China CXMT DRAM Production Capacity at 12% of Global Level This Year

Expected Monthly Production of 250,000 Wafers Next Year

Changes in Samsung and SK Strategies

Reducing General-Purpose Share to Address Oversupply

China's top DRAM manufacturer, Changxin Memory Technologies (CXMT), has expanded its legacy (general-purpose) DRAM production, closing in on the third-ranked global semiconductor company, the US-based Micron. As the industry’s concern that "the pace of the chase is faster than expected" suggests, the global memory semiconductor landscape is gaining credibility in predictions that it will shift from the 'big three' system of Samsung Electronics, SK Hynix, and Micron to a 'big four' system.

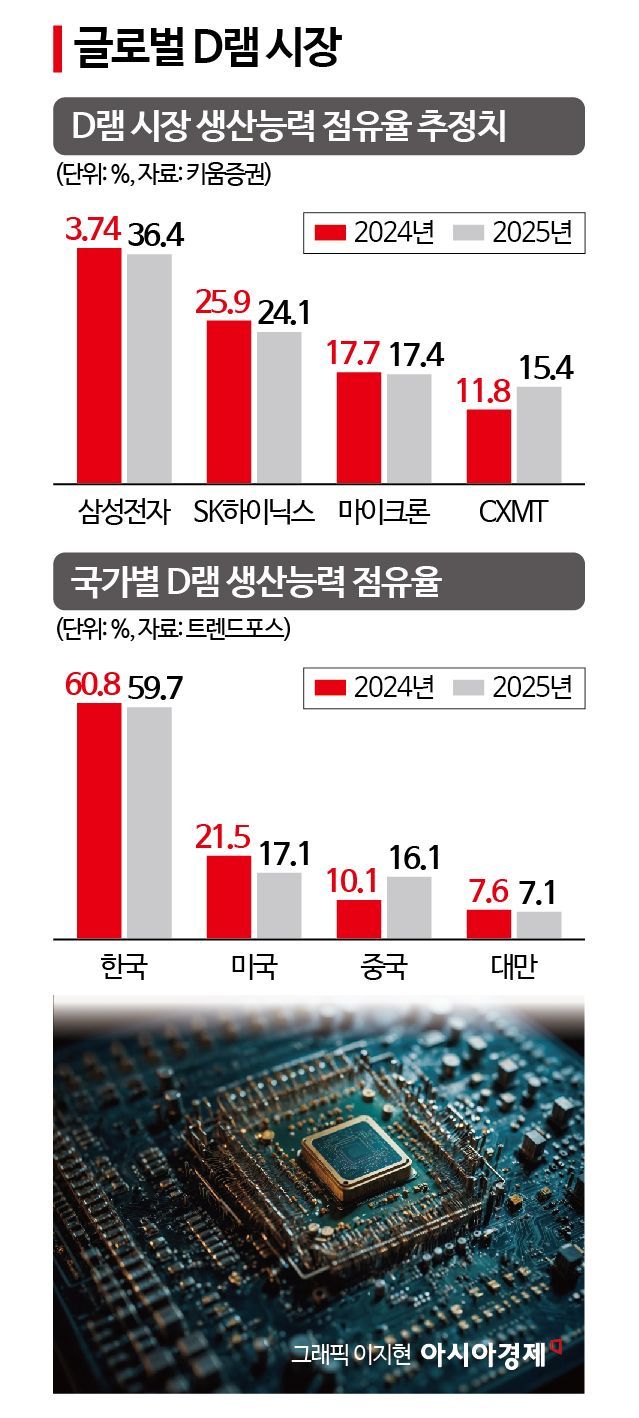

According to Taiwanese market research firm TrendForce on the 4th, CXMT's share of global production capacity is expected to rise from 4% in 2022 to 12% by the end of this year. Next year, that ratio is expected to exceed 15%. Currently, Samsung Electronics, SK Hynix, and Micron hold DRAM production shares of approximately 37%, 25%, and 17%, respectively, meaning CXMT has caught up to fourth place, just behind third-ranked Micron.

CXMT's average monthly DRAM wafer input is projected to increase from 175,000 wafers this year to 250,000 wafers next year, a 42.9% increase. Samsung Electronics, SK Hynix, and Micron are expected to input 601,000, 421,000, and 311,000 wafers respectively this year, with prevailing views suggesting only about a 10% increase compared to this year. This indicates that CXMT's growth rate is threatening the memory 'big three.'

The core of CXMT's market share expansion lies in older semiconductors such as DDR4. The company plans to increase production of mature process semiconductors by more than 50% next year. Prices for mature process semiconductors are inevitably continuing to decline. According to DRAMeXchange, last month, the average price of general-purpose NAND flash products for memory cards and USB (128GB 16Gx8 MLC) plummeted 29.18% month-on-month to $3.07, dropping to the low $3 range. This product had maintained a $4 price level continuously since late October last year ($3.88). The average price of general-purpose PC DRAM products (DDR4 8GB) last month was $1.70, remaining at the same level for two consecutive months. After maintaining $2.10 from April to July, it fell to $2.05 in August, continuing a weak trend.

TrendForce stated, "CXMT is actively expanding DDR4 production capacity, and the government is providing subsidies to offer promotional prices to more PC manufacturers," adding, "As a result, contract prices in the fourth quarter are expected to fall by 5-10%."

The rise of Chinese memory companies is expected to bring changes to the strategies of Samsung Electronics and SK Hynix. Samsung Electronics recently unusually attributed the performance of its Device Solutions (DS) division, which handles semiconductor business, to the "impact of Chinese memory companies." This is the first time Samsung Electronics has specifically mentioned the rise of Chinese memory companies.

Domestic companies are reducing the proportion of general-purpose memory business to address concerns about oversupply. Kim Jae-jun, Vice President and Head of Strategic Marketing at Samsung Electronics Memory Business Division, revealed a production cut strategy during a conference call on the 31st of last month, stating, "For some general-purpose products, both DRAM and NAND flash production will be adjusted downward according to market demand."

SK Hynix also stated in a recent conference call, "The acceleration of legacy entry by Chinese suppliers has increased negative impacts on supply and demand, such as higher DRAM price volatility," and added, "We will reduce the production scale of legacy products and expedite the transition to advanced processes." Regarding this, they reported plans to reduce the production share of DDR4 and low-power (LP) DDR4 from 40% in the second quarter to 30% in the third quarter, and further down to 20% in the fourth quarter.

An Ki-hyun, Executive Director of the Korea Semiconductor Industry Association, explained, "Chinese-made DRAM is difficult to export but is selling very well in the Chinese domestic market," adding, "(The global DRAM market) could be reorganized from the existing big three system of Samsung, SK, and Micron to a big four system including CXMT, which could pose a threat to the Korean semiconductor industry."

However, the industry believes that China's influence in the next-generation DRAM market will be limited. Since China cannot acquire essential extreme ultraviolet (EUV) lithography equipment required for advanced processes, there are limits to realizing cutting-edge semiconductors.

An industry insider said, "China is attempting to internalize equipment and independently produce AI semiconductors, but competitiveness is lacking," adding, "The share of DDR4 in the DRAM market is gradually decreasing, so the technology gap is expected to be maintained for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)