Integrated Required Capital Increased by 6.8% Due to Stock Risks in Insurance Affiliates

Only Mirae Asset's Adequacy Ratio Rises... Kyobo Down 44.8%P, Hanwha Down 17.7%P

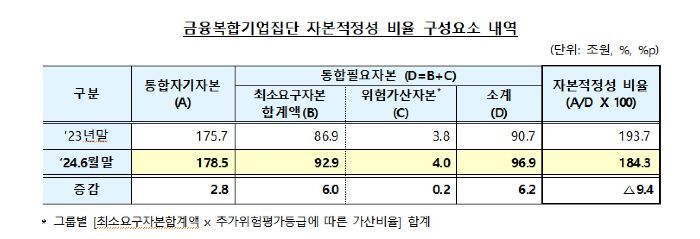

In the first half of this year, the capital adequacy ratios of seven financial conglomerates including Samsung, Hanwha, Kyobo, Mirae Asset, Hyundai Motor, DB, and Daou Kiwoom declined by 9.4 percentage points (P) compared to the end of last year due to an increase in integrated required capital.

On the 7th, the Financial Supervisory Service announced that the capital adequacy ratio of the seven financial conglomerates decreased from 193.7% at the end of last year to 184.3%.

The integrated capital increased by KRW 2.8 trillion (1.6%) to KRW 178.5 trillion from KRW 175.7 trillion at the end of last year. This was mainly due to an increase in retained earnings from the rise in adjusted reserves of insurance affiliates and improved performance of overseas affiliates.

The integrated required capital also rose by KRW 6.2 trillion (6.8%) to KRW 96.9 trillion from KRW 90.7 trillion at the end of last year. This was due to an increase in market risk amounts such as stock risk of insurance affiliates and the growth in required capital following the increase in asset size of overseas affiliates.

By financial conglomerate, Mirae Asset saw a 9.4 percentage point increase, while Kyobo (-44.8 percentage points), Hanwha (-17.7 percentage points), Samsung (-9.6 percentage points), Hyundai Motor (-2.8 percentage points), Daou Kiwoom (-2.7 percentage points), and DB (-2.5 percentage points) experienced declines.

DB had the highest capital adequacy ratio at 216.2%. It was followed by Daou Kiwoom (206.0%), Samsung (200.9%), Kyobo (194.1%), Mirae Asset (164.7%), Hanwha (154.5%), and Hyundai Motor (151.8%).

The Financial Supervisory Service evaluated the loss absorption capacity of the financial conglomerates as being at a sound level but plans to closely monitor them in preparation for increased volatility in the financial markets.

Jang Hangpil, head of the Financial Group Supervision Team, stated, "The capital adequacy ratios of all seven financial conglomerates exceed regulatory requirements, and their loss absorption capacities are sound. However, as financial market volatility may increase due to changes in the international situation, we will closely monitor the capital adequacy trends of financial conglomerates and continue to encourage strengthening internal controls and risk management for potential group risks such as contagion and concentration risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.