Implementation of Electronic Claims for Indemnity Insurance on the 25th

Participation Confirmed by 4,223 Medical Institutions

Sequential Implementation Starting with 210 Hospitals on the 25th

Expansion to Clinics and Pharmacies Next Year

Starting from the 25th, electronic processing of indemnity insurance claims will be implemented for hospitals with 30 or more beds and public health centers. It is now possible to claim insurance benefits online without having to visit the hospital counter and deal with complicated paperwork.

Indemnity insurance is called the second national health insurance, with about 39.97 million subscribers and over 100 million insurance claims annually as of last year. Previously, indemnity insurance subscribers had to visit medical institutions in person to obtain claim-related documents and submit them to the insurance company to receive benefits. From now on, you can simply access the 'Silsun24' application (app) or website and claim insurance benefits with just a few clicks.

When accessing the Silsun24 app on that day, menus such as 'My Indemnity Claims,' 'My Child Claims,' and 'My Parent/Third Party Claims' appear. Clicking on 'My Indemnity Claims' brings up the options 'New Claim' and 'Additional Claim.' Here, by selecting 'Type of Accident' and 'Date of First Treatment,' the indemnity insurance of the insurer you are subscribed to is displayed. After clicking on the insurance and searching for the hospital you visited, selecting treatment details, claim information, and insurance payment account completes the claim process. It takes less than five minutes.

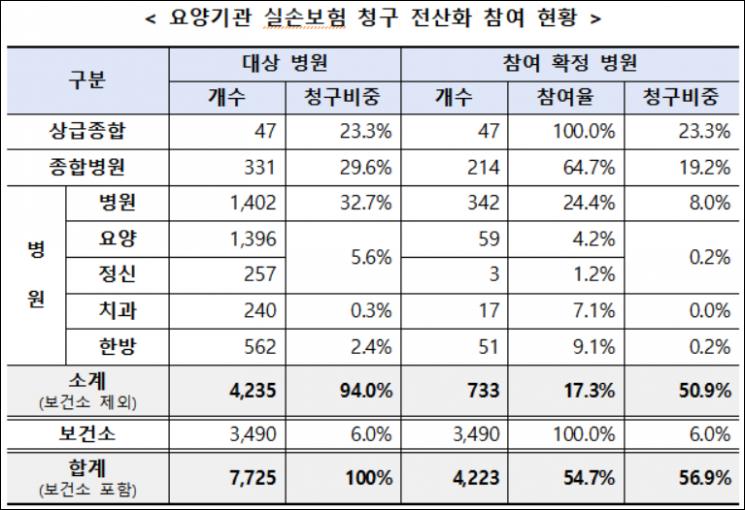

However, not all hospitals can use the electronic indemnity insurance claim service yet. This year, it will be applied first to hospitals with 30 or more beds and public health centers, and from October 25, 2025, it will be expanded to clinics and pharmacies. As of the previous day, 733 hospitals and 3,490 public health centers have announced their participation in electronic claim processing. Among hospitals, all 47 advanced general hospitals are participating, 214 general hospitals (64.7%) are participating, and 342 (24.4%) general hospitals are participating. On this day, electronic claim processing will be sequentially implemented starting with 210 hospitals, and other hospitals will begin the service sequentially as their electronic systems are completed.

The financial authorities plan to strengthen communication with non-participating hospitals and electronic medical record (EMR) companies to encourage participation in electronic claim processing. The 'Indemnity Claim Electronic Processing Task Force (TF),' which was an informal organization, will be legalized to strengthen communication channels with the medical community. Kim Byung-hwan, Chairman of the Financial Services Commission, said, "Electronic processing of indemnity insurance claims simplifies the insurance claim procedure and returns small insurance benefits that were previously abandoned to insurance consumers," adding, "Despite various disagreements during the preparation process, it is meaningful that we have taken the first step focusing solely on the people."

Medical institutions participating in the digitization of indemnity insurance claims as of the 24th. [Source: Financial Services Commission]

Medical institutions participating in the digitization of indemnity insurance claims as of the 24th. [Source: Financial Services Commission]

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)