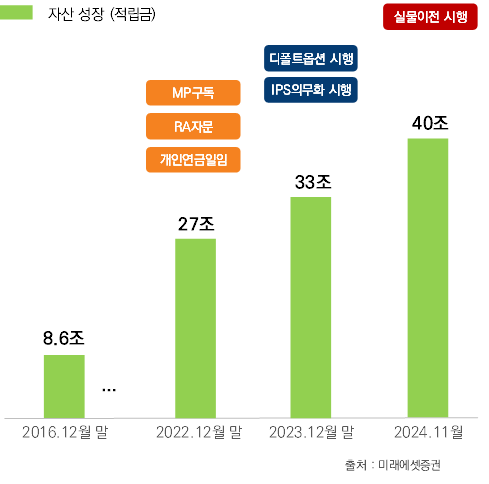

Mirae Asset Securities announced on the 6th that it has achieved pension asset reserves of 40 trillion KRW, the first in the industry.

As of the 4th, Mirae Asset Securities' pension assets consist of 27.7 trillion KRW in retirement pensions and 12.3 trillion KRW in personal pensions. Since its founding, pension assets have grown approximately fivefold from 8.6 trillion KRW in just eight years, demonstrating its unrivaled number one position in the securities industry.

Recently, Mirae Asset Securities achieved the milestone of surpassing 10 trillion KRW in Individual Retirement Account (IRA) reserves, the first in the industry, accomplishing the pension triple crown with over 10 trillion KRW each in personal pensions, defined contribution (DC) reserves, and IRA reserves. Mirae Asset Securities has shown excellent performance not only in reserves but also in returns. In the 2024 Q3 retirement pension reserves and returns disclosure, both DC and IRA ranked among the top performers.

The achievement of 40 trillion KRW in pension assets was driven by two key strategies focused on contributing to successful asset management for pension customers and ensuring a peaceful retirement. First, to enhance long-term returns, Mirae Asset Securities provides customized products and portfolio services tailored to customer preferences, supporting customers in successfully managing their assets. Second, the consulting capabilities of the largest pension organization in Korea, with numerous experts in tax, labor, and actuarial fields, form the foundation for contributing to customers' peaceful retirement and are credited as the basis for reaching 40 trillion KRW in pension assets.

With the possibility of physical transfers starting at the end of October, the money move toward "investing pensions" is expected to proceed smoothly. Due to the necessity of investing pensions, money moves are occurring in individual pension assets, and even in an unstable financial market environment, global asset allocation and stable returns through pension portfolio services (MP subscription, robo-advisor, personal pension wrap) and digital pension asset management services are unique strengths exclusive to Mirae Asset Securities.

Additionally, starting mid-November, robo-advisor services will be offered through M-STOCK, providing the same personalized design experience for personal pensions (pension savings accounts) as for retirement pensions (DC and IRA), delivering an integrated pension robo-advisor service. Notably, Mirae Asset Securities is the first to integrate retirement pensions and personal pensions into a single customer experience (UI/UX) by developing its own algorithm as a retirement pension provider.

Choi Jong-jin, Head of the Pension Division at Mirae Asset Securities, stated, "We will do our best to support customers' successful asset management and contribute to a peaceful retirement."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)