Major National Carriers and LCCs Rebound

Expectations for Oil Price Stabilization... Cost Concerns 'Peak Out'

"China's Visa-Free Policy to Stimulate Passenger Demand"

Airline stocks, which have been struggling for a long time, are showing signs of recovery. The securities industry analyzed that the stabilization of oil prices, which affect costs, and China's visa-free policy will stimulate fare increases, highlighting stock momentum.

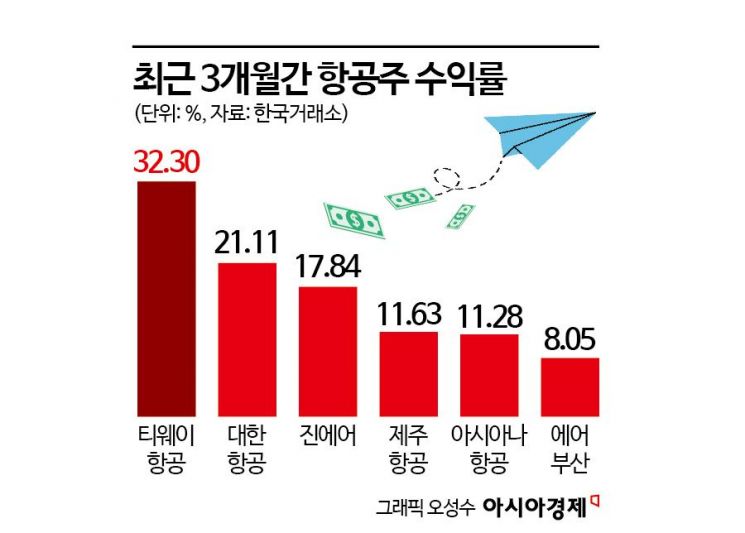

According to the Korea Exchange on the 7th, based on the previous day's closing price, Korean Air has risen 21.11% over the past three months, reaching 24,100 KRW. In addition, T'way Air (32.30%), Jin Air (17.84%), Jeju Air (11.63%), Asiana Airlines (11.28%), and Air Busan (8.05%) also increased respectively. The airline sector, which had been sluggish due to demand slowdown and fare decline pressure amid recession concerns over the past several months, along with investors' indifference, is now showing signs of a rebound.

In particular, the outlook that international oil prices will remain stable without a sharp rise is expected to have a positive effect on stock prices. Hainhwan Ha, a researcher at KB Securities, said, "Wars such as the Russia-Ukraine war and Middle East conflicts have been factors causing sharp oil price increases according to past analysis methods, and each time the war escalated, there was a possibility of oil price rises. However, the extent of oil price increases experienced over the past two years has been very limited," adding, "This is because oil suppliers have diversified, and the fossil fuel market no longer depends solely on the Middle East and Russia."

Ha explained that concerns about oil price increases leading to cost risks have peaked and are now declining. He analyzed, "If oil prices maintain their current level, the year-on-year growth rate will enter negative territory from the fourth quarter of this year and will be maintained at least until the third quarter of next year. From a base effect perspective, attention should be paid to the airline industry." He added, "In the case of Korean Air, stock prices tend to move in line with or lag behind the year-on-year growth rate of crude oil prices. As long as the monthly or quarterly average oil price does not exceed $70, there will be no negative impact on stock prices."

There is also anticipation that airline fares will rise following China's Ministry of Foreign Affairs' announcement on the 1st allowing holders of Korean passports to enter China without a visa. Yeonseung Jung, a researcher at NH Investment & Securities, said, "Demand recovery on China routes has been slow, and airlines have continued fare discounts. Since traveling to China is relatively inexpensive in terms of perceived travel costs, a rebound in travel demand from Korea is possible," adding, "In a situation where the airline industry was concerned about a slowdown in medium- to long-term travel demand growth and fare declines due to increased supply, a demand rebound on China routes could reverse the downward trend in fares."

This is the first time since the establishment of diplomatic relations between Korea and China that Korea has been included in the visa-free category. Responding to this, if Korea's visa policy also changes, passenger demand is expected to increase further, Jung predicted. He observed, "The key issue going forward is whether Korea will change its visa policy for holders of Chinese passports," adding, "If Korea implements a visa-free policy for Chinese entrants, air passenger demand between the two countries will surge."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.