'Last War: Survival' and 'Beoseotkeo Growing' Rank 1st and 2nd in Downloads

Also Rise to 2nd and 3rd in Revenue Rankings

Chinese game companies' titles ‘Last War: Survival’ and ‘Beoseotkeo Kiugi’ recorded the highest growth rates in the domestic mobile game market this year, according to a recent survey.

On the 13th, global market research firm Sensor Tower published the ‘2024 South Korea Mobile Game Market Insights’ report, which showed that ‘Last War: Survival,’ developed by Chinese game company First Fun, and ‘Beoseotkeo Kiugi,’ developed by Joy Nice Games, ranked first and second respectively in South Korea's mobile game download rankings this year. These two games also ranked second and third in revenue rankings.

In particular, ‘Last War: Survival’ generated $250 million (approximately 350 billion KRW) in revenue in South Korea from January to October, a 33-fold increase compared to the previous year, accounting for 21.4% of its total global revenue. ‘Beoseotkeo Kiugi’ also earned $140 million (approximately 200 billion KRW) during the same period in the Korean market, representing 31% of its global revenue.

Sensor Tower explained, "In addition to these two games, titles such as ‘Whiteout Survival,’ ‘Royal Match,’ and ‘Brawl Stars’ ranked within the top 10 in revenue, making South Korea a popular market where mobile games worldwide actively expand overseas."

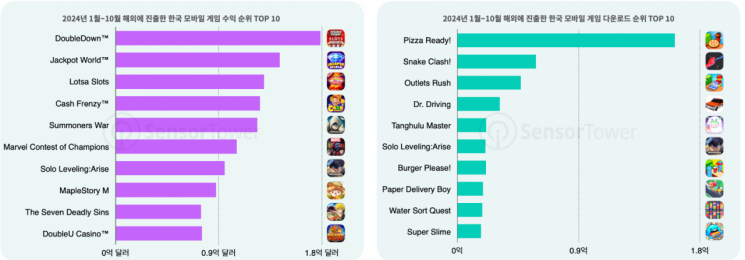

Conversely, looking at the top 10 revenue rankings for Korean mobile games that entered overseas markets from January to October, six games including Netmarble’s ‘Jackpot World’ ranked among the top 10 Korean mobile games by overseas revenue. The total revenue exceeded $100 million (approximately 140 billion KRW).

Additionally, six games from Supercent ranked in the top 10 for downloads of Korean mobile games in overseas markets, with ‘Pizza Ready,’ ‘Snake Clash,’ and ‘Outlet Rush’ taking the top three download spots.

The number of mobile game downloads in the Korean market in the third quarter of this year increased by 17% year-on-year to 130 million. The cumulative downloads through the third quarter reached 350 million, with 70% of these occurring on Google Play. In-app purchase revenue during the same period slightly increased by 3% year-on-year to $1.24 billion (approximately 1.75 trillion KRW). Cumulative revenue through the third quarter reached $3.7 billion (approximately 5.21 trillion KRW), with 75% generated on Google Play.

Mobile puzzle games, represented by ‘Block Blast (Tetris),’ remained the most downloaded game genre in the Korean market. From January to October this year, downloads increased by 7% year-on-year to 88 million, accounting for 23% of total mobile game downloads. Furthermore, the emergence of new games such as ‘Unbbal Jonmangem’ and ‘Squad Busters’ led to a 23% surge in mobile strategy game downloads in the Korean market.

Mobile RPGs continued to be the most profitable game genre in the Korean market, generating over $2.1 billion (approximately 2.96 trillion KRW) in revenue from January to October, accounting for 52% of the total revenue in the Korean mobile game market. Mobile strategy games showed remarkable performance this year in the Korean market, with revenue increasing by 69% year-on-year. Sensor Tower analyzed, "Games like ‘Last War: Survival’ cleverly combined monetization mechanisms with strategy and casual gameplay, attracting many players and achieving impressive revenue growth."

Seventeen and 45 new games entered the TOP 100 in the Korean mobile game revenue and download rankings, respectively. Netmarble’s ‘Na Honjaman Level Up: Arise’ ranked first in revenue among new Korean games from January to October.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)