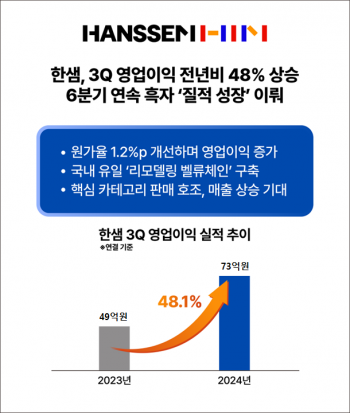

Hanssem announced on the 5th that its consolidated operating profit for the third quarter of this year was tentatively estimated at 7.3 billion KRW, a 48.1% increase compared to the same period last year.

During the same period, sales decreased by 5.6% to 454.1 billion KRW, but net profit turned positive at 93 billion KRW.

Hanssem has posted profits for six consecutive quarters since turning profitable in the second quarter of last year.

The impact of the delayed settlements with TMON and WEMAKEPRICE, which began to be reflected from the second quarter, was concluded with a bad debt provision of 2.9 billion KRW in this third quarter.

Accordingly, Hanssem expects a more significant profit improvement starting from the fourth quarter.

In particular, the fourth quarter is traditionally the peak season for the interior and furniture market, and recent positive customer responses centered on key products such as kitchens, storage, and hotel beds are expected to drive sales recovery.

On the same day, Hanssem also announced a cash dividend of 6,200 KRW per share.

A Hanssem representative said, “Although sales slightly decreased due to the economic downturn and delayed recovery in consumer sentiment, we improved the cost ratio through supply chain optimization. We are pursuing business efficiency, brand advancement, strengthening ESG (environmental, social, and governance) management, and redefining corporate culture with the long-term goal of becoming Korea’s No.1 furniture and interior company.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)