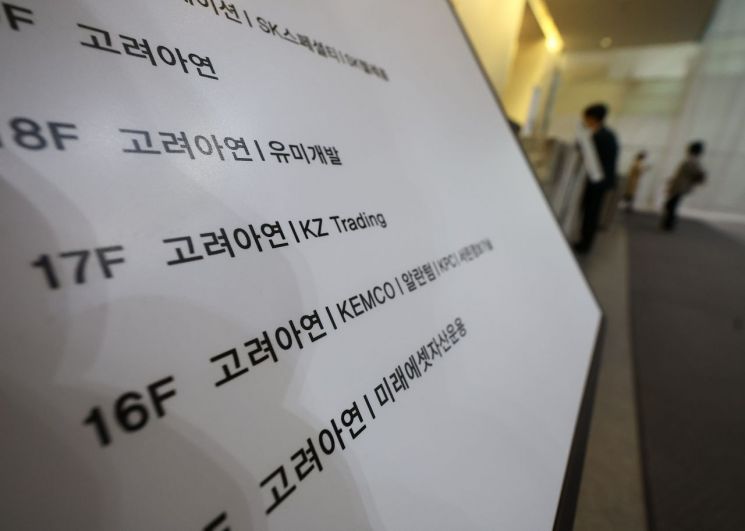

Yeongpung, the largest shareholder of Korea Zinc, submitted an application for permission to convene an extraordinary general meeting of shareholders to the Seoul Central District Court on the 1st.

MBK Partners and Yeongpung stated, “On October 28th, in accordance with the Commercial Act, we lawfully requested the board of directors to convene an extraordinary general meeting of shareholders, but the company has yet to proceed with the convening process. Rather, just two days after the request, the board decided on a large-scale paid-in capital increase worth 2.5 trillion KRW. If this capital increase proceeds as planned, it could cause damage to existing shareholders and lead to changes in the company’s shareholder composition and governance structure. Therefore, there is a need for the extraordinary general meeting to be held promptly, which is why we applied to the court.”

MBK Partners and Yeongpung, the largest shareholders of Korea Zinc who increased their voting rights by an additional 5.34% through a public tender offer, requested the Korea Zinc board on the 28th to convene an extraordinary general meeting of shareholders with the agenda and reason for convening being the appointment of 14 new directors and the amendment of the articles of incorporation to introduce an executive officer system.

MBK Partners and Yeongpung judged that the existing Korea Zinc board, which has lost its independent executive oversight function, has reached the end of its term, and decided to reorganize the board by appointing new directors so that the intentions of all major shareholders, not just specific ones, can be reflected in the board’s decision-making.

Furthermore, to overcome the limitations of the current Korea Zinc governance structure, where decision-making on management, execution of decisions, and supervisory authority over execution are all concentrated in the board of directors, they decided to introduce an executive officer system to establish a new governance framework.

The executive officer system is a structure where the board retains supervisory and decision-making authority over the company, while actual management is handled by executive officers such as the Chief Executive Officer (CEO), Chief Financial Officer (CFO), and Chief Technology Officer (CTO). Cases of listed companies adopting the executive officer system can be easily found in the United States, Europe, and Japan. In Korea, some large corporations such as Samsung Electronics, SK Innovation, LG Electronics, and POSCO Holdings have separated the roles of board chairman and CEO, with outside directors or other non-executive directors serving as board chairmen, effectively introducing the executive officer system in the form of a supervisory board.

An MBK Partners representative said, “The board’s decision on the paid-in capital increase, which caused losses to existing shareholders and threw the market into confusion, clearly reveals how severely Korea Zinc’s governance has been damaged due to the arbitrary actions of Chairman Choi Yoon-beom. We request the court to consider these circumstances and promptly grant permission.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)