Real Estate R114, Weekly Apartment Market in the Seoul Metropolitan Area

Major Price Changes in the First Week of November

Seoul Apartment Sale Prices Up 0.03% · Jeonse Prices Up 0.02%

Announcement of Didimdol Loan Management Plan, Concerns Over 'Pre-Contracts' Before Regulations Increase

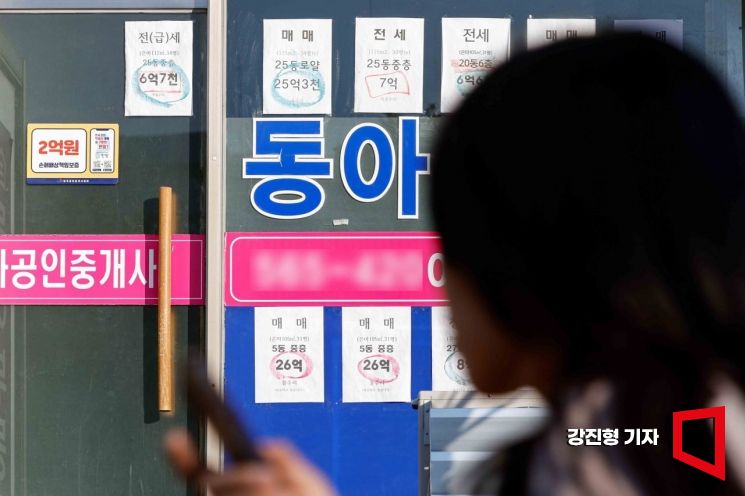

Due to the impact of loan regulations and other factors, apartment transactions have slowed down, causing listings to continue to accumulate. On the 24th, sales and jeonse (long-term lease) flyers were posted at a real estate office in Gangnam, Seoul. Photo by Kang Jin-hyung

Due to the impact of loan regulations and other factors, apartment transactions have slowed down, causing listings to continue to accumulate. On the 24th, sales and jeonse (long-term lease) flyers were posted at a real estate office in Gangnam, Seoul. Photo by Kang Jin-hyung

The government announced a plan to supply 50,000 new housing units, including 20,000 units in Seoul, as part of a supply strategy through the release of the Greenbelt. In Seoul, the Seocho Seoripul district (20,000 units) is included, and in Gyeonggi Province, the Goyang Daegok station area (9,000 units), Uiwang Ojeonwanggok (14,000 units), and Uijeongbu Yonghyeon (7,000 units) are planned, covering the highly preferred Seoul Gangnam living area, which is expected to convert some demand into waiting demand.

On the 8th, Real Estate R114 revealed this in the 'First Week of November Metropolitan Area Sales Price Major Change Rate,' stating, "However, considering the first sale in 2029 and the first move-in in 2031 for the Greenbelt release measures, it is difficult to prepare for immediate housing demand. Therefore, it is necessary to resolve demand inflow through the previously announced 2.7 million+α supply plan and the prompt supply of the 3rd new towns."

This week, Seoul apartment sales prices rose by 0.03%, increasing by 0.02 percentage points compared to the previous week. Reconstruction led the rise with a 0.04% increase. General apartments rose by 0.02%. New towns and Gyeonggi/Incheon remained flat (0.00%) last week but rose by 0.01% this year.

By individual areas in Seoul, prices rose in the order of Gangnam (0.13%), Guro (0.04%), Dongdaemun (0.03%), Seongdong (0.02%), Mapo (0.02%), Gangseo (0.02%), and Gangbuk (0.02%), while Geumcheon (-0.03%) and Nowon (-0.03%) declined. Gangnam-gu, which saw the largest price increase, was significantly influenced by large complexes such as Gaepo-dong DH Firstier I-Park, Yeoksam-dong Yeoksam Prugio, and Daechi-dong Hanbo Mido Mansion 1~2, where prices rose by 25 million to 50 million KRW.

New towns rose in the order of Dongtan (0.05%), Paju Unjeong (0.01%), and Bundang (0.01%). In Gyeonggi and Incheon, Suwon (0.05%) and Incheon (0.03%) increased, while Icheon (-0.04%) and Pyeongtaek (-0.01%) decreased.

The jeonse (long-term lease) market has recently slowed somewhat but shows no significant change in the overall upward trend. Future price fluctuations are expected depending on whether loan regulations on jeonse deposits are implemented. Seoul rose by 0.02% compared to the previous week, and new towns, Gyeonggi, and Incheon rose by 0.01%.

By individual areas in Seoul, prices rose in the order of Dongdaemun (0.06%), Gangnam (0.06%), Gangdong (0.05%), Mapo (0.02%), Yeongdeungpo (0.01%), Seongdong (0.01%), Seodaemun (0.01%), and Guro (0.01%). New towns rose in the order of Dongtan (0.06%), Sanbon (0.02%), Paju Unjeong (0.01%), and Pangyo (0.01%). Gyeonggi and Incheon rose in the order of Suwon (0.08%), Guri (0.05%), Ansan (0.02%), and Incheon (0.02%).

A Real Estate R114 official said, "According to the Ministry of Land, Infrastructure and Transport’s ‘customized management plan’ for Didimdol loans, from the 2nd of next month, a deduction system (5.5 million KRW deduction in Seoul, 4.8 million KRW deduction in Gyeonggi) will be applied to apartments in the metropolitan area (non-metropolitan and non-apartment loans remain as before), reducing the possible loan amount by several million KRW."

He added, "Post-pledge loans (unregistered apartment mortgage loans) will only apply to complexes that announce recruitment before December 2 and move in by the first half of 2025. Exceptions are made for newborn special loans to address low birth rates and low-priced housing under 300 million KRW, but most low-income real demanders living in the metropolitan area are expected to be subject to regulations. With the regulation enforcement about a month away, concerns will deepen over whether to rush into home purchase contracts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.