Q3 Revenue Down About 11%, Operating Profit About 24%, Net Profit About 65% Decrease

Red Flag on Funding Needed for Environmental Investment Reflecting 'Future Investment' Policy

The cement industry is downcast. With third-quarter earnings declining, there is an emergency in securing funds for environmental investment costs this year.

According to the Financial Supervisory Service's electronic disclosure system on the 19th, the sales of the seven major domestic cement companies decreased by about 11% year-on-year (1.3624 trillion KRW → 1.2141 trillion KRW), and operating profit and net profit fell by approximately 24% (173 billion KRW → 131.9 billion KRW) and about 65% (317.6 billion KRW → 111.1 billion KRW), respectively.

The cement industry feels that "what was expected has come." The anticipated base effect from last year's price increase, which was expected to be only a temporary boost in the first half due to a double-digit shipment decline, has become a reality. The problem lies in the emergency situation in securing funds for environmental facility investments necessary for the sustainable development of the cement industry and compliance with government environmental policies aimed at achieving greenhouse gas reduction targets.

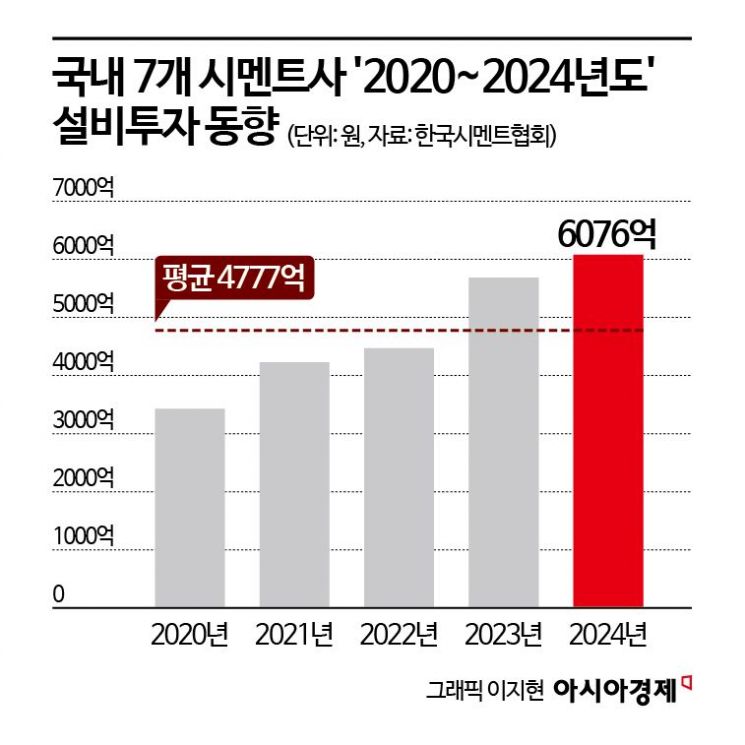

According to the Korea Cement Association, the cumulative net profit of the cement industry up to the third quarter was 425.2 billion KRW, and the total net profit for this year, including the expected fourth-quarter performance, is estimated to be around 500 billion KRW. This amount falls short by about 107.6 billion KRW compared to this year's planned facility investment of 607.6 billion KRW.

The industry must secure the shortfall in facility investment funds through internal reserves or foreign capital procurement, but even that is difficult. Although the cost of procuring thermal coal stabilized somewhat last year, the increase in electricity rates offset this, preventing any windfall gains, and recently, conditions in the corporate loan market have also tightened.

An industry insider said, "The scale of environmental facility investments increases year by year, but management performance is actually declining. It has become difficult to create conditions to respond promptly to government environmental regulations." He added, "Moreover, with electricity rates rising by double digits, the increased cost burden surpasses the fuel cost savings from thermal coal price stabilization, causing only more wrinkles."

To make matters worse, the facility investment plan excludes the investment cost for installing 'high-efficiency nitrogen oxide reduction facilities (SCR)' to reduce nitrogen oxide emissions. This means additional funds must be secured for SCR installation.

In response, in September, CEOs of cement companies issued a joint statement requesting a postponement of the regulatory tightening schedule, arguing that the SCR technology verification was completed without sufficiently reflecting the reality of the domestic cement industry, and that the regulation should be strengthened at a time when actual application is feasible.

The industry claims that applying regulatory standards that can be achieved by operating the current 'Selective Non-Catalytic Reduction (SNCR)' facilities at maximum efficiency and sophistication should be prioritized. Expanding application without sufficient prior review and verification could lead not only to production disruptions but also losses due to redundant investments.

Ultimately, the cement industry is caught in a vicious cycle: "construction market downturn → sharp decline in cement shipments → worsening net profits → shortage of funds for environmental investment → suspension of facilities not meeting environmental standards → sharp decline in cement shipments → worsening net profits."

A representative from the Cement Association said, "Environmental investment is not something that can be postponed. It is inevitable to advance investments in pollutant reduction facilities and to establish and expand related facilities to stably increase the use of circular resources necessary to achieve carbon neutrality." However, he added, "Due to the sharp decline in shipments leading to poor sales and worsening net profits, management performance is declining, and securing funds for environmental investment is urgent, putting the industry in a dire situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.