Strategic Partnership and Service Agreement with TME

Major Group Occupying Over 70% of China's Music Market

DearU's Operating Profit Soars in Yeouido Securities District, 'Unified Voice'

The corporate value of DearU, a global fan communication platform, is rising. This is due to the positive effects expected from its strategic partnership with Tencent Music Entertainment Group (TME), the largest music platform company in China.

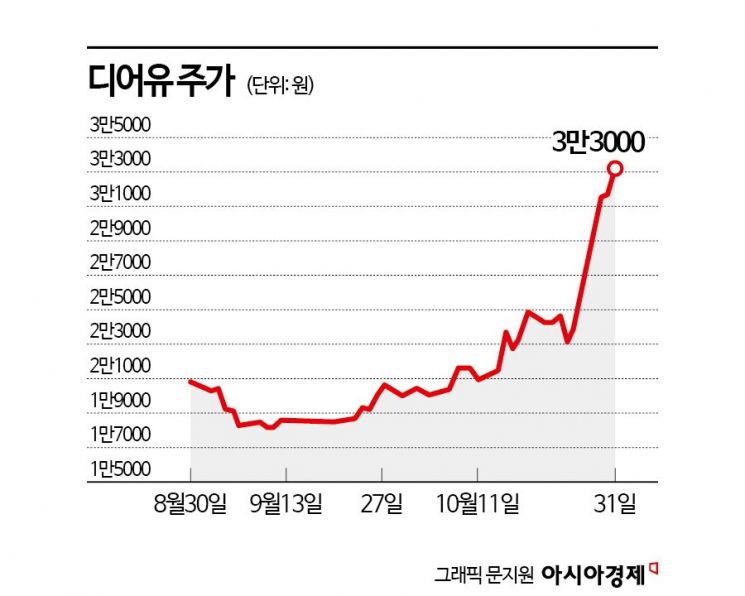

According to the financial investment industry on the 1st, DearU's stock price rose 38.7% over four days starting from the 28th of last month. Domestic institutional investors and foreigners led the stock price increase by continuously net buying for four days. Institutions recorded a cumulative net purchase of 9.4 billion KRW over the past month. Due to the recent stock price rise, DearU's market capitalization has expanded to 780 billion KRW.

Earlier, on the 28th of last month, DearU signed a strategic partnership and service contract with TME. DearU’s ‘Bubble’ was launched within QQ Music, a music streaming platform, providing Chinese users with opportunities to interact directly not only with K-pop but also with popular local stars. As of the second quarter of this year, Chinese subscribers accounted for 35% of Bubble’s total subscribers.

By collaborating with TME and launching the Bubble service on Tencent’s widely used 'My App' in China, an influx of Android users within China is expected. TME also plans to cooperate with other music platforms such as Kugou Music and Kuwo Music.

A DearU representative expressed, "The cooperation with TME will not only expand IP and subscribers but also serve as an opportunity to further solidify DearU’s position as a global fandom platform."

The financial investment industry is also optimistic about the outlook. Minha Choi, a researcher at Samsung Securities, said, "The service is expected to be launched in the first half of next year," adding, "Revenue will be recognized by receiving about 10% of sales as royalties, similar to the Japan business."

Hanwha Investment & Securities forecasts that DearU’s profits will increase by more than 8 billion KRW in the second half of next year. Sooyoung Park, a researcher at Hanwha Investment & Securities, explained, "Assuming the service starts in the third quarter of next year and the average monthly active users (MAU) reach about 3.42 million, an additional profit of approximately 8.4 billion KRW could be generated in the second half of next year." As of February, QQ Music’s MAU was 342.38 million, so even a 1% conversion rate could achieve the expected figures.

The continued popularity of K-pop singers in China also supports the positive outlook for performance improvement through cooperation with TME. In the third quarter of this year, the export volume related to K-pop to China increased by 50% compared to the same period last year. Kyuyeon Kim, a researcher at Mirae Asset Securities, analyzed, "DearU’s operating profit will increase from 29 billion KRW last year to 28 billion KRW this year and 49 billion KRW next year," and added, "The target stock price is raised from the previous 37,000 KRW to 42,000 KRW."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)