Two Days Left Until the Spot Transfer System Implementation on the 31st

Brokerages Make Every Effort to Capture 'Transfer Customers'

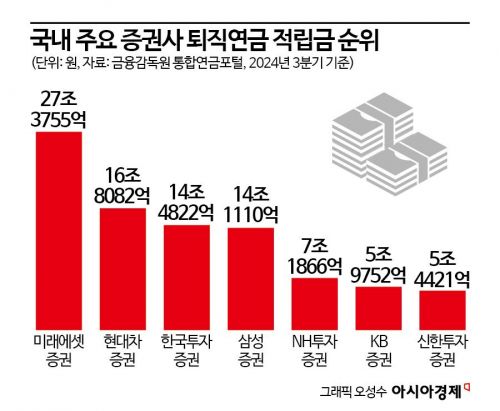

Mirae Asset Remains Unchallenged No.1... Samsung and Others in Hot Pursuit

With domestic retirement pension reserves approaching 400 trillion won, the implementation of the retirement pension in-kind transfer system is just two days away on the 31st of this month. The securities industry is putting all its efforts into capturing 'transfer customers,' anticipating the movement of large-scale funds that were previously tied up more than half in banks.

According to the financial investment industry on the 29th, the retirement pension in-kind transfer system will be implemented on the 31st of this month. This system allows the transfer of retirement pension accounts to other financial companies without selling the existing investment portfolio, maintaining it as is during the transfer.

As of the third quarter of this year, banks hold more than 50% of the total retirement pension market reserves of 400.0793 trillion won. Banks possess 210.2811 trillion won in reserves. However, with the maturation of the pension system and investors' preference for higher returns, the securities industry's share is gradually increasing. Securities firms expect the growth of individual retirement pensions to accelerate further once the in-kind transfer system is fully implemented this month. Unlike banks, where principal-guaranteed products make up most of the lineup, securities firms can offer products that provide relatively higher compound interest benefits.

Mirae Asset Securities is recognized as a leader in the retirement pension sector within the securities industry. Mirae Asset Securities' reserves amount to 27.3755 trillion won, with a net increase of about 4 trillion won this year alone. Hyundai Motor Securities (16.8082 trillion won), Korea Investment & Securities (14.4822 trillion won), Samsung Securities (14.1110 trillion won), and NH Investment & Securities (7.1866 trillion won) also rank among the top.

Mirae Asset Securities emphasizes an 'investing pension.' Its strengths include providing various products and services aligned with global asset management trends through its global network, global asset allocation, stable returns, and specialized digital pension asset management services. Samsung Securities is noted for its diverse management, expert organization, and efforts to reduce subscribers' fee burdens through direct IRP.

Securities firms are also focusing on strengthening digital pension content targeting MZ generation office workers. Representative channels include YouTube channels such as Samsung Securities' 'Samsung Pop' and Mirae Asset Securities' 'Smart Money.' This reflects the MZ generation's tendency to obtain information through YouTube searches rather than general portal sites. Many firms have also launched events offering department store gift certificates for advance reservations of IRP pension transfers.

An industry insider said, "The implementation of this system will further accelerate the money move toward investing pensions," adding, "In the pension market, where long-term investment of over 30 years is essential, the images each company holds will also be an important factor influencing investors' choices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.