Sudden Rights Offering Announcement by Korea Zinc Causes Stock Price to Plunge to Lower Limit

Rights Offering and Employee Stock Ownership Plan Used to Narrow 3% Gap with MBK Alliance

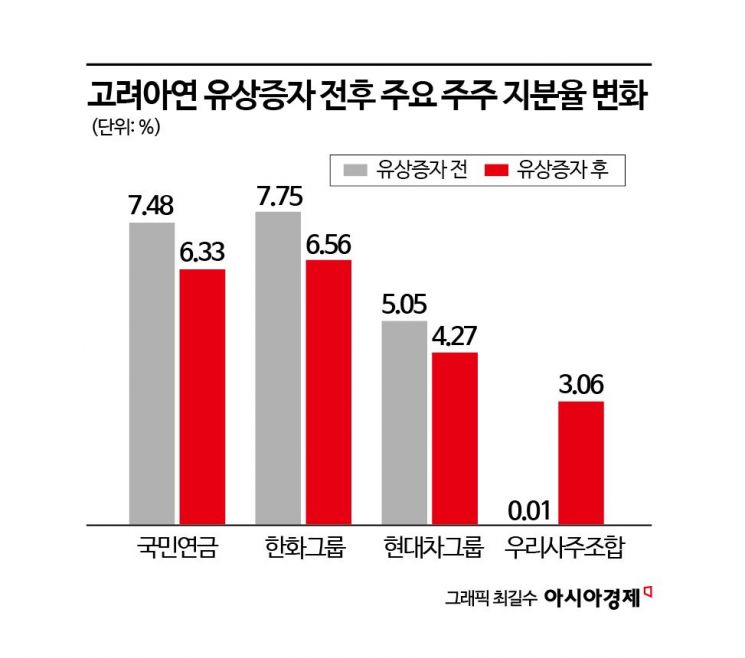

Major Shareholders Including National Pension Service and Hyundai Motor Expected to Experience Dilution

Korea Zinc is launching a defense of its management rights through a general public offering rights issue worth 2.5 trillion KRW. As MBK Partners and Young Poong have become the largest shareholders through a tender offer, Chairman Choi Yoon-beom's side is interpreted as aiming for a comeback through the rights issue. The plan is to increase friendly shares as much as possible during the rights issue process to gain an advantage in voting rights shares. However, this rights issue decision inevitably dilutes the shares of existing shareholders such as the National Pension Service and Hyundai Motor. The stock price, which had exceeded 1.5 million KRW, quickly fell to the lower limit of the price range (limit down).

Korea Zinc aims to close the 3 percentage point gap with 'Rights Issue + Employee Stock Ownership'

On the 30th, Korea Zinc held a board meeting at its headquarters in Jongno-gu, Seoul, and announced that it had decided on a rights issue of 3,732,650 common shares. This corresponds to 18% of the total issued shares of Korea Zinc before the cancellation of treasury shares acquired through the tender offer.

The subscription price per share is 670,000 KRW, which applies a 30% discount to the reference price of 956,116 KRW, calculated as the weighted arithmetic average stock price over 3 to 5 trading days before the subscription date.

The purpose of fund raising is 2.3 trillion KRW for debt repayment and 135 billion KRW for facility funds. A general public offering will be conducted for 80% of the total shares to be raised, with the subscription scheduled for the 3rd to 4th of next month. The remaining 20% will be preferentially allocated to the employee stock ownership association.

If the rights issue succeeds, Chairman Choi's side is expected to secure about an additional 3% of voting rights through the shares held by the employee stock ownership association. Previously, before the tender offer battle between Chairman Choi's side and the Young Poong-MBK alliance, the difference in shareholding ratio between the two sides was about 3 percentage points. Additionally, it is expected that friendly shares can be further secured during the general public offering process.

Korea Zinc explained, "We aim to resolve stock price instability caused by a sharp decrease in stock circulation after the tender offer and to prevent investor damage due to designation as a management stock or involuntary delisting." It added, "Repaying borrowings through fund raising will reduce interest burdens and contribute to stabilizing the financial structure." Furthermore, "We will expand the shareholder base by providing opportunities for various investors to participate as shareholders."

Existing shareholders such as National Pension Service and Hyundai Motor inevitably face share dilution... Stock price plummets to limit down

After the announcement of the rights issue, the stock price hit the limit down. On that day, the stock closed at 1,081,000 KRW, down 462,000 KRW (29.94%) from the previous trading day.

If the rights issue succeeds, the shares of existing shareholders will be diluted, lowering their shareholding ratios. As of the end of the third quarter, the National Pension Service, which held 7.48%, will see its shareholding ratio fall to 6.33%. The white knight Hanwha Group's shares will also drop from 7.75% to 6.56%. Hyundai Motor Group (5.05%) will see its shareholding ratio diluted to 4.27%. A source from the investment banking (IB) industry lamented, "If treasury shares are bought at 890,000 KRW and canceled, and the rights issue is conducted at 670,000 KRW, what happens to existing shareholders?"

MBK stated, "We cannot help but deplore Chairman Choi Yoon-beom's actions that disregard the capital market and shareholders," adding, "The decision on the rights issue is an act that tramples on existing shareholders and market order." It continued, "After conducting a tender offer for treasury shares at 890,000 KRW with high-interest borrowings, causing enormous financial damage to the company, they now intend to cover that financial damage with public money. If the rights issue is conducted at a 30% discount from the early December reference price, the value of the remaining shareholders' stocks will be further diluted," expressing concern.

Meanwhile, the Financial Supervisory Service is scheduled to hold an emergency briefing on the afternoon of the 31st regarding the Korea Zinc tender offer. Since investigations into unfair trading related to the Korea Zinc tender offer and accounting audits of Korea Zinc and Young Poong have been conducted, related announcements are expected.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.