Q3 Revenue Hits 10.69 Trillion KRW

Active Customers and Per Capita Sales Also Increase

"The Secret to Sustainable Growth is Wow Membership"

Coupang recorded sales exceeding 10 trillion won in the third quarter of this year. Despite concerns about so-called 'Talpang (Coupang withdrawal)' due to the increase in paid membership (Wow) fees, it broke the record for the highest quarterly sales ever. Operating profit also surged by nearly 30%, reaffirming rapid growth. Kim Beom-seok, the founder of Coupang, said, "Considering the enormous untapped potential, we are just taking our first steps."

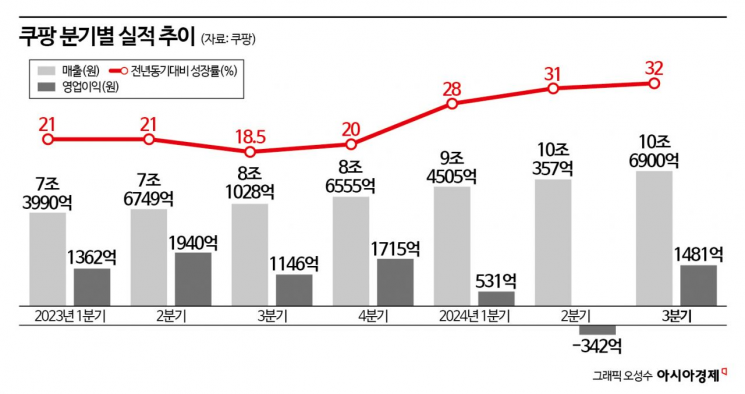

Coupang, a company listed on the New York Stock Exchange, announced on the 6th that its third-quarter sales this year reached $7.866 billion, a 32% increase compared to the same period last year. Applying the quarterly average KRW-USD exchange rate of 1,359.02 won provided by Coupang, sales amount to approximately 10.69 trillion won, the highest quarterly figure ever.

Over 20% 'Rapid Growth' in 14 out of 15 Quarters Since Listing

On the conference call that day, Chairman Kim emphasized, "Existing loyal customers are increasing their spending, and more members are recognizing the various benefits and value of the Wow membership," adding, "Among the 15 quarterly results disclosed since the IPO, 14 quarters recorded sales growth of over 20% in Korean won terms, and we achieved it again this quarter."

Since its listing on the New York Stock Exchange in 2021, Coupang has maintained rapid growth. The lowest growth rate was recorded in the third quarter of last year (18% growth), while all other quarters saw sales growth exceeding 20%.

Operating profit was $109 million (approximately 148.1 billion won), a 29% increase compared to the previous year. This marks a turnaround to profitability just one quarter after a loss in the second quarter. Coupang recorded an operating loss of 34.2 billion won in the second quarter this year, reflecting a fine of 163 billion won imposed by the Korea Fair Trade Commission. As a result, cumulative operating profit for the first three quarters of this year was 167 billion won, down 62% from 444.8 billion won in the same period last year. The operating profit margin relative to third-quarter sales was 1.38%, slightly lower than last year's 1.41%.

Net profit in the third quarter also turned positive at $64 million (86.9 billion won). However, this figure is 27% lower than last year, and the net profit margin relative to sales fell from 1.5% last year to 0.8%. Net income for the first three quarters last year was 426.4 billion won, but this year recorded a cumulative net loss of 88.7 billion won for the same period.

"Loyal Customers Increasing Spending"... Concerns Over 'Talpang' Dispelled

Coupang also explained that the number of active customers who purchased products at least once in the third quarter was 22.5 million, an 11% increase compared to 20.2 million in the same period last year, and sales per customer rose 8% to $318 (432,160 won). Earlier, in July, Coupang raised the monthly membership fee for existing paid members from 4,990 won to 7,890 won. While the industry was paying close attention to the potential size of the 'Talpang' group withdrawing from Coupang, the impact of the Wow fee increase was interpreted as virtually nonexistent.

Sales in the product commerce sector, including Rocket Delivery and Rocket Fresh, reached $6.891 billion (9.365 trillion won), a 20% increase year-on-year. Adjusted EBITDA for the product commerce segment was $470 million, an 18% increase from last year. Chairman Kim said, "Active customers in product commerce grew 11%, driven by increased spending from existing customers," but added, "Only one-quarter of customers purchase from more than nine of the over 20 categories currently offered."

Chairman Kim also said, "Wow members' order frequency is nine times higher than that of non-members," and "The longest-standing Wow members spend on average 2.5 times more than new Wow members." Regarding the reason for increased spending by loyal customers, he emphasized, "Expansion of product lines in new businesses such as Rocket Delivery, Rocket Fresh, and Rocket Growth has driven this."

Exterior view of Gwangju Advanced Logistics Center, the largest in the Honam region, which Coupang officially opened in the third quarter of this year and has begun full-scale operations. Provided by Coupang

Exterior view of Gwangju Advanced Logistics Center, the largest in the Honam region, which Coupang officially opened in the third quarter of this year and has begun full-scale operations. Provided by Coupang

Farfetch Achieves Near-Breakeven Profitability

Sales in growth business sectors such as Coupang Eats, Coupang Play, and Farfetch reached $975 million (1.325 trillion won), a 356% increase compared to last year. Adjusted EBITDA loss decreased by about 21% to $127 million (172.5 billion won). Farfetch's adjusted EBITDA loss was $2 million (2.7 billion won), significantly down from $31 million (42.4 billion won) in the second quarter.

Chairman Kim said, "Farfetch has made significant progress in improving operational efficiency," adding, "As announced earlier this year, the goal is to achieve near-breakeven profitability, and we reached that milestone this quarter." Regarding Coupang Eats and the Taiwan business, he explained, "We are very encouraged by the enthusiastic response from Eats customers who have experienced excellent service and value," and "In Taiwan, we are expanding customer choice by partnering directly with more brands."

However, Coupang recorded a free cash flow deficit of $42 million (57 billion won) due to intensified nationwide logistics infrastructure investments in the third quarter. Coupang's free cash flow in the same period last year was a surplus of $536 million (about 702 billion won). Previously, Coupang announced plans to build and operate logistics centers in nine regions including Daejeon, Gwangju, Gyeongbuk, and Busan by 2026, directly employing 10,000 people. The amount invested in logistics infrastructure this quarter was about $383 million (approximately 520.5 billion won).

Gaurav Anand, Coupang's Chief Financial Officer (CFO), said, "Most of the capital expenditures are related to infrastructure investments in Korea," adding, "Investments are also being made in technology and infrastructure to provide better service to customers and support future growth."

"R.lux Is Just One Example... We Will Increase Customer Delight"

Earlier, Coupang launched a new luxury service called R.lux last month. Chairman Kim said, "We provide new premium delivery by partnering directly with luxury brands, allowing customers to shop exclusive brands in a sophisticated shopping environment," adding, "With Rocket next-day and same-day delivery, customers can receive R.lux products with specially designed premium packaging."

However, Chairman Kim stated, "Coupang's mission is to provide the best customer experience with the best products, prices, and services," but "there are still many product categories not yet offered through Rocket Delivery." R.lux is just one example of newly added options and services to enhance customer satisfaction, and more services will be added in the future.

Chairman Kim emphasized, "Our share in the vast commerce market is still only a part, and I believe there are still many untapped growth opportunities ahead." CFO Anand also said, "New products and categories like Rocket Growth (FLC) and the new luxury service R.lux are examples showing tremendous growth opportunities from the expansion of Rocket Delivery's selection."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.