Demand deposits, known as "core deposits," decreased by about 10 trillion won in October. Analysts suggest that following the Bank of Korea's interest rate cut, idle funds in the market ended their wait-and-see stance and subscribed to deposit products at peak rates.

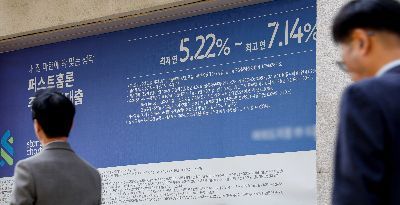

On the 23rd, as domestic market interest rates and bank loan interest rates rapidly rise, a banner displaying loan interest rates is hung on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

On the 23rd, as domestic market interest rates and bank loan interest rates rapidly rise, a banner displaying loan interest rates is hung on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

According to the financial sector on the 6th, the balance of demand deposits at the five major domestic banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 613.3937 trillion won at the end of last month. This represents a 1.59% (9.9236 trillion won) decrease compared to the end of the previous month (623.3173 trillion won).

Demand deposits refer to funds that depositors can withdraw or deposit at any time. Common examples include regular savings accounts and on-demand deposit accounts (commonly called parking accounts). For banks, these are considered "low-cost deposits" or "core deposits" because they can raise funds at low interest rates.

The balance of demand deposits at these banks had shown a steady increase recently, with 611.0815 trillion won in July, 617.2323 trillion won in August, and 623.3173 trillion won in September. As the possibility of a base rate cut increased and the domestic stock market fell into a slump, idle funds in the market entered a wait-and-see mode.

A bank official explained, "The decrease in demand deposits was more significant in corporate accounts, especially large corporations, rather than in retail accounts." Another bank official said, "It is difficult to pinpoint the exact cause of the increase or decrease, but considering the interest rate cut and the trend, it is clear that funds are moving away from demand deposits."

Meanwhile, idle funds in the market appear to be flowing back into bank deposit products. As of the end of last month, the balance of savings and time deposits at the five major banks was 980.9309 trillion won. This is a 1.3% (12.4522 trillion won) increase compared to the previous month. The five banks’ savings and time deposits have been increasing by 6 to 20 trillion won monthly, with 925.7608 trillion won in June, 945.1121 trillion won in July, 962.2286 trillion won in August, and 968.4787 trillion won in September. This indicates a surge in demand for the last chance to lock in high interest rates.

The reason idle funds are flowing into deposit products is attributed to the cold spell in the domestic securities market. The KOSPI index closed at 2,576.88 on the 5th, down 11.03% from its yearly high of 2,896.43 on July 11. Due to this, standby funds in the stock market are also rapidly decreasing. According to the Korea Financial Investment Association, investor deposits stood at 50.5865 trillion won at the end of last month, down more than 6 trillion won from 56.8328 trillion won at the end of the previous month. Investor deposits refer to funds deposited by investors to trade financial products such as stocks and bonds.

A financial sector official said, "If banks reduce loans for any reason, they do not need to raise funds, so deposit interest rates naturally decline," adding, "This is why there is a rush of last-chance demand for savings and time deposits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.