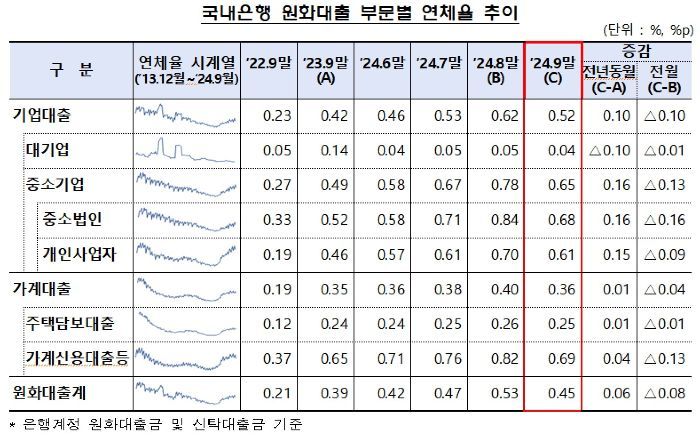

Compared to September last year, up 0.06 percentage points

Non-performing loan cleanup scale, 4.3 trillion KRW... Increased by 2.9 trillion KRW in one month

Corporate loan delinquency rate down 0.10 percentage points... Household loan delinquency rate down 0.04 percentage points

As of the end of September, the delinquency rate on won-denominated loans at domestic banks decreased by 0.08 percentage points compared to August, due to the expanded scale of delinquent loan disposal such as sales and write-offs.

According to the Financial Supervisory Service on the 15th, the delinquency rate on won-denominated loans at domestic banks stood at 0.45% at the end of September, down from 0.53% at the end of August. However, it was 0.06 percentage points higher compared to September of last year.

Typically, at the end of a quarter, the delinquency rate tends to drop significantly due to banks' increased disposal of delinquent loans. In fact, the amount of newly incurred delinquencies was 2.5 trillion won, a decrease of 500 billion won from 3 trillion won at the end of August, while the scale of delinquent loan disposal increased by 2.9 trillion won to 4.3 trillion won within a month.

The delinquency rate for corporate loans by sector was 0.52%, down 0.10 percentage points from the previous month. The delinquency rate for large corporate loans decreased by 0.01 percentage points, for small and medium-sized enterprise (SME) loans by 0.13 percentage points, for small and medium-sized corporations by 0.16 percentage points, and for individual business owner loans by 0.09 percentage points. Compared to the same period last year, delinquency rates were higher across all categories except for large corporate loans.

The delinquency rate on household loans also fell by 0.04 percentage points over the month to 0.36%. The delinquency rate on mortgage loans decreased by 0.01 percentage points to 0.26%, and the delinquency rate on other household loans dropped by 0.13 percentage points. However, compared to the same period last year, these rates were 0.01 and 0.04 percentage points higher, respectively.

A Financial Supervisory Service official stated, "Despite the recent trend of interest rate cuts in major countries, economic uncertainties still persist, which may lead to an increase in delinquency rates, especially among vulnerable borrowers." The official added, "We plan to continuously strengthen loss absorption capacity through provisions for loan losses and support debt burden relief by activating internal debt restructuring for borrowers temporarily facing difficulties, such as those at risk of delinquency."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.