NVIDIA Market Cap Hits $3.4 Trillion

AI Software Stocks Surge in Domestic Market

Growing Market Growth Expectations Highlight Software Sector

The day after NVIDIA became the publicly traded company with the largest market capitalization in the global stock market, AI-related stocks in the domestic market also saw gains for the first time in a while. Stocks such as Douzone Bizon, Saltlux, Conan Technology, Maum AI, and Polaris AI rose more than 10% in a single day. Expectations that AI can enhance corporate productivity and forecasts that the related market will grow rapidly are gaining momentum.

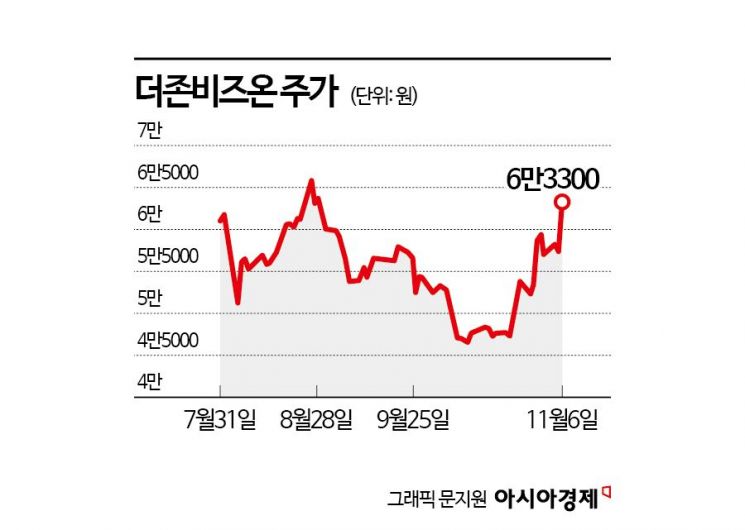

According to the Korea Exchange on the 7th, Douzone Bizon rose 10.12% the previous day. Its market capitalization increased from 1.74 trillion won to 1.92 trillion won.

Douzone Bizon recorded sales of 99.4 billion won and operating profit of 20.4 billion won in the third quarter of this year. These figures represent increases of 17.1% and 23.6%, respectively, compared to the same period last year. Park Jong-sun, a researcher at Eugene Investment & Securities, explained, "The sales growth rate has maintained double digits for three consecutive recent quarters."

Kim So-hye, a researcher at Hanwha Investment & Securities, analyzed, "More than 1,000 corporate clients have contracted within five months since the launch of ONE AI," adding, "They are additionally adopting AI products priced 50% higher than existing products." She also noted, "Once AI products start contributing significantly to sales, profits are expected to increase rapidly."

Saltlux rose more than 20% the previous day. Expectations for the AI search service being prepared by its subsidiary, Goober, drove the stock price up. Goober recorded 98% accuracy and 97% freshness in a Korean language quality comparison test for question-and-answer performance conducted independently. The company explained that this accuracy level is similar to that of ChatGPT. They plan to launch the Goober mobile app on both Apple and Android markets.

AI software developer Conan Technology even surged to the daily price limit at one point during trading the previous day. The news that it was selected as the executor of the project "AI pilot development using digital twins and unmanned aerial vehicle onboard demonstration" influenced the stock price.

Positive news related to ongoing AI projects led to an increase in corporate value. NVIDIA, the AI superstar, surpassing Apple to claim the number one spot in market capitalization also helped improve investment sentiment toward AI-related stocks. On the New York Stock Exchange, NVIDIA recorded a market capitalization of $3.432 trillion as of the close on the 5th (local time). NVIDIA is one of the most important hardware suppliers in AI and machine learning research.

Expectations for AI industry growth remain strong. Global research firm Statista projected that the worldwide AI market size will grow from $95.6 billion in 2021 to $1.8475 trillion by 2030, with an average annual growth rate of 39%. Market research firm MarketsandMarkets also forecasted the AI market size to reach $1.3452 trillion by 2030, representing a compound annual growth rate of 36.8% based on last year's $150 billion figure.

NH Investment & Securities has no disagreement with the forecast that the AI market will grow more than 30%, analyzing that AI technologies such as machine learning, natural language processing, and computer vision are enhancing productivity across various fields including healthcare, finance, manufacturing, and retail. Global IT giants such as Google, Microsoft, and Amazon are competing in the AI service market. The fiercer the competition, the faster the pace of technological advancement.

Son Se-hoon, a researcher at NH Investment & Securities, said, "Following NVIDIA's overwhelming stock performance, we can expect a strong stock trend for AI software companies," adding, "Looking at past stock trends and performance, interest in software companies increased after hardware advancements and overwhelming stock price rises."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.