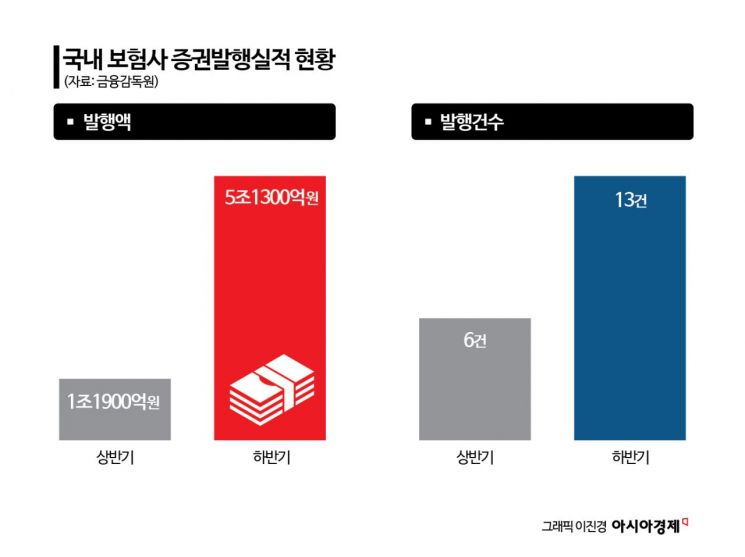

Issued 5.13 Trillion KRW in Capital Securities in H1

4.3 Times Increase Compared to 1.19 Trillion KRW in H2

Kyobo Issued 1.3 Trillion KRW, Hyundai 900 Billion KRW

Insurance companies are making every effort to strengthen their capital. This appears to be a preemptive defense as the solvency ratio (K-ICS·K-ICS) is expected to decrease due to the declining interest rate trend and changes in the International Financial Reporting Standards (IFRS17).

According to the 'Securities Issuance Performance' of insurance companies registered on the Financial Supervisory Service's electronic disclosure system on the 19th, insurance companies have raised 5.13 trillion won through subordinated bonds and hybrid capital securities as of the previous day in the second half of this year. This is 4.3 times the amount in the first half (1.19 trillion won). Insurance companies issued six capital securities in the first half, but the number surged to 13 in the second half.

Generally, insurance companies can choose between two types of capital securities: hybrid capital securities and subordinated bonds. Insurance companies generally preferred subordinated bonds. Hybrid capital securities are essentially perpetual bonds with no maturity, and because of their long maturity, they have higher interest rates.

The insurance company that issued the most capital securities this year is Kyobo Life Insurance. Kyobo Life did not issue any capital securities in the first half of this year but issued subordinated bonds worth 700 billion won in August. It was the first time in 19 years that Kyobo Life issued subordinated bonds. On the 12th, Kyobo Life also issued hybrid capital securities worth 600 billion won, issuing a total of 1.3 trillion won in capital securities in the second half of this year alone.

As of the first half of this year, Kyobo Life's K-ICS was 161.2% (before applying transitional measures), down 32.6 percentage points compared to the end of last year. From this year, the calculation basis for discount rates on insurance liabilities changed, increasing the required capital affecting K-ICS and reducing available capital, causing K-ICS to decline. Compared to the top three life insurers?Samsung Life (201.5%) and Hanwha Life (162.8%)?Kyobo Life's K-ICS was the lowest, which is interpreted as a reason for aggressive capital expansion. A Kyobo Life official explained, "This capital increase is to enhance responsiveness to K-ICS and maintain stable financial soundness," adding, "Through this issuance, we will prepare for changes in the financial environment and secure business competitiveness."

Hyundai Marine & Fire Insurance issued the most capital securities among non-life insurers. Hyundai Marine & Fire issued subordinated bonds worth 500 billion won in June and 400 billion won on the 4th, totaling 900 billion won this year. As of the first half of this year, Hyundai Marine & Fire's K-ICS was 169.7%, the lowest among the domestic big five non-life insurers (Samsung, DB, Meritz, Hyundai, KB). It is the only one among the big five with K-ICS below 200%. A Hyundai Marine & Fire official said, "With this capital procurement, we expect K-ICS to rise to 175.1%."

By number of issuances, Lotte Insurance issued the most capital securities. Lotte Insurance issued subordinated bonds worth 80 billion won in February, 140 billion won in June, and 200 billion won on the 12th, totaling 420 billion won this year. As of the first half, Lotte Insurance's K-ICS was 139.1%, below the financial authorities' recommended level (150%). If K-ICS falls below the legal standard (100%), the financial authorities may take timely corrective actions such as management improvement recommendations.

The reason insurance companies have actively raised capital in the second half is the expectation that interest rates will fall further. The Korea Insurance Research Institute analyzed that when the base interest rate falls by 1 percentage point, life insurers' K-ICS will decrease by 25 percentage points, and non-life insurers' by 30 percentage points.

Recently, as the financial authorities announced IFRS17 improvement measures such as assumptions on surrender rates for no-lapse and low-lapse insurance, insurance companies' capital raising activities are expected to increase further. On the 7th, the financial authorities predicted that applying the recently announced IFRS17 improvement measures would reduce the average K-ICS of all insurers by about 20 percentage points compared to the end of the first half of this year (217.3%). Doha Kim, a researcher at Hanwha Investment & Securities, said, "Due to guidelines on no-lapse and low-lapse insurance, required capital is expected to increase and insurance contract service margin (CSM) to decrease," adding, "Next year, the biggest issue for insurers will be managing K-ICS rather than new contracts or performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)