'2024 Major Companies' Social Value Report'

Although the average individual profit of domestic companies nearly dropped by 40% last year, spending on social contribution increased compared to the previous year, reaching the highest level in the past five years. Among new social contribution areas, environmental activities accounted for the largest share.

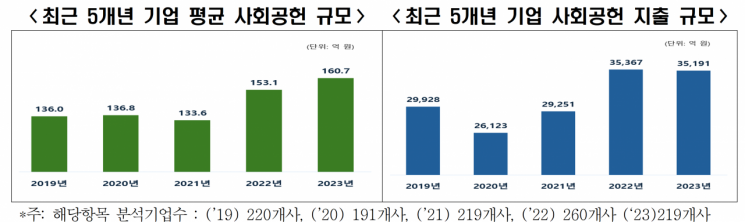

The Korea Economic Association announced the "2024 Major Corporate Social Value Report" on the 3rd, based on responses from 247 out of the top 500 companies by sales last year. The average social contribution expenditure per company last year was 16.07 billion KRW, a 5% increase from the previous year, marking the highest level in the past five years. Although the total social contribution expenditure was 3.5191 trillion KRW, a 0.5% decrease from the previous year, the average spending per individual company actually increased.

Recent 5-Year Average Corporate Social Contribution Scale (Left) and Corporate Social Contribution Expenditure Scale [Image Source=Hankyung Business Association]

Recent 5-Year Average Corporate Social Contribution Scale (Left) and Corporate Social Contribution Expenditure Scale [Image Source=Hankyung Business Association]

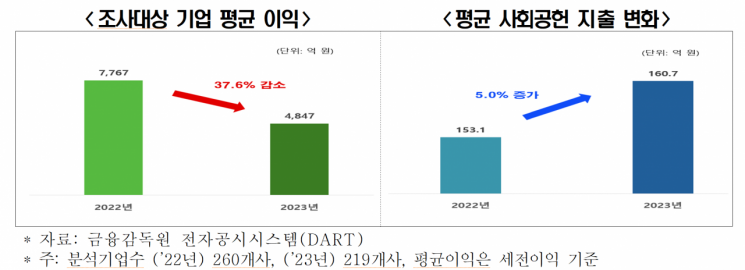

In particular, even though the average operating profit per company sharply declined by 37.6%, from 776.7 billion KRW in 2022 to 484.7 billion KRW in 2023, social contribution spending increased. Among the analyzed companies, 9.1% (20 companies) pursued social contribution activities despite reporting pre-tax losses. The Korea Economic Association evaluated that "companies increased social contribution spending to fulfill their social responsibilities despite deteriorating performance."

As the importance of ESG management is emphasized internationally, domestic companies are actively engaging in environment-related social contributions. Among new social contribution programs last year, the environmental sector accounted for the highest proportion at 23.9%, followed by children and youth (21.8%) and community development (15.6%). Programs targeting youth more than doubled compared to the previous year, demonstrating that companies are actively conducting various activities such as practical mentoring and startup support for young people.

In this report, the Korea Economic Association presented "Coexistence and Win-Win (CO-EXIST)" as the core keyword for corporate social contribution. This signifies companies’ efforts to strengthen social contribution and ESG management by addressing social issues together with specialized partners even amid economic downturns.

Average Profit (Left) and Average Social Contribution Expenditure Changes of 219 Companies [Image Source=Hankyung Business Association]

Average Profit (Left) and Average Social Contribution Expenditure Changes of 219 Companies [Image Source=Hankyung Business Association]

In sustainable management, the areas companies focus on most are environment (40.2%), society (36.0%), and governance (23.8%) in that order. Key issues in each area include "greenhouse gas reduction and energy management" (55.2%) for environment, "safety and health" (28.1%) for society, and "compliance and ethical management" (37.0%) for governance.

Among the top 500 companies by sales, nearly half?236 companies?disclose their greenhouse gas emissions. The number of companies disclosing Scope 3 emissions, which include indirect emissions, has been increasing annually: 101 in 2021, 127 in 2022, and 155 in 2023. Last year, companies’ investments in environmental and safety sectors totaled 34.2212 trillion KRW, more than doubling compared to the previous year.

Companies cited difficulties in promoting ESG management such as "sustainable disclosure and regulatory response" (39.3%), "cost burden" (17.2%), and "lack of ESG awareness within organizations" (15.6%).

Lee Sang-yoon, Director of the Sustainability Growth Division at the Korea Economic Association, said, "Companies appear to prioritize philosophy and vision over short-term results in social contribution spending and aim to realize social value," adding, "Our society needs to support and encourage companies so they can bring about positive change."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)