KCGI Asset Management's 3-Year Pension Fund AUM Survey

Overseas Fund Proportion 49.8%→61.3%

It has been found that the proportion of overseas fund subscriptions increases when subscribing to public stock-type pension funds.

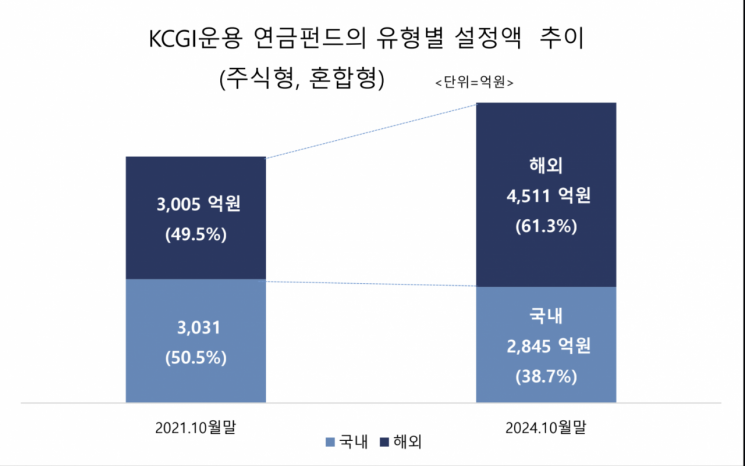

KCGI Asset Management announced on the 14th that, based on an analysis of the past three years of settings for its public stock-type and mixed-type pension funds as of the end of October, the proportion of overseas funds in pension funds increased by 11.5 percentage points (P), from 49.8% to 61.3%.

In terms of setting amounts, domestic stock-type and mixed-type pension funds showed little to no increase or even a decrease, while overseas stock-type and mixed-type pension funds increased by about 50%, from 300.5 billion KRW to 451.1 billion KRW. Most of the newly set funds are being filled with overseas funds.

By type, the increase in setting amounts was particularly notable in TDF and overseas mixed-type funds. TDF increased by 147%, from 39.1 billion KRW to 96.7 billion KRW. Overseas mixed-type funds also rose by 80%, from 103.7 billion KRW to 187.3 billion KRW. Preference for global asset allocation funds is growing.

During the same period, among KCGI Asset Management’s pension funds with setting amounts exceeding 10 billion KRW, the KCGI Salaryman Fund showed the largest increase in setting amount, rising by 67.3 billion KRW over three years. This global asset allocation fund selects various asset classes worldwide, combining growth and stability for medium- to long-term diversified investment, and is one of KCGI Asset Management’s flagship funds.

Following this, the TDF2050 and TDF2045 funds increased by 15.7 billion KRW and 15.0 billion KRW, respectively. The KCGI Senior Fund and KCGI Global High Dividend Stock, which invest in stable global assets, increased by 11.3 billion KRW and 10.0 billion KRW, respectively.

Among the top 10 funds by increase amount, eight were overseas funds, while the domestic funds KCGI The Women Fund and KCGI Korea Pension Securities Self-Investment Fund were also listed.

Domestic stock-type funds, including domestic stock-type and domestic stock mixed-type, showed a slowdown or decrease in capital inflow. This indicates a waning interest in domestic stock-type funds when investing in pension funds.

A KCGI Asset Management official explained, "Recently, the US-centered market has continued to rise more than the domestic stock market," adding, "In pension accounts, the relative tax-saving effect of overseas funds is gaining attention." He further noted, "Since 2022, the proportion of overseas pension fund settings has surpassed domestic funds," and predicted, "The trend of incorporating overseas funds into pension accounts for asset allocation and tax benefits is expected to continue for the time being."

When purchasing overseas funds in pension savings or IRP accounts, taxation on management profits is deferred, and a low-rate pension income tax is applied after pension commencement. In contrast, when managing overseas funds in general accounts, dividend income tax (15.4%) or comprehensive income tax is imposed on management profits, whereas in pension accounts, if certain conditions are met, pension income tax (5.5~3.3%) is applied at the time of pension receipt on management profits and the amount of tax credits received. This provides tax advantages. On the other hand, domestic stock-type funds already enjoy non-taxation benefits on capital gains, so overseas funds are relatively more attractive in pension accounts from a tax perspective.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)