KOSPI-listed company Haitron Systems announced the acquisition of Nasdaq-listed Exicure, which surged on expectations of capital raising and meeting Nasdaq listing maintenance conditions.

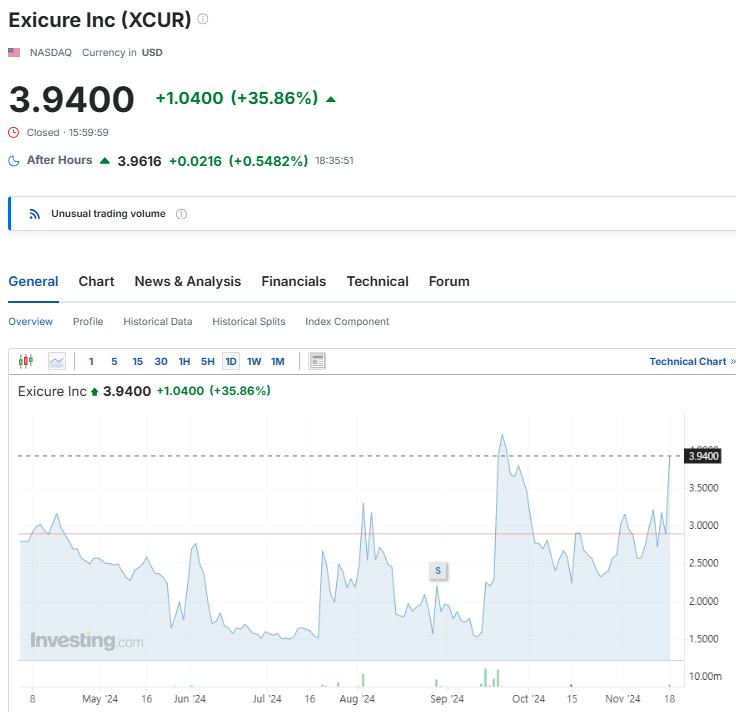

On the 18th (local time) at the New York Stock Exchange, Exicure closed at $3.94, up $1.04 (35.86%) from the previous day. It also recorded a rise of over 6% in after-hours trading. Over the past month, Exicure has shown a strong gain of more than 47%.

Exicure's strength is interpreted as being driven by capital raising from Haitron and expectations of meeting Nasdaq listing maintenance conditions. On the 14th, Exicure announced its Q3 financial results on its website.

Haitron announced on the 5th that it would conduct a paid-in capital increase of $10 million (approximately 13.8 billion KRW) in Exicure. The first investment is $1.3 million, followed by a second investment of $8.7 million. The issuance price per share is $3. Haitron plans to complete the acquisition of management rights by appointing directors to the board after the second investment is completed in mid-December.

Accordingly, Exicure expects to meet the Nasdaq listing requirements. Previously, Exicure failed to meet the continuous listing requirements related to capital due to litigation expenses and other factors. However, Exicure believes it will meet the formal requirements after this capital increase and has requested Nasdaq to extend the listing review deadline until December 17.

Additionally, Exicure significantly reduced its net loss. In Q3 this year, Exicure recorded a net loss of $1.1 million (approximately 150 million KRW), a substantial decrease compared to the $5.3 million (approximately 730 million KRW) net loss in the same period last year. Exicure stated that gains from asset sales of $1.5 million, the absence of convertible bond investment amortization that occurred last year, and reduced operating expenses contributed to the decrease in net loss.

Meanwhile, Haitron plans to proceed with the bio business together with GPCR USA after acquiring Exicure. Haitron expects synergy between Exicure, a nucleic acid therapeutic drug developer, and GPCR, which specializes in anticancer drugs targeting GPCRs, various cell membrane proteins that make up the cell surface.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)