including ▲house searches and seizure of movable property ▲provision of credit information ▲travel bans ▲prosecution referrals ▲restrictions on licensed businesses, and will intensify tracking efforts.

Kim Jin-man, Director of the Seoul Metropolitan Government’s Finance Bureau, stated, "For unscrupulous high-amount and habitual tax delinquents who fail to fulfill their tax obligations and maliciously hide assets or live lavishly, we will implement strong administrative sanctions such as public disclosure, travel bans, and providing delinquent credit information to credit bureaus. At the same time, we will initiate enforcement measures such as house searches and public auctions to establish a mature taxpaying culture and realize tax justice."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.