Krafton Achieves Record Quarterly Revenue

Nexon Also Forecasts Strong Performance with 1.3 Trillion KRW

Global Success Drives Earnings

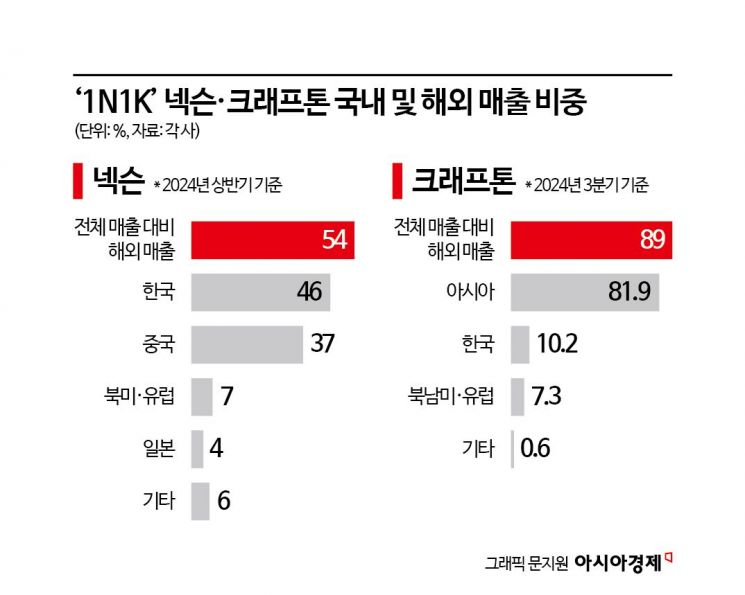

Overseas Sales Share: Krafton 77%, Nexon 54%

As domestic game companies continue to announce their earnings one after another, there is an assessment that the so-called ‘3N2K’ system has come to an end. 3N2K refers to the five major domestic game companies including Nexon, Netmarble, NCSoft, Kakao Games, and Krafton. These companies have long led the domestic game market, but recently, as the performance gap between each company widened due to overseas sales results, the market is being reorganized into a ‘1N1K’ structure.

According to the industry on the 12th, the most prominent company is Krafton. In the third quarter of this year, Krafton’s consolidated revenue reached 719.3 billion KRW, and operating profit was 324.4 billion KRW. These figures represent a sharp increase of 59.7% and 71.4%, respectively, compared to the same period last year. In particular, the revenue recorded the highest quarterly figure ever, and the cumulative revenue up to the third quarter of this year exceeded 2 trillion KRW (2.0922 trillion KRW) for the first time since the company’s founding.

Nexon’s third-quarter earnings forecast has not yet been released, but it is expected that revenue will exceed 1.3 trillion KRW and operating profit will surpass 500 billion KRW.

The driving force behind these companies’ performance was overseas sales. Krafton, led by its flagship intellectual property (IP) ‘Battlegrounds,’ generated 640 billion KRW in overseas sales in the third quarter. By region, Asia accounted for 81.9%, Korea 10.2%, North America and Europe 7.3%, and others 0.6%.

Nexon’s mobile game ‘Dungeon & Fighter Mobile,’ released in China last May, has gained immense popularity, ranking first in global mobile game revenue. Additionally, ‘First Descendant,’ launched in July, succeeded in the root shooter genre, which Korean games had not previously challenged, ranking first in revenue in 13 countries within a day of release. Nexon’s overseas sales are expected to reach 2 trillion KRW this year. The combined global revenue of games based on Nexon’s three core IPs?Dungeon & Fighter, MapleStory, and FC?in the second quarter increased by 57% compared to the same period last year.

Netmarble also succeeded in reversing its performance this year based on overseas sales growth. Its third-quarter revenue was 647.3 billion KRW, and operating profit was 65.5 billion KRW, turning profitable compared to the same period last year. Its flagship title, ‘Solo Leveling: Arise,’ maintained stable popularity, with overseas sales accounting for 77%. North America accounted for the largest share at 43%, but the portfolio is diversified with Korea at 23%, Europe 13%, Southeast Asia 8%, and Japan 7%.

On the other hand, NCSoft’s overseas sales accounted for only 29%. Its consolidated revenue for the third quarter this year was 401.9 billion KRW, with an operating loss of 14.3 billion KRW. It is assessed that its flagship IP, Lineage, has not overcome the limitation of being primarily focused on the domestic market. Additionally, Kakao Games’ overseas sales accounted for only 25?30%. Its third-quarter revenue decreased by 14.3% compared to the same period last year, and operating profit plummeted by 80.1%.

The industry analyzes that overseas sales performance has become a key indicator determining the success and earnings of game companies. As the game industry’s growth slowed after the COVID-19 boom and the limitations of the domestic market became apparent, the overseas market has become more important. An industry insider said, “Overseas performance, centered on the world’s largest markets, the United States and Japan, will determine the long-term growth and profitability of game companies,” adding, “This year is likely to be recorded as the year when the 3N2K era ended and a new landscape led by Nexon and Krafton was formed.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)